“When interpreting data on Reserves, it’s important to keep in mind the quantity of reserves in Banking System is determined almost entirely by the Central Bank’s actions.

An individual Bank can Reduce their Reserves by “Lending Them Out or Using them 2 Purchase other Assets.”

An individual Bank can Reduce their Reserves by “Lending Them Out or Using them 2 Purchase other Assets.”

“But these actions Do Not Change the Level of Reserves in the Banking System.”

“The general idea should be clear: while an Individual Bank can reduce its level of reserves by “lending to firms or households, the same is not true of the Banking System as a Whole.”

“The general idea should be clear: while an Individual Bank can reduce its level of reserves by “lending to firms or households, the same is not true of the Banking System as a Whole.”

“No matter how many times the Funds are lent out by the Banks or used to make Purchases -Total Reserves in the Banking System do not change.”

“In particular, one can’t infer from the high level of aggregate reserves that banks are hoarding funds rather than lending them out.”

“In particular, one can’t infer from the high level of aggregate reserves that banks are hoarding funds rather than lending them out.”

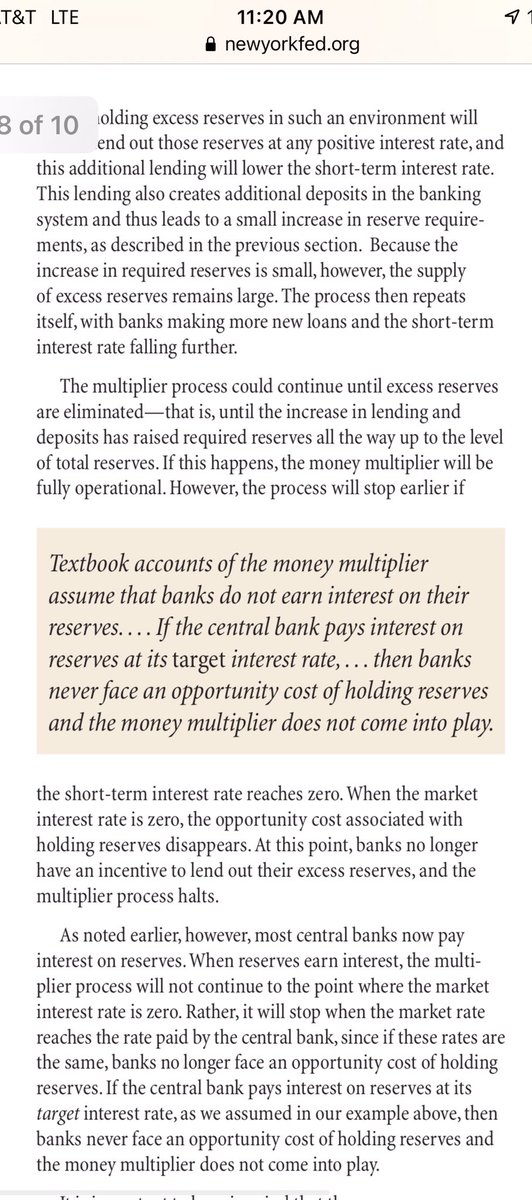

I’m telling y’all right now the traditional fractional banking system has been completely gutted in a QE Floor System… Deposit Multiplier is as good as Dead.

Reserves are Cash & Can be Lent Out… Now subject to LCR/RLAP & Sheet Capital constraints per Basel 3.

$XLF #Reflation

Reserves are Cash & Can be Lent Out… Now subject to LCR/RLAP & Sheet Capital constraints per Basel 3.

$XLF #Reflation

Begs the question for Lacy Hunt, who is very knowledgeable & should be deeply respected… but one can still disagree or be unsure of his characterization of “m” or little m in this piece given Basel III has neutered the money multiplier by paying IOER.

hoisington.com/pdf/HIM2021Q2N…

hoisington.com/pdf/HIM2021Q2N…

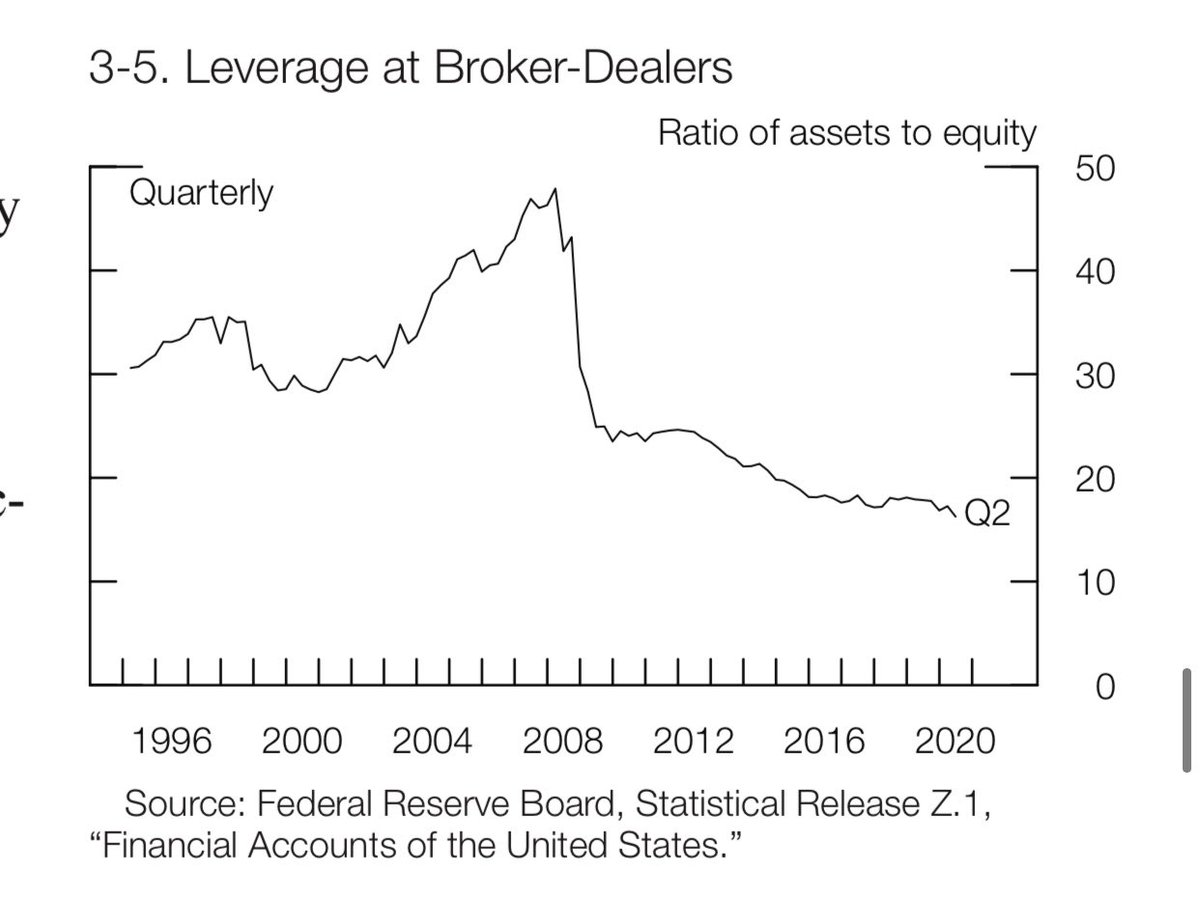

His point about long term public debt is a good one in that it subtracts from growth over long periods of time, but now we have a QE system by design so L/D ratio falls dramatically, but also loans have been pushed out to Shadow banks, CLOs & Life Insurance companies as well.

Regulated $XLF system much safer as a result 4 depositors. Now we have $2Trillion in XS savings from Covid, Pent Up Demand & a willing + Able Banking system ready to make loans = Higher LT Yields, not lower. I think good chance last Summer was a bottom at 50bps on 10 Yr. Let’s c.

We spent 12 Yrs fixing $XLF System w Basel III + Dodd Frank shaving off 50bps (u pick exact number) of annual GDP growth… now we have the best capitalized system in 30+ years..time to take the Shackles off & execute regular Covid normalization + recoup years of stifled growth.

$XLF CET1 ratios r way too high.. Fed can reduce reliance on 0% RWAs 4 $TLT & 20% 4Agencies… by Recalibrating SCBs, SLRs, GSIB Scores which is good for Loans..& see this economy rip…even beyond Covid Normalization for next 2 years… & bring people back into the Labor Force.

• • •

Missing some Tweet in this thread? You can try to

force a refresh