I've had a lot of people reach out recently and ask what's been driving the #LightningNetwork's latest exponential growth phase.

I think I'd attribute it to four main sources:

🧵👇

I think I'd attribute it to four main sources:

🧵👇

https://twitter.com/VetleLunde/status/1414935599321124864

1) The combo of @getumbrel, @RaspiBlitz, and @voltage_cloud with the host of node & liquidity management guides produced by @LeoAW and @hmichellerose have made it stupid easy to get a node online and connected.

docs.lightning.engineering

docs.lightning.engineering

This laid the groundwork for some super vibrant communities of node runners to pop up a la Ring of Fire and Plebnet. These groups are the primordial soup out of which the next wave of LN startups will emerge IMO... lots of tinkering and lots of great memes

https://twitter.com/capoczino/status/1415992091885383684?s=20

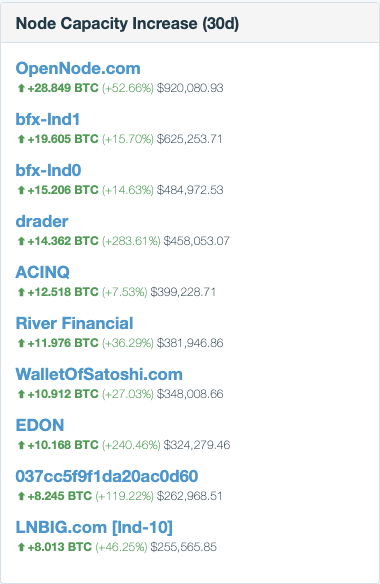

2) real sustainable volume growth across the board has lead to large influxes of capital to/from popular nodes as seen by the largest growers over the last 30 days.

@OpenNodeCo, @bitfinex, @acinq_co, @river, and @walletofsatoshi account for ~1/3 of the 300 BTC added in that time

@OpenNodeCo, @bitfinex, @acinq_co, @river, and @walletofsatoshi account for ~1/3 of the 300 BTC added in that time

3) the remittance use case has successfully crossed the chasm (h/t @MichaelLevin) thanks to @jackmallers, @ln_strike and El Salvador. Huge amount of new inbound interest in an LN integration from exchanges & wallets with users in remittance-heavy countries

michael-levin.medium.com/part-2-lightni…

michael-levin.medium.com/part-2-lightni…

Importantly, many users are not willing to wait for their local exchange or mobile wallet to integrate LN, but are downloading @Breez_Tech, @MuunWallet or @bluewalletio to get the benefits of instant low-fee remittances today. @KalKassa has the receipts

https://twitter.com/KalKassa/status/1415120232293806080?s=20

4) people are catching on to the fact that LN is more than just a payments network, it's an incentivized private data network where satoshis are just one kind of data. @ImperviousAi gets this, @sphinx_chat gets this, @SatoshisStream and @PodcastindexOrg get this...

Every routing node has four natural resources it can monetize: bitcoin liquidity, storage, bandwidth, and compute. We've already started building a marketplace for allocating liquidity with @LightningPool.

When marketplaces for the other three start showing up, watch out 🤯

When marketplaces for the other three start showing up, watch out 🤯

These 4 factors combine into a flywheel that's starting to spin:

🔁more users on the network

🔁more volume flowing through it

🔁more fees to capture

🔁more people running nodes

🔁more devs tinkering

🔁more users on the network

Aren't network effects a beautiful thing @starkness?

🔁more users on the network

🔁more volume flowing through it

🔁more fees to capture

🔁more people running nodes

🔁more devs tinkering

🔁more users on the network

Aren't network effects a beautiful thing @starkness?

• • •

Missing some Tweet in this thread? You can try to

force a refresh