Amazon Unbound is obviously a must read. So many different topics are touched on consistent with Amazon’s sprawling nature. But feels appropriate given today’s news to dive in today on one very important for the future: grocery and last mile. This will be long and meandering…

Throughout both the Everything Store and Amazon Unbound, the importance of Bezos as a driving force behind new initiatives is clear. AWS, Kindle, Alexa all seem almost willed to be by him.

“But for years he took a more passive approach to home delivery of food”

“But for years he took a more passive approach to home delivery of food”

The guy in charge of Amazon Fresh kept pushing to go faster. But “Consumer adoption of hike grocery delivery, Bezos believed, was going to be a more gradual process”

So Herrington wrote a memo that stating that of the largest retailers “All of them anchor their customer relationship with groceries”.

Then he challenged Bezos in Bezosian terms saying “We should be less timing investing in the future”

Then he challenged Bezos in Bezosian terms saying “We should be less timing investing in the future”

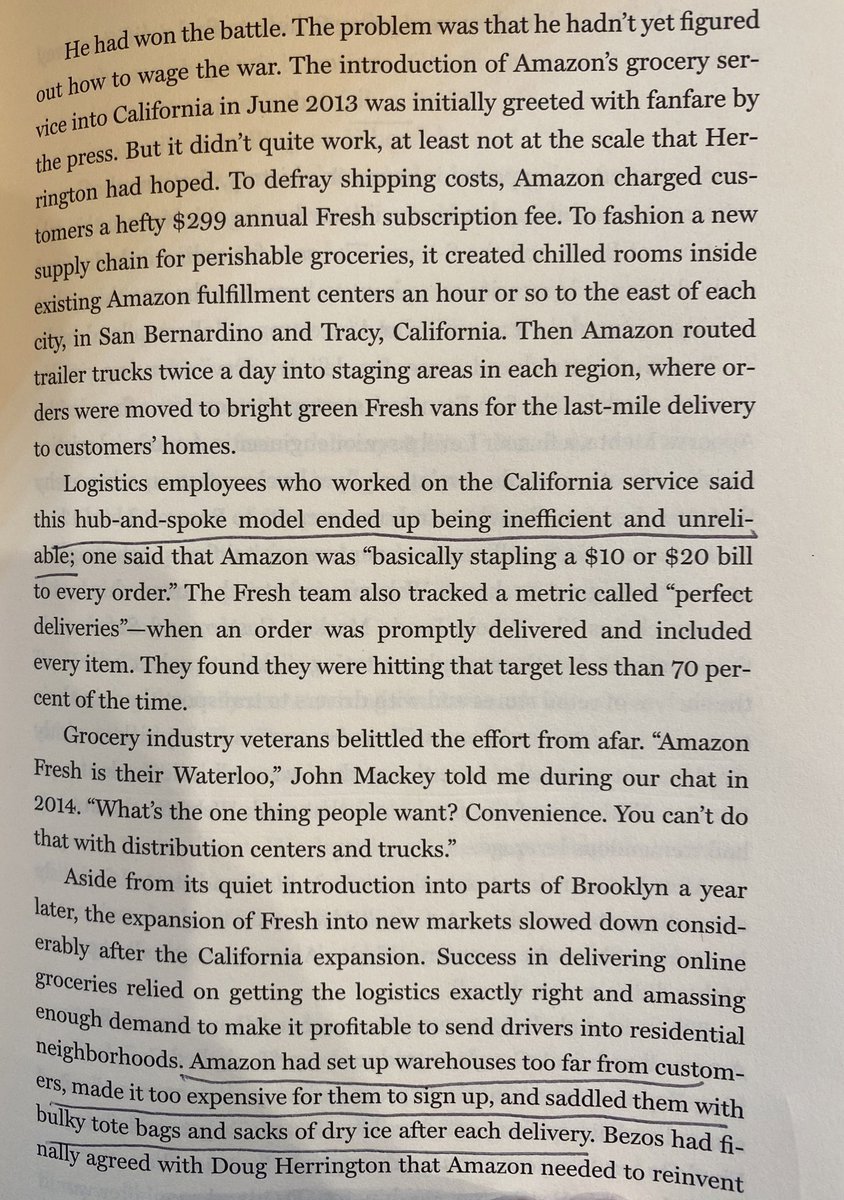

Having won the right to expand Amazon Fresh, a problem with logistics was quickly encountered “the hub-and-spoke model ended up being inefficient and unreliable”

The existing Amazon supply chain was not built to accommodate the needs of grocery.

The existing Amazon supply chain was not built to accommodate the needs of grocery.

Nothing like emerging competitors to focus the mind. Instacart bursts on the scene and having learned better, refuses to take Amazons calls. Meanwhile, Amazon was even more worried about Google Shopping Express (😂).

Ok so now it’s a priority to figure this grocery thing out. One of the ideas they come up with is to sell limited selection of popular products from urban warehouses. A different group was going to try and even more curated selection on trucks to be delivered within 10 minutes.

“Bezos approved these plans but wasn’t as immersed in their development as he was in new technology projects, like Alexa”

Yada yada yada, they buy Whole Foods, and then the book moves on. The next chapter is titled The Last Mile, and focuses on the efforts to build out the massive logistics network that underpins Amazon's competitive advantage in core retailing, FCs, airplanes, trucks, etc.

I found the juxtaposition perfect. Grocery and Last Mile belong next to each other, yet the book reflecting the company, doesn't quite connect the two to each other. I am the last person to accuse Bezos/Amazon of a blind spot, but this appears to have left an opening.

Just as WMT's DCs were built to service supercenters not ecommerce, AMZN's FC's were built to win at two day and then one day, not at sub 2 hours or sub 15 minutes...

This article amazingly doesn't even mention Amazon, which is obviously silly

ft.com/content/87cd99…

This article amazingly doesn't even mention Amazon, which is obviously silly

ft.com/content/87cd99…

For years we've talked about the folly of directly attacking FANG, you're not going to buy more planes than Amazon. So is a last mile network a way to build up an infrastructure that can disrupt Amazon?

https://twitter.com/modestproposal1/status/1381701159098933252

I don't think Amazon is blind to this, which is why I started compiling this thread earlier this year.

https://twitter.com/modestproposal1/status/1370040275125600260

Now with the context of the mid 2010s, I find the whole thing so much more interesting. Did Bezos lack of interest or urgency in grocery potentially leave a meaningful flank exposed? They clearly understood needing urban located "dark stores", and even sub 10 min delivery.

Second guessing arguably the most innovative forward thinking playing on hard mode company in the world is not my intention. Given stakes involved in last mile for grocery, retail and ecomm, thought it was fascinating context to the fight playing out today

https://twitter.com/modestproposal1/status/1372669343931195394

Btw anyone who has worked at amazon, logistics providers, last mile players, grocery etc and wants to correct the record or if you just want to argue, please chime in or DMs are open

• • •

Missing some Tweet in this thread? You can try to

force a refresh