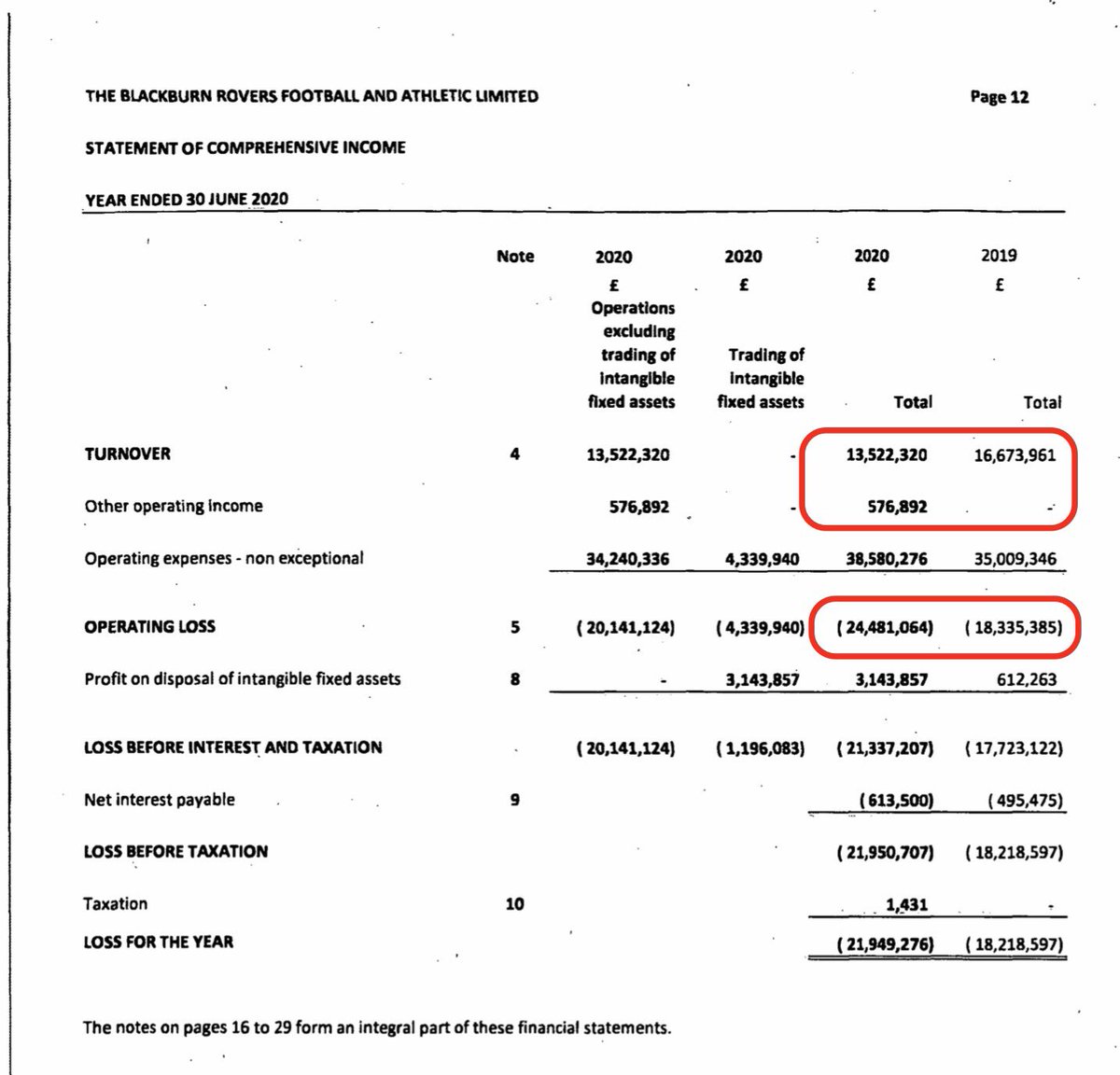

Blackburn made operating losses of over £24 million in 2019/20. Player sales reduced this to ‘just’ £21 million. #Rovers

Blackburn total losses over the years now exceed £282,000,000. This has been funded by loans and shares bought by the Venkys.

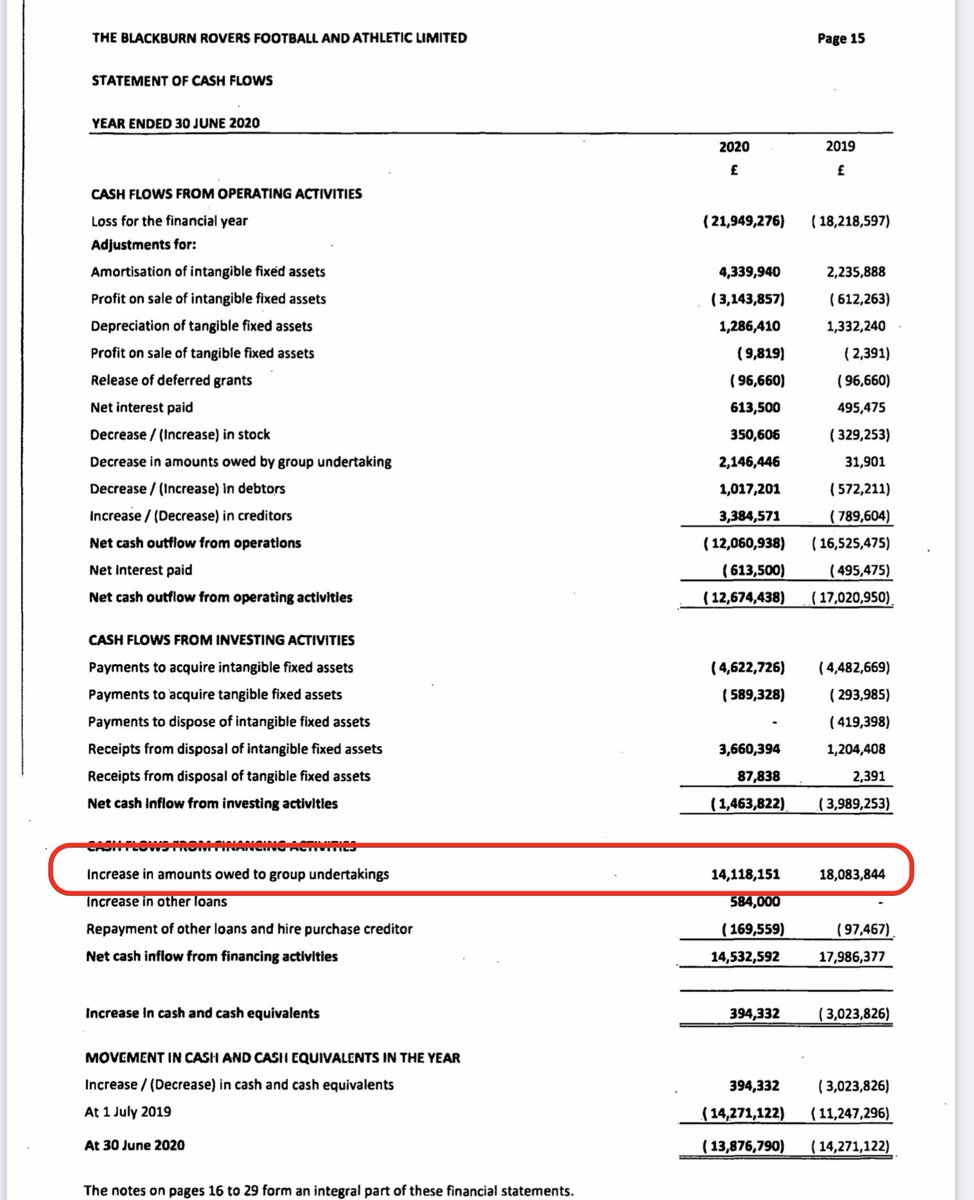

Venkys lent #Rovers £14 million in 19/20 on top of £18 million the previous year. I suspect @AndyhHolt is unimpressed at the casino style football finance operations we constantly see in the Championship

All three revenue streams (matchday, broadcast, commercial) at #Rovers down in 19/20. Covid would have played a part at end of season but isn’t responsible for everything. Wages up £3m and £190 for every £100 of income #sustainable

#Rovers owe the Venkys over £140m and other clubs £6m for transfer instalments. Tax creditors have doubled to over £5m as club took advantage of @RishiSunak relaxation of PAYE rules.

Rovers have put in an insurance claim for loss of revenue due to COVID-19 but looks as if the insurance company is trying to wriggle on paying out #smallprint #whatasurprise

• • •

Missing some Tweet in this thread? You can try to

force a refresh