I was on CNBC earlier today talking about plunging bond yields.

1/6

1/6

I'm in the camp that says inflation is not transitory. I still believe this is correct.

But, as the bottom panel suggests, this is not what the markets are worried about. Note that yields (orange) and the relative performance of reopening stocks (green) are nearly the same

2/6

But, as the bottom panel suggests, this is not what the markets are worried about. Note that yields (orange) and the relative performance of reopening stocks (green) are nearly the same

2/6

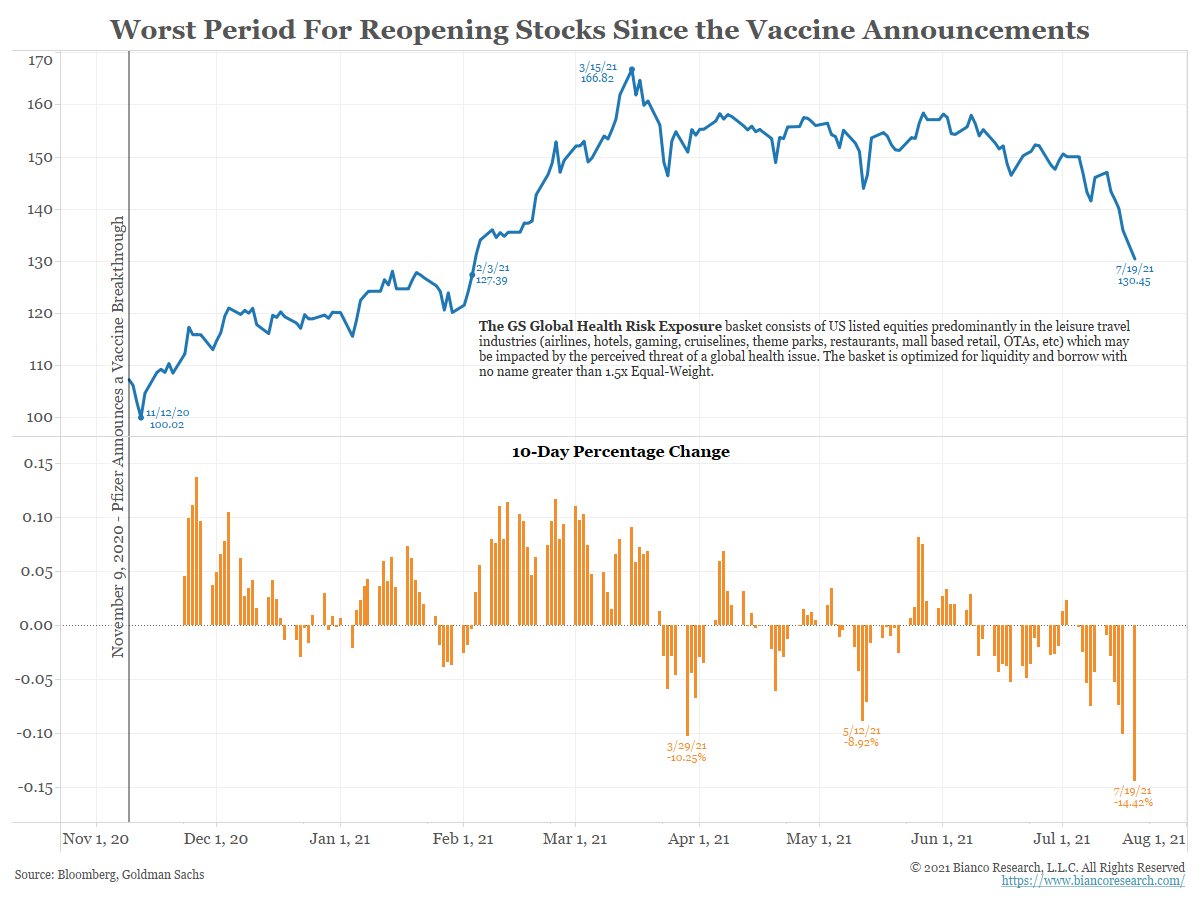

So, the market is focused on growth and not inflation. On this front, it is not good. The reopening stocks are having their worst stretch since the Pfizer vaccine announcement last November.

3/6

3/6

Why now? As the next two charts show (same chart, different time periods), case counts are doubling roughly every 7-days.

So while the level of cases is still low, give it two or three weeks.

4/6

So while the level of cases is still low, give it two or three weeks.

4/6

What is the market worried about?

The same President that accused Facebook of "killing people" for not censoring anti-vax posts is going to conclude this rise in cases means some version of "spring 2020 lockdowns" is necessary again.

5/6

The same President that accused Facebook of "killing people" for not censoring anti-vax posts is going to conclude this rise in cases means some version of "spring 2020 lockdowns" is necessary again.

5/6

Disagree?

What makes Biden say ...

"Today cases went over 200,000/day because of the Delta variant. Nevertheless, I call on all Americans to fill the offices, stadiums, schools, and commuter trains."

Do you really think he uses hospitalizations and death rates to dismiss?

6/6

What makes Biden say ...

"Today cases went over 200,000/day because of the Delta variant. Nevertheless, I call on all Americans to fill the offices, stadiums, schools, and commuter trains."

Do you really think he uses hospitalizations and death rates to dismiss?

6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh