You want to buy a house.

You take a loan from the bank.

The bank asks you, “what if you don’t pay back?”

You say, “take my home and sell it”.

(Thread)

You take a loan from the bank.

The bank asks you, “what if you don’t pay back?”

You say, “take my home and sell it”.

(Thread)

That makes sense. The bank gives you a loan and in case you don’t pay, the bank will take over your house and sell it and recover its money.

That’s collateral.

That’s collateral.

Banks also lend money to big corporations. With them, banks don’t always have collateral.

So a loan where the bank has collateral is considered safer for the bank.

So a loan where the bank has collateral is considered safer for the bank.

In the early 2000s, the banks in the USA were giving out loans to people for buying houses.

The economy had just recovered from the tech bubble in 2000 where many banks had given out loans to businesses that had shut down.

The economy had just recovered from the tech bubble in 2000 where many banks had given out loans to businesses that had shut down.

In that backdrop, the banks found giving home loans safer.

At the same time, the real estate prices were climbing steadily. So the banks weren’t as worried about the loans since they thought they could always sell the house and recover their money. Probably even more than they were supposed to get.

Banks can sell loans to other institutions. When they do so, the money need not be paid back to the original bank but to the new owner of the loans (or mortgage).

They did so.

They did so.

Investors loved the idea of a safe loan that was backed by collateral. So there was a great demand for buying mortgages from banks.

Banks made good money by selling these loans. There was a demand for it.

So they started giving out even more loans to supply the high demand.

Banks made good money by selling these loans. There was a demand for it.

So they started giving out even more loans to supply the high demand.

In doing so, they started giving loans to people who weren’t as credit-worthy (people who weren’t as likely to pay back).

Nobody was too concerned about this because they thought, if these low credit-worthy borrowers didn’t pay back, the bank could always take over their property and sell it to recover the money.

So, here’s what was happening at this point:

Banks give out money to borrowers to buy a house.

Then, banks sell this mortgage to institutional investors.

So they again have money.

This money they lend out again.

Again, they sell this new mortgage to institutional investors.

Banks give out money to borrowers to buy a house.

Then, banks sell this mortgage to institutional investors.

So they again have money.

This money they lend out again.

Again, they sell this new mortgage to institutional investors.

This continues.

And so does the price of houses.

But towards the end of 2007, many people start defaulting on their loans.

No big deal.

And so does the price of houses.

But towards the end of 2007, many people start defaulting on their loans.

No big deal.

The mortgage owners can sell the houses and recover their money.

They start putting these houses up for sale.

More people default on their loans.

More houses come on sale.

They start putting these houses up for sale.

More people default on their loans.

More houses come on sale.

Here’s where it becomes bad.

Supply and demand kick in.

There are so many houses on sale and not enough buyers.

So house prices start falling.

Supply and demand kick in.

There are so many houses on sale and not enough buyers.

So house prices start falling.

Suddenly, mortgage owners realize they can’t recover their money back.

More borrowers start defaulting on their loans. More houses come on sale. Houses continue to become so cheap, borrowers cannot recover their money.

Banks run out of money to lend.

More borrowers start defaulting on their loans. More houses come on sale. Houses continue to become so cheap, borrowers cannot recover their money.

Banks run out of money to lend.

Without money to lend, other industries that rely on loans to operate (like the auto industry, construction industry, etc) cannot operate.

With some industries slowing down, the economic cycle starts getting affected.

With some industries slowing down, the economic cycle starts getting affected.

One industry affects the other and soon, most industries are down and suffering.

With that, comes job losses.

With job losses, comes reduced spending.

With reduced spending, comes a slowdown.

With that, comes job losses.

With job losses, comes reduced spending.

With reduced spending, comes a slowdown.

This is the extremely simplified story of how the 2008 recession happened - also called the Great Recession.

Right after the 2000 tech bubble, investors and the entire economic system was determined to avoid another tech bubble.

Right after the 2000 tech bubble, investors and the entire economic system was determined to avoid another tech bubble.

In doing so, they let the housing bubble build and finally burst in 2008.

The US being such a major economy, this recession affected the entire globe.

The US being such a major economy, this recession affected the entire globe.

The US Fed printed money and managed to stimulate the economy back into health over the next few years.

The impact of such massive events is that people’s focus is on making sure the same doesn’t repeat.

The impact of such massive events is that people’s focus is on making sure the same doesn’t repeat.

From around 2012-2013, every few months you’d hear someone talking about the impending recession or bubble.

That continued right from 2012 to 2020.

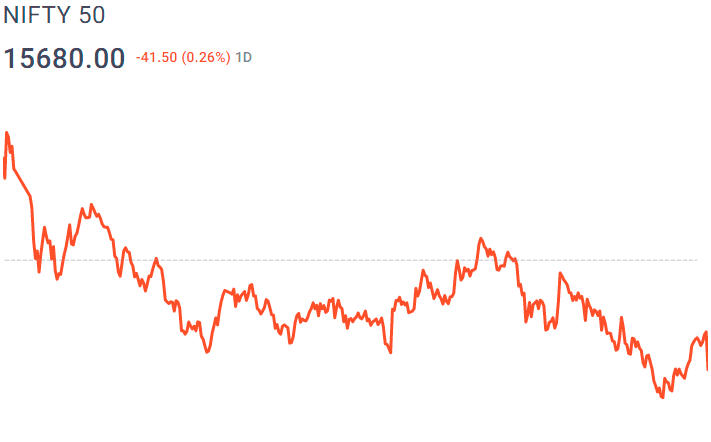

In 2020, the markets fell just as sharply.

That continued right from 2012 to 2020.

In 2020, the markets fell just as sharply.

But this 2020 market crash wasn’t caused by a housing bubble or tech bubble.

It was caused by a pandemic - a threat nobody quite expected or saw coming.

It was caused by a pandemic - a threat nobody quite expected or saw coming.

The next recession, whenever it comes, hopefully, will be much farther away and milder in nature, will probably not be caused by a housing bubble or a virus

It’ll be caused by something that the markets by large aren’t prepared for or cautious about.

The lesson for the investor is the same be it the tech bubble of 2000, the Great Recession of 2008, or the pandemic of 2020.

The lesson for the investor is the same be it the tech bubble of 2000, the Great Recession of 2008, or the pandemic of 2020.

Make sure you have enough emergency money kept safely, make sure you invest in a diversified manner to keep safe from sudden shocks, and always keep a safety margin in your investments.

Another important control every investor needs to have is control over their own fear and greed.

Don't get too greedy when the markets are good. Don't be too fearful when the markets are bad.

Don't get too greedy when the markets are good. Don't be too fearful when the markets are bad.

Recessions have been different each time.

But the same investment strategy has done well through all those recessions.

But the same investment strategy has done well through all those recessions.

• • •

Missing some Tweet in this thread? You can try to

force a refresh