1/22. Last week, everyone was talking about inflation rising +5.4%, the largest YoY increase since 2008.

But few know what inflation is & why it exists. Accordingly, Kraken Intelligence produced a deep-dive report on inflation.

Here's a quick thread👇

kraken.docsend.com/view/69nu44cwt…

But few know what inflation is & why it exists. Accordingly, Kraken Intelligence produced a deep-dive report on inflation.

Here's a quick thread👇

kraken.docsend.com/view/69nu44cwt…

Inflation is the general rise in the price of goods &

services.

Inflation is generally the result of an increase in the money supply, which is controlled by a central bank (CB).

Inflation can be harmless if under control. But if it's out of control, it can destroy a nation.

services.

Inflation is generally the result of an increase in the money supply, which is controlled by a central bank (CB).

Inflation can be harmless if under control. But if it's out of control, it can destroy a nation.

Note that an increase in the money supply doesn't always = inflation.

When the $ supply ⬆️, lending and investment ⬆️, which results in tech advances (which are often deflationary).

Economists commonly cite the "Triangle Model" to describe 3 types of inflation, which are...

When the $ supply ⬆️, lending and investment ⬆️, which results in tech advances (which are often deflationary).

Economists commonly cite the "Triangle Model" to describe 3 types of inflation, which are...

Demand-Pull Inflation:

◆ When demand for goods and services rise faster than productive capacity

◆ Due to an increase in the money supply and cheap credit (low interest rates)

◆ As more money is put into circulation and is easily

accessible, both demand and prices rise

◆ When demand for goods and services rise faster than productive capacity

◆ Due to an increase in the money supply and cheap credit (low interest rates)

◆ As more money is put into circulation and is easily

accessible, both demand and prices rise

Cost-Push Inflation:

◆ When input costs increase (wages, raw materials, etc.)

◆ As prod. costs rise, supply falls b/c there are fewer

goods & services

◆ Demand is unchanged, so producers pass the

additional cost to consumers

The Oil Shock in the 70s is a notorious example.

◆ When input costs increase (wages, raw materials, etc.)

◆ As prod. costs rise, supply falls b/c there are fewer

goods & services

◆ Demand is unchanged, so producers pass the

additional cost to consumers

The Oil Shock in the 70s is a notorious example.

Some say inflation is bad & others say it can be good.

Pros: enables economic growth, leads to wage growth, allows for prices to adjust, asset values increase, benefits debtors (pay back with lower value $)

Cons: Means weaker $ - bad for savers, creditors, workers, & spenders

Pros: enables economic growth, leads to wage growth, allows for prices to adjust, asset values increase, benefits debtors (pay back with lower value $)

Cons: Means weaker $ - bad for savers, creditors, workers, & spenders

Regardless, history shows that when inflation is rapid, excessive, and out-of-control, wealth is destroyed.

Hyperinflation can cause:

◆ Fiat's value to fall

◆ Goods stockpiling

◆ Bank runs (big withdrawals & no deposits)

◆ Less tax rev. for gov. (less $ for social services)

Hyperinflation can cause:

◆ Fiat's value to fall

◆ Goods stockpiling

◆ Bank runs (big withdrawals & no deposits)

◆ Less tax rev. for gov. (less $ for social services)

CBs target an annual rate of 2-3% to promote a "healthy amount of economic growth" by increasing or decreasing the money supply (the total $ held by the public).

Tools CBs have to influence the money supply:

◆ Discount Rate

◆ Reserve Requirements

◆ Open Market Operations

Tools CBs have to influence the money supply:

◆ Discount Rate

◆ Reserve Requirements

◆ Open Market Operations

Discount Rate: The rate banks can borrow from a CB

B/c CBs cant set interest rates for mortgages, auto loans, etc, they influence these rates via the discount rate (DR).

Low DR = cheaper to borrow from CB = banks can loan more $ = $ supply rises = more economic growth

B/c CBs cant set interest rates for mortgages, auto loans, etc, they influence these rates via the discount rate (DR).

Low DR = cheaper to borrow from CB = banks can loan more $ = $ supply rises = more economic growth

Reserve Requirement: The amount of money a bank is required to hold

By lowering the RR, banks have more $ on hand to lend out, which increases the $ supply.

If banks need $, they can borrow from another bank. CBs will try to influence this rate by also altering the $ supply.

By lowering the RR, banks have more $ on hand to lend out, which increases the $ supply.

If banks need $, they can borrow from another bank. CBs will try to influence this rate by also altering the $ supply.

Open Market Operations: When CBs buy/sell assets (gov. bonds) on the open mkt

This creates an artificial supply/demand that drives interest rates to the CB's target.

The US Fed will credit a bank $ for assets and add assets to their balance sheet. This is how $ is created.

This creates an artificial supply/demand that drives interest rates to the CB's target.

The US Fed will credit a bank $ for assets and add assets to their balance sheet. This is how $ is created.

CBs can also use Quantitative Easing (QE) and Repo operations to influence the $ supply.

QE: CBs purchase long-term gov bonds from banks and reinvest proceeds

Repo: CBs sell short-term securities to investors and then repurchase at a premium

CBs used both after COVID-19.

QE: CBs purchase long-term gov bonds from banks and reinvest proceeds

Repo: CBs sell short-term securities to investors and then repurchase at a premium

CBs used both after COVID-19.

So, how is inflation measured?

Governments and CBs typically look at a basket of goods & services to measure price changes and derive an inflation rate.

In the US, economists look at the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) index.

Governments and CBs typically look at a basket of goods & services to measure price changes and derive an inflation rate.

In the US, economists look at the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) index.

Many believe that inflation indexes are flawed/manipulated for several reasons:

◆ Public programs benchmark against inflation, so lower inflation is ideal

◆ They ignore changes in spending habits

◆ They disregard asset appreciation

◆ They neglect regional price differences

◆ Public programs benchmark against inflation, so lower inflation is ideal

◆ They ignore changes in spending habits

◆ They disregard asset appreciation

◆ They neglect regional price differences

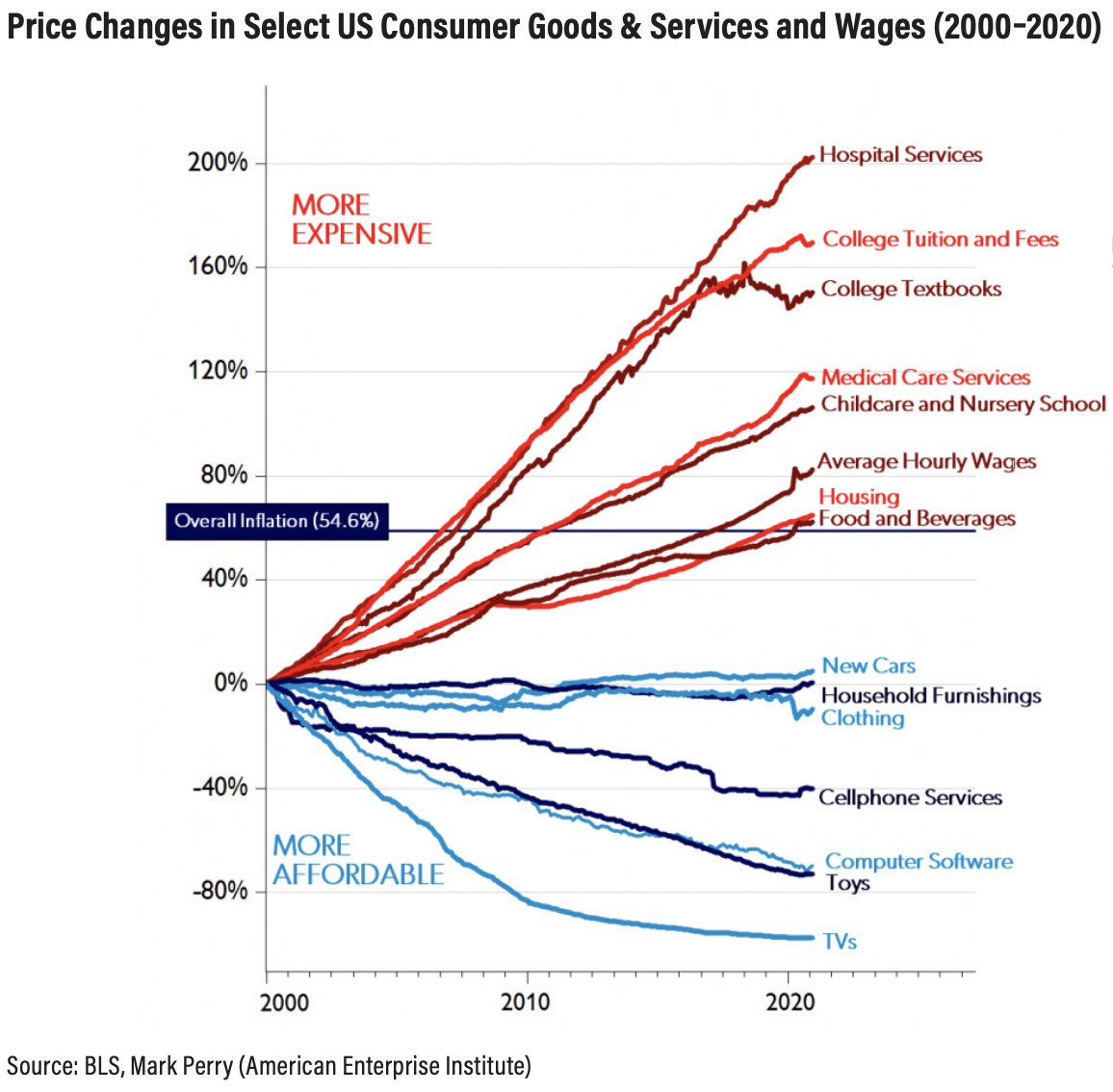

In this chart, we can see the red lines represent prices subject to regulatory intervention by US government (ex. food). Blue lines are subject to free market forces.

US inflation doesn't account for an increase in education, housing, or medical care costs, yet they've surged.

US inflation doesn't account for an increase in education, housing, or medical care costs, yet they've surged.

So, what can you do to protect yourself from inflation?

Own assets that can appreciate with inflation, such as gold, #bitcoin, stocks, real estate, & bonds. Cash is trash.

These “inflation hedges” have been and will be part of many portfolios for several reasons.

Own assets that can appreciate with inflation, such as gold, #bitcoin, stocks, real estate, & bonds. Cash is trash.

These “inflation hedges” have been and will be part of many portfolios for several reasons.

Why gold?

Can have price stability, has performed well during economic downturns, and has sound monetary properties.

Between 1977–81, inflation rose as high as 18%. Fed Chairman Volcker rose interest rates to stop inflation from getting out of hand. Gold prices rose +148%.

Can have price stability, has performed well during economic downturns, and has sound monetary properties.

Between 1977–81, inflation rose as high as 18%. Fed Chairman Volcker rose interest rates to stop inflation from getting out of hand. Gold prices rose +148%.

Why #bitcoin?

It's digital gold, but better. That is, it's provably scarce, supply inflation-resistant, divisible, durable, highly fungible, & more.

Both retail and institutions are slowly but surely, allocating to this emerging asset given its properties and upside potential.

It's digital gold, but better. That is, it's provably scarce, supply inflation-resistant, divisible, durable, highly fungible, & more.

Both retail and institutions are slowly but surely, allocating to this emerging asset given its properties and upside potential.

Why stocks?

Stocks aren't created equal; businesses that can pass costs to customers, like consumer staples (foods & beverages, household goods, and hygiene products), can benefit.

Also, note that stocks tend to outperform bonds when looking at 20 years of high inflation.

Stocks aren't created equal; businesses that can pass costs to customers, like consumer staples (foods & beverages, household goods, and hygiene products), can benefit.

Also, note that stocks tend to outperform bonds when looking at 20 years of high inflation.

Why real estate?

Historically, real estate rises with inflation.

This is b/c input costs also rise, higher interest rates from rising inflation will push builders to demand higher home prices to offset borrowing costs, landlords can demand higher rent, and land is finite.

Historically, real estate rises with inflation.

This is b/c input costs also rise, higher interest rates from rising inflation will push builders to demand higher home prices to offset borrowing costs, landlords can demand higher rent, and land is finite.

Why inflation linked bonds?

Bonds like US Treasury inflation-protected securities (TIPS) increase in value with inflation; the principal amount will reset according to changes in inflation.

Don't expect a big yield, but do expect to outperform normal treasury bonds.

Bonds like US Treasury inflation-protected securities (TIPS) increase in value with inflation; the principal amount will reset according to changes in inflation.

Don't expect a big yield, but do expect to outperform normal treasury bonds.

Although no one knows for certain where inflation is headed, now is the time to get smart. It's important that everyone understands inflation and what they can do to protect themselves.

If you want to learn even more, check out the complete report!👇

kraken.docsend.com/view/69nu44cwt…

If you want to learn even more, check out the complete report!👇

kraken.docsend.com/view/69nu44cwt…

• • •

Missing some Tweet in this thread? You can try to

force a refresh