1/ Hard to soft Money: The Hyperinflation of the Roman Empire

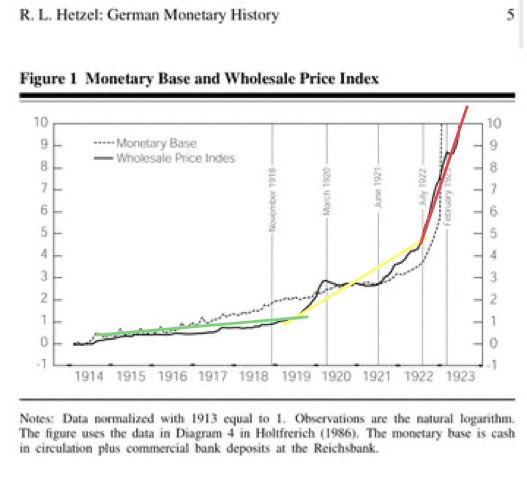

Thousands of years before 1920s Weimar Germany 🇩🇪 hyperinflation, there was the great currency debasement of the Roman Empire 🪙 .

🧵 👇

Thousands of years before 1920s Weimar Germany 🇩🇪 hyperinflation, there was the great currency debasement of the Roman Empire 🪙 .

🧵 👇

2/ At the turn of the 2nd Century AD, the Roman Empire controlled all of Western Europe, parts of North Africa and the Middle East. Some estimate up to 65-100 million people lived under Roman rule. (Approximately 20% of the world 🌎 population) .

3/ Yet, 150 years later the Empire was near collapse. There are many factors which caused the ‘Crisis of the Third Century’ (235–284 AD).

Notably political disorders, corruption, slowing expansion, wars etc… The biggest factor IMO was the debasement of the Roman Currency 💴

Notably political disorders, corruption, slowing expansion, wars etc… The biggest factor IMO was the debasement of the Roman Currency 💴

4/ The debasement of the Roman currency ultimately led to over-taxation and inflation which in turn caused financial crises.

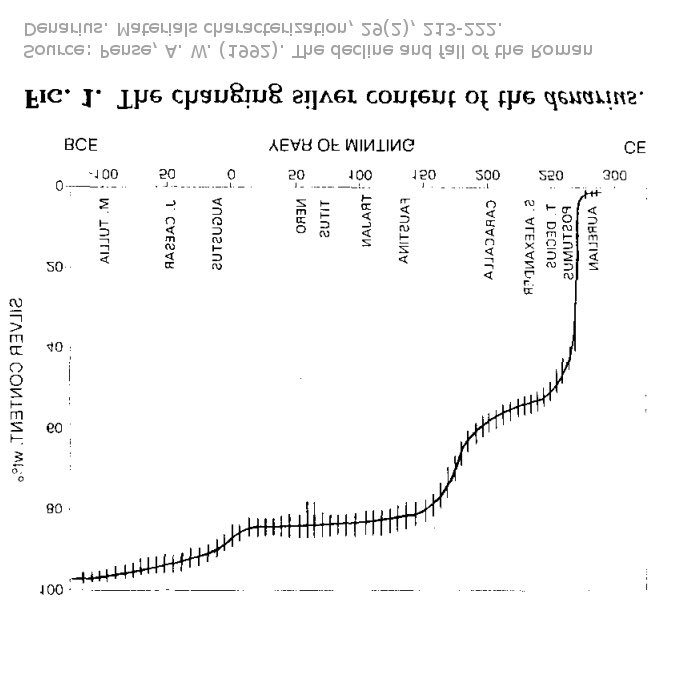

5/ The gradual debasement of the Roman currency/ coin 🪙 can be tracked through the metal composition of the denarius.

The silver denarius was minted for common use during the first 2 centuries of the Roman Empire.

The silver denarius was minted for common use during the first 2 centuries of the Roman Empire.

6/ A 4-gram coin 🪙 was comprised of 95% Silver at the time of 60 AD.

By 110 AD - 85% Silver

By 170 AD - 75% Silver

By 211 AD - 60% Silver

By 270 AD - 5% Silver

Soon thereafter, the coins were minted in Bronze.

Inflation was severe as the value of the currency declined.

By 110 AD - 85% Silver

By 170 AD - 75% Silver

By 211 AD - 60% Silver

By 270 AD - 5% Silver

Soon thereafter, the coins were minted in Bronze.

Inflation was severe as the value of the currency declined.

7/ By 290 AD new coins such as the solidus were introduced (see CBDC’s today).

This failed to stop runaway inflation, leading to the ‘Edict on Maximum Prices’. (See Weimar Germany 🇩🇪 rent controls).

The Edict, was designed to ‘cap’ the prices of over 1,000 goods & services.

This failed to stop runaway inflation, leading to the ‘Edict on Maximum Prices’. (See Weimar Germany 🇩🇪 rent controls).

The Edict, was designed to ‘cap’ the prices of over 1,000 goods & services.

8/ The Edict was also unsuccessful. Prices of goods were now 70 TIMES 👀 what they were that 2 centuries prior & most of that price increased would have occurred in the last (290 AD) decade.

9/ What began as steady devaluation soon became a rapid destruction of the currency in Rome.

You see, the debasement starts slowly at first (it always does). It’s easy to debase in the beginning. Shave a little silver here, add a few more coins there, what’s the big deal!?

You see, the debasement starts slowly at first (it always does). It’s easy to debase in the beginning. Shave a little silver here, add a few more coins there, what’s the big deal!?

10/ Besides we are creating new money (early day money printers 🖨 ) for the economy & that’s great! Or is it?

The problem is currency debasement is a lot like heroin (wouldn’t know personally, but stay with me). The first time you use it is the most potent.

The problem is currency debasement is a lot like heroin (wouldn’t know personally, but stay with me). The first time you use it is the most potent.

11/ Afterwards you are constantly trying to take more & more to get the same ‘high’ (economic stimulus via printing new money). In the end, you overdose by taking too much. The same holds true for currency debasement, in the end your currency collapses.

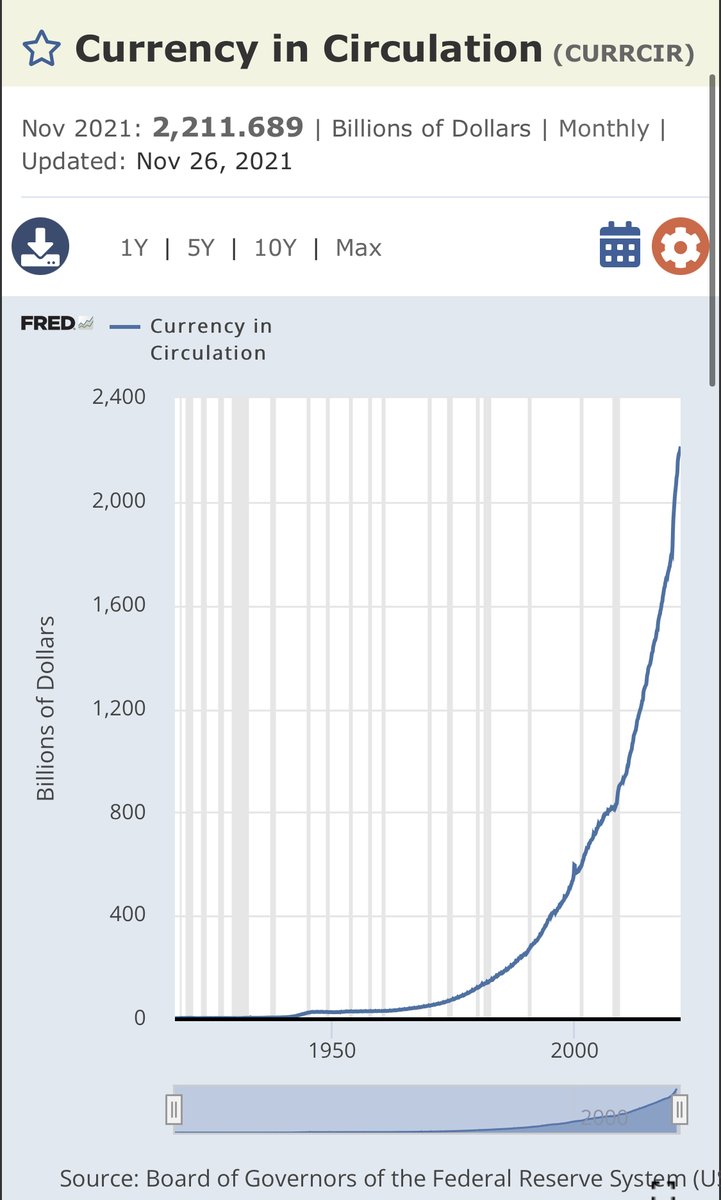

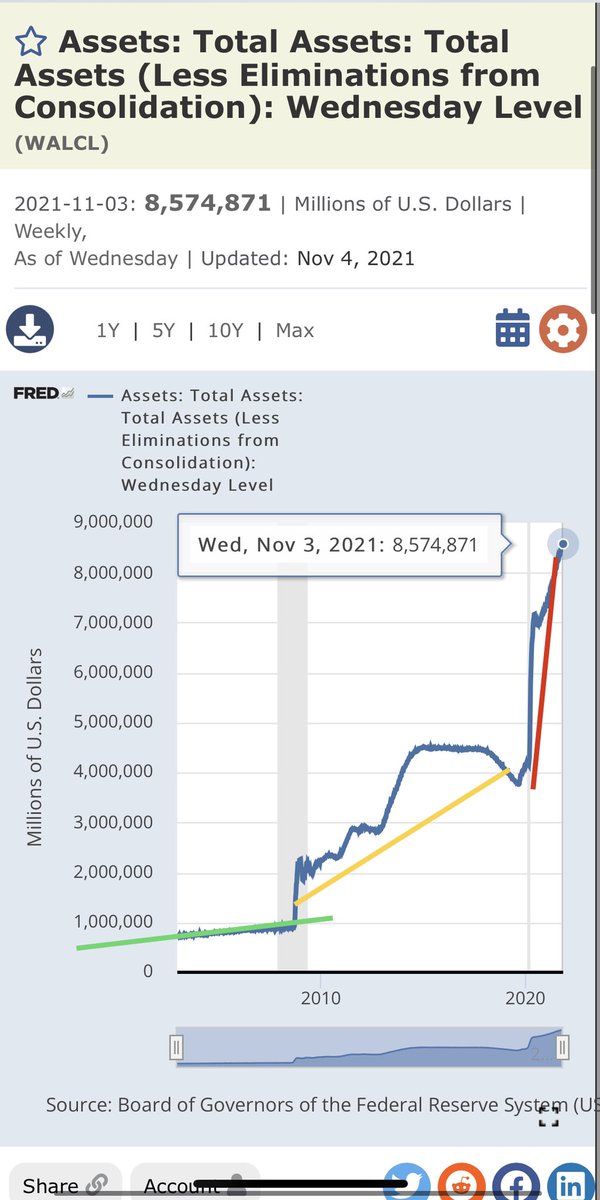

12/ Where this history lesson becomes eye opening 👀 to me is when you compare the striking similarities b/w the Roman silver content chart (chart intentionally inverted to show the amount of NON-Silver in a coin 🪙) & the balance sheet of any Central Bank 🏦 these days (FED)

13/ The similarities of these charts should be a massive fire alarm 🚨 in your head screaming ‘WARNING’. I’m showing the charts again for added affect.

14/ You see, the problem with currency debasement is it is a hard habit to kick. Worse, most don’t even realize that it’s bad. This held true in Rome, held true in Weimar Germany, and holds true today.

History is rhyming…

History is rhyming…

https://twitter.com/drew_macmartin/status/1418182390128709632

15/ US politicians in power do not see balance sheet expansion as an issue that needs solving. Worse they do not see it as a cause of inflation, or that high inflation is bad.

Currency debasement is a 1-way street. The boulder only rolls downhill.

Currency debasement is a 1-way street. The boulder only rolls downhill.

16/ @FossGregfoss said it best “I am 100% certain that Fiats will continue to debase….on an accelerated basis”

THEY CAN’T STOP PRINTING

THEY CAN’T STOP PRINTING

17/ You need to protect yourself against inflation by purchasing hard assets. Buy #Bitcoin, Gold, Silver, Real Estate. Things that are hard/ scarce & difficult to re-produce. To me, #Bitcoin is the fastest horse (best investment) of the lot by a country mile, but you do you.

18/ Finally get educated to what’s going on, the following people are excellent for breaking down what’s happening:

@PrestonPysh

@FossGregfoss

@MarkYusko

@1MarkMoss

@maxkeiser

@BTCization

@JeffBooth

@anilsaidso

@nic__carter

@theRealKiyosaki

@LawrenceLepard

@saifedean

@PrestonPysh

@FossGregfoss

@MarkYusko

@1MarkMoss

@maxkeiser

@BTCization

@JeffBooth

@anilsaidso

@nic__carter

@theRealKiyosaki

@LawrenceLepard

@saifedean

• • •

Missing some Tweet in this thread? You can try to

force a refresh