What is good debt?

There are 3 ways you can leverage your assets to borrow against them:

🏠 Borrow against your property

📰 Borrow against your life insurance

📈 Borrow against your stock holdings

Why would you do it?

All three provide opportunities you can’t get elsewhere 👇🏻

There are 3 ways you can leverage your assets to borrow against them:

🏠 Borrow against your property

📰 Borrow against your life insurance

📈 Borrow against your stock holdings

Why would you do it?

All three provide opportunities you can’t get elsewhere 👇🏻

Im not big on owing someone something. But I can’t ignore math.

I decided to finally try one: borrowing against my stock holdings.

This debt is good debt because you have the collateral, and can leverage a great interest rate because of that for further gain. 👇🏻

I decided to finally try one: borrowing against my stock holdings.

This debt is good debt because you have the collateral, and can leverage a great interest rate because of that for further gain. 👇🏻

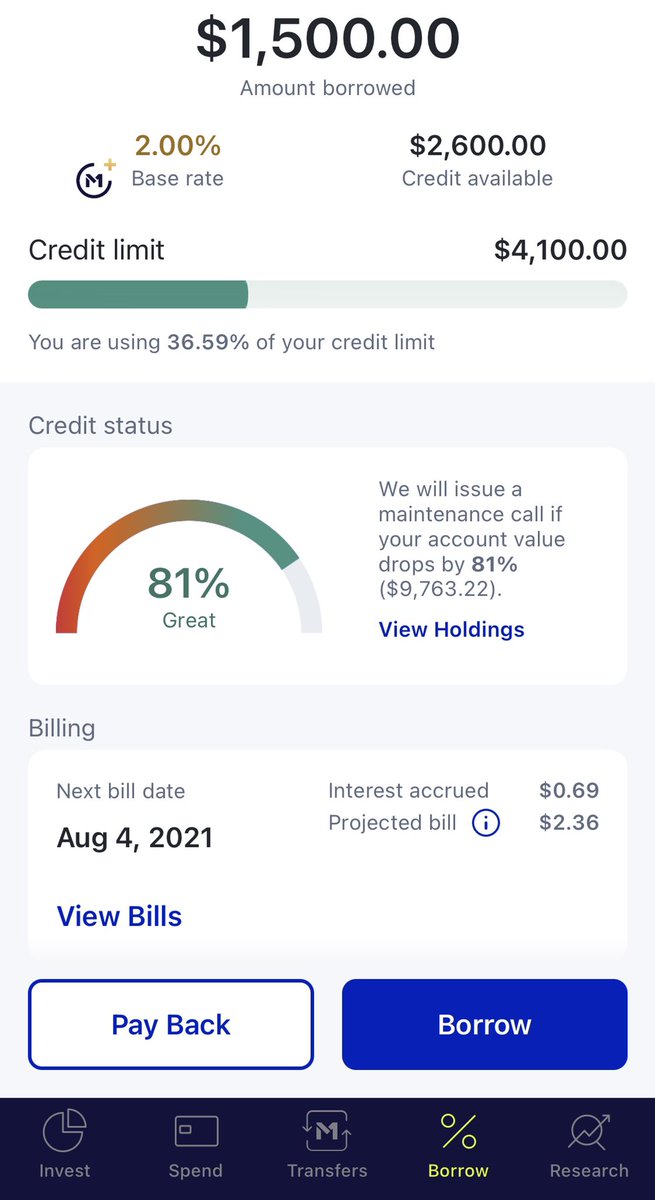

I have an account with @M1_Finance that allows me to borrow up to 35% of my account value at 2% interest.

That’s a really good rate!

And instead of selling my holdings to generate cash, I can leave them alone and borrow, allowing them to grow while I still use the cash 👇🏻

That’s a really good rate!

And instead of selling my holdings to generate cash, I can leave them alone and borrow, allowing them to grow while I still use the cash 👇🏻

My @M1_Finance account has about $12,000 in it, so I can borrow about $4100.

The risk you run with doing this with stocks is getting a margin call — if the value of your stocks drop below a certain level the brokerage issues a margin call requiring you to add more money. 👇🏻

The risk you run with doing this with stocks is getting a margin call — if the value of your stocks drop below a certain level the brokerage issues a margin call requiring you to add more money. 👇🏻

OR they can sell your shares.

This keeps them safe.

You don’t want them to sell your holdings as it would be locking in losses at lower levels.

I’m only borrowing $1500. That means my account would have to drop by almost $10k to get a margin call (unlikely) 👇🏻

This keeps them safe.

You don’t want them to sell your holdings as it would be locking in losses at lower levels.

I’m only borrowing $1500. That means my account would have to drop by almost $10k to get a margin call (unlikely) 👇🏻

What could you do with this money?

-Use it to pay off higher interest debt.

If your credit card debt was 18%, using this debt at 2% allows you to pay that off saving you 16% AND letting your stocks keep growing.

Another option is to use it to fund other investments 👇🏻

-Use it to pay off higher interest debt.

If your credit card debt was 18%, using this debt at 2% allows you to pay that off saving you 16% AND letting your stocks keep growing.

Another option is to use it to fund other investments 👇🏻

I’m using it to fund other investments.

I’m trying arbitrage, investing it in $RYLD and $QYLD paying dividends around 10% annually.

I’ll use the monthly dividend payments to pay the interest due, and pocket the rest.

It’s been a fun lesson in how debt can be an asset 👇🏻

I’m trying arbitrage, investing it in $RYLD and $QYLD paying dividends around 10% annually.

I’ll use the monthly dividend payments to pay the interest due, and pocket the rest.

It’s been a fun lesson in how debt can be an asset 👇🏻

I was able to borrow the money in about 2 minutes.

I didn’t have to go into an office.

There was no long credit check or negotiation.

I just clicked a few buttons and the money was mine.

There’s a power in that 👇🏻

I didn’t have to go into an office.

There was no long credit check or negotiation.

I just clicked a few buttons and the money was mine.

There’s a power in that 👇🏻

This is how the rich stay rich.

They borrow without interrupting their asset growth, and can often write off the interest (the interest payments are technically a tax write off).

It was important for me to learn not all debt is bad, and you can leverage it to your advantage 👇🏻

They borrow without interrupting their asset growth, and can often write off the interest (the interest payments are technically a tax write off).

It was important for me to learn not all debt is bad, and you can leverage it to your advantage 👇🏻

If you enjoyed this thread and are interested in the idea with stocks, check out @M1_Finance via my referral link for $50

Their plus version allows the 2% rate, and their unique pie feature lets you build your own “index funds” without the fees

m1.finance/5eHoZjWafgvw

Their plus version allows the 2% rate, and their unique pie feature lets you build your own “index funds” without the fees

m1.finance/5eHoZjWafgvw

For more on how to use this strategy with a life insurance policy, check out @ChroniclesNate

He will change how your brain thinks about money.

He will change how your brain thinks about money.

@RespectWallSt has also brought up some great points.

Three disclaimers:

-I have an emergency fund and can repay these margin loans immediately if needed.

-I’ve borrowed a very small % of my overall portfolio.

-I’ve done my own research (and so should you ALWAYS)

Three disclaimers:

-I have an emergency fund and can repay these margin loans immediately if needed.

-I’ve borrowed a very small % of my overall portfolio.

-I’ve done my own research (and so should you ALWAYS)

• • •

Missing some Tweet in this thread? You can try to

force a refresh