0/ In Today’s Delphi Daily, Speculators vs. Hodlers, @opensea Dominance, @Uniswap LP Returns.

Check out the full analysis in the free report below

delphidigital.io/reports/specul…

Check out the full analysis in the free report below

delphidigital.io/reports/specul…

1/ Market Update-

🔹We’re starting to see an interesting pattern: prices increase during the Asia session,lower during the London session, and New York wakes up to buy the dip.

🔹Altcoins have had a pretty rough day so far, with the exception of $AXS which just keeps moving.

🔹We’re starting to see an interesting pattern: prices increase during the Asia session,lower during the London session, and New York wakes up to buy the dip.

🔹Altcoins have had a pretty rough day so far, with the exception of $AXS which just keeps moving.

2/ The amount of $BTC with short-term holders is in decline while the picture of longer-term holders is the opposite.

Since the start of the year, the number of BTC held by long-term holders is up by 5.3% while the number of BTC with shorter-term investors has reduced by 9.1%.

Since the start of the year, the number of BTC held by long-term holders is up by 5.3% while the number of BTC with shorter-term investors has reduced by 9.1%.

3/ As noted above, the number of short-term holders/speculators is on the decline, as is their profitability.

Looking at @glassnode’s data, the amount of BTC held by speculators is now just under 20%. This figure maxed out in April at 100%.

Looking at @glassnode’s data, the amount of BTC held by speculators is now just under 20%. This figure maxed out in April at 100%.

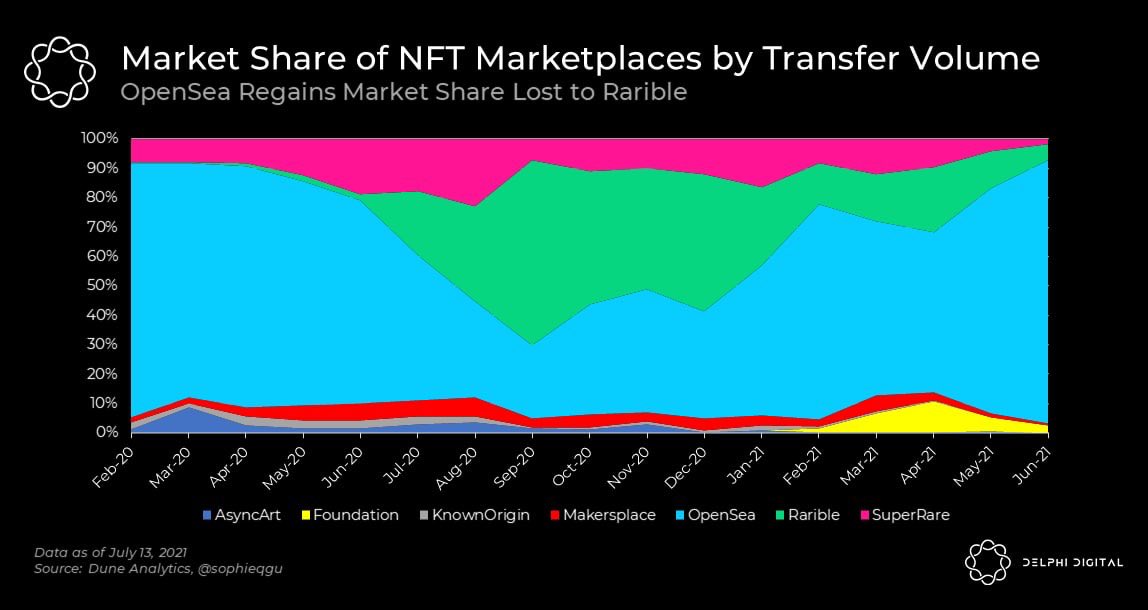

4/ There’s one thing NFT Marketplaces and decentralized exchanges have in common: a single platform owning the vast majority of the market. @opensea is the @Uniswap of NFT markets, and has seen resilient volume and usage in light of the broad market decline.

5/ For a few months, @rariblecom had sizeable volumes and briefly captured 60% of market share in 9/2020. Rarible was starting to look like an OpenSea contender, but its numbers have fallen.

OpenSea’s consistent growth is a testament to the demand for permissionless NFT markets.

OpenSea’s consistent growth is a testament to the demand for permissionless NFT markets.

• • •

Missing some Tweet in this thread? You can try to

force a refresh