Papa has a suitcase full of LIC bonds, I wanted to dig around returns so went LIC office yesterday to get the surrender value quotes. 📈

Read this Mini Thread 🧵 before your family LIC uncle tries to sell you the next policy!

‘Don’t mis insurance with an Investment.’

Read this Mini Thread 🧵 before your family LIC uncle tries to sell you the next policy!

‘Don’t mis insurance with an Investment.’

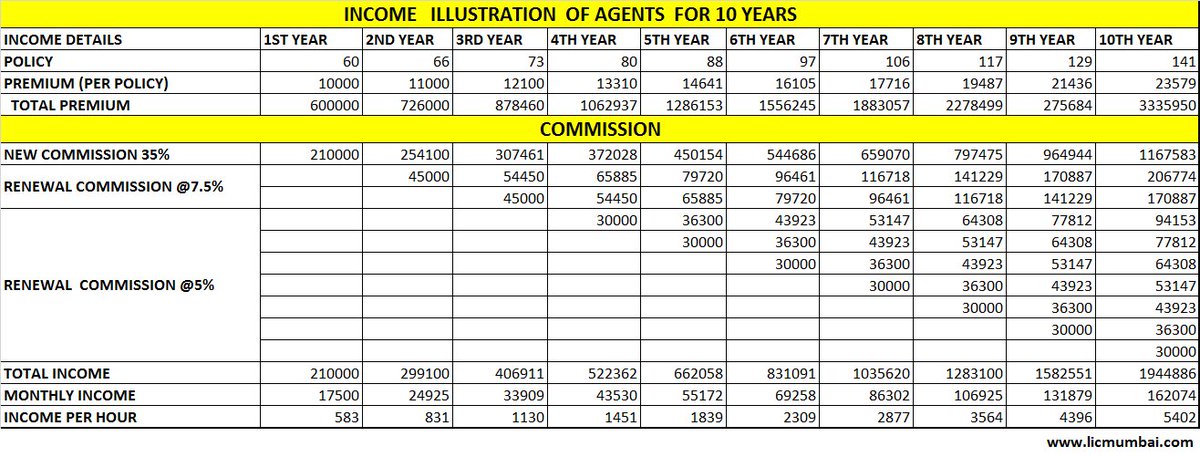

So LIC Agents earn the commission for the policies they sale. LIC offers 25% to 35% commission on the policy premium for the first year, then 7.5% for 2nd & 3rd Year + 5% till the policy maturity.

Now, I wouldn’t call this a SCAM but for sure it’s the biggest MLM (Multi-Level Marketing) scheme ever, well marketed/sponsored by authorities.

You can sell anything in India if you can play around emotion and trust, LIC has built a robust network of branch, distributors/agents.

You can sell anything in India if you can play around emotion and trust, LIC has built a robust network of branch, distributors/agents.

So is adopting the personalised sales approach, you’re more convinced to trust your relatives vs a Bank RM.

Just check the global and Indian market share of LIC.

Just check the global and Indian market share of LIC.

Talking about returns on your investment, if the agents are promised to receive 5% every year till you pay premiums so I believe you can do the maths yourself.

I will make it more easy for you, visit the nearest LIC branch with your policies and ask for surrender value. You can also request the same over email.

Now, Compare the returns with FD, Gold and Mutual Funds and instruments you feel comfortable investing.

Now, Compare the returns with FD, Gold and Mutual Funds and instruments you feel comfortable investing.

The average CAGR of policies that my father holds ranges from 4-6% which doesn’t even beat PPF returns.

Well they say - ‘Zindagi ke Sath bhi, Zindagi ke Bad Bhi.’

Guaranteed poor returns seem missing in the line. ❌

Well they say - ‘Zindagi ke Sath bhi, Zindagi ke Bad Bhi.’

Guaranteed poor returns seem missing in the line. ❌

So how does LIC makes money?

(Important)

They trap you with poor insurance plans while they themselves invest in equities.

Well LIC booked a whopping record ₹37,000 crore profit from share sales in 2020-21, the highest in its 65-year history!

livemint.com/companies/news…

(Important)

They trap you with poor insurance plans while they themselves invest in equities.

Well LIC booked a whopping record ₹37,000 crore profit from share sales in 2020-21, the highest in its 65-year history!

livemint.com/companies/news…

Insurance is not an investment so don’t mix them, I never ever recommend investing in LIC policies to anyone. If insurance/risk-cover is the question in the subject just get a decent Term Insurance Cover.

If retirement planning is your goal, go with ELSS, PPF, EPF and other compounding instruments but just don’t let a family uncle make a sweet commission on your hard-earned money.

Thanks for reading!

Be informed about your investment decisions, if you liked reading this thread please consider RT so it reaches more people. 🙏

Happy Investing.💰

Be informed about your investment decisions, if you liked reading this thread please consider RT so it reaches more people. 🙏

Happy Investing.💰

Ignore the grammatical errors please, wrote this from mobile keyboard so autocorrect is the intern who made mistakes. 😛

CC - @venkyHQ @pooniawalla @dipikajaikishan @SejalSud

CC - @venkyHQ @pooniawalla @dipikajaikishan @SejalSud

This is a chain of my other threads, Navigate if you are interested.

https://twitter.com/Ravisutanjani/status/1412115956080386049?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh