I like to compare companies with different metrics. It helps me understand a little better each business. This time, I am sharing the metric Gross Profit / Employee.

Hope you find it interesting 🙂

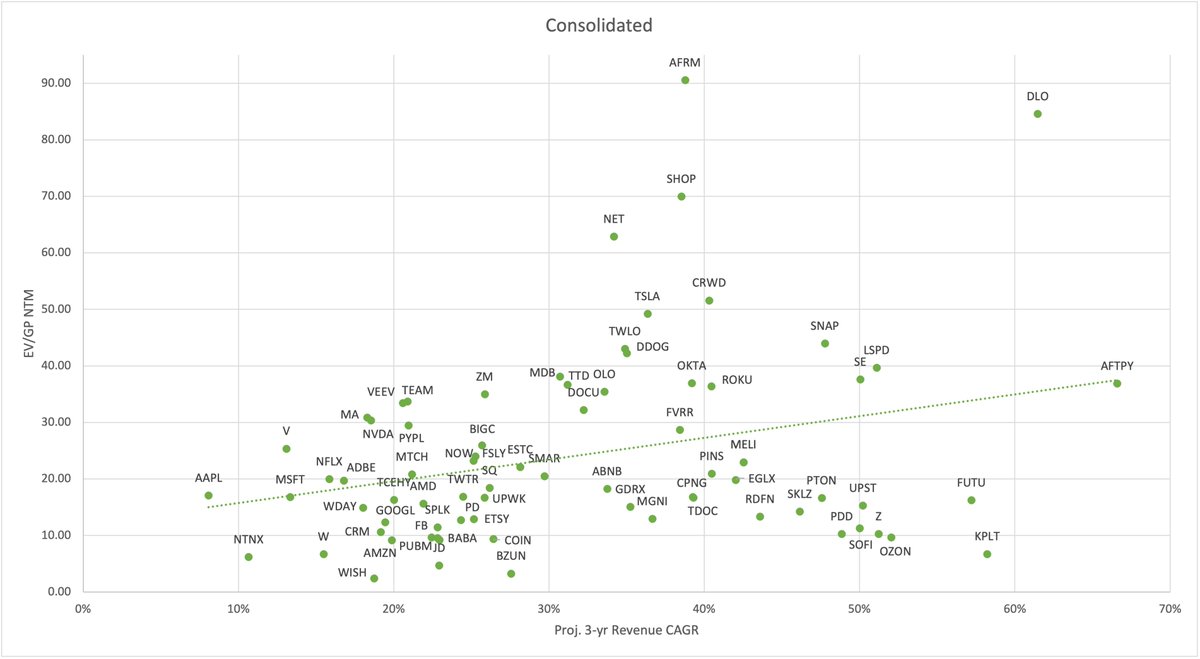

This is the consolidated graph. The next graphs are grouped by industry 👇

Hope you find it interesting 🙂

This is the consolidated graph. The next graphs are grouped by industry 👇

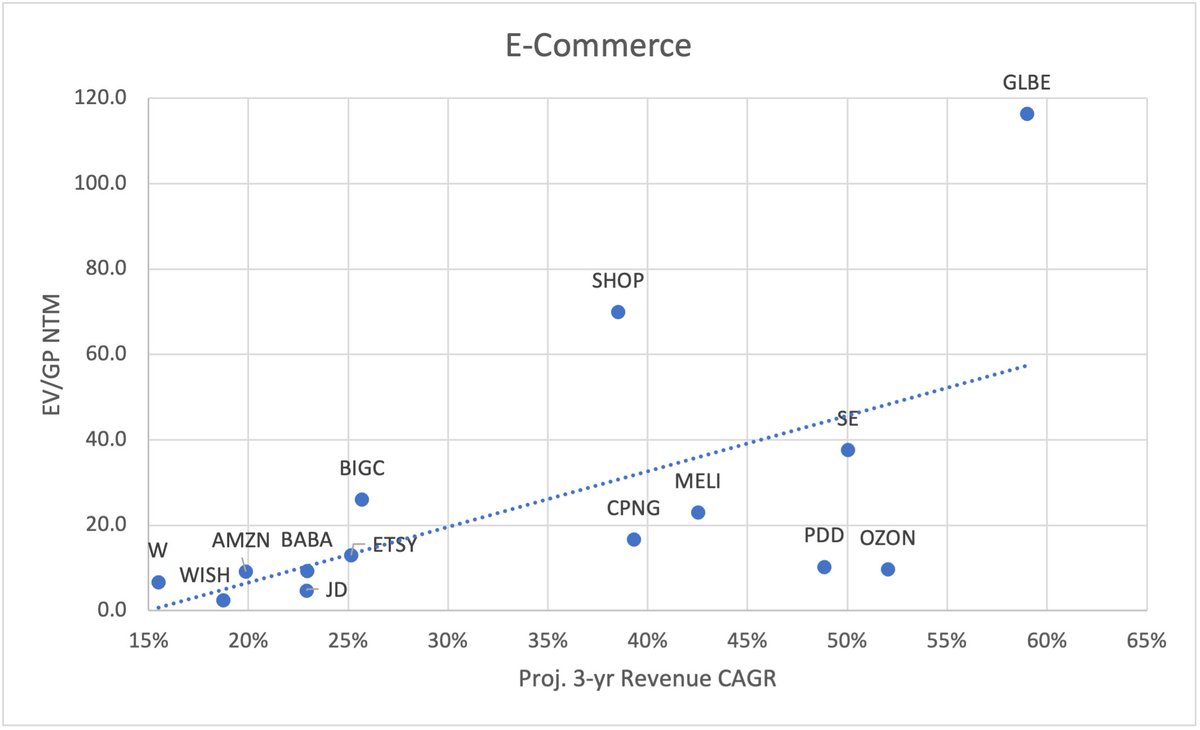

1.E-Commerce

Gross Profit / Employee (FY 2020)

$ETSY $909k

$PDD $712K

$W $248k

$SHOP $234k

$BABA $179k

$GLBE $154K

$CPNG $148k

$BIGC $132k

$MELI $125k

$AMZN $120k

$OZON $100K

$JD $55K

$SE $54K

Gross Profit / Employee (FY 2020)

$ETSY $909k

$PDD $712K

$W $248k

$SHOP $234k

$BABA $179k

$GLBE $154K

$CPNG $148k

$BIGC $132k

$MELI $125k

$AMZN $120k

$OZON $100K

$JD $55K

$SE $54K

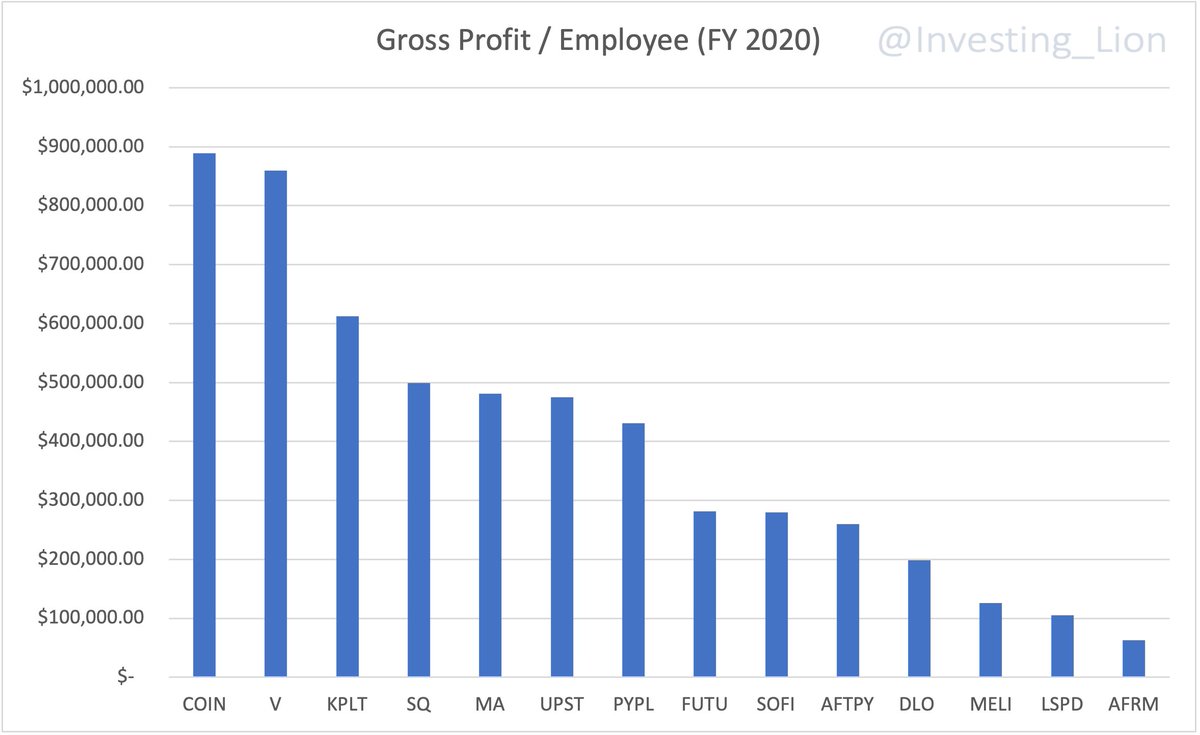

Fintech and Payments

Gross Profit / Employee (FY 2020)

$COIN $888K

$V $859K

$KPLT $612K

$SQ $499K

$MA $481k

$UPST $475k

$PYPL $431k

$FUTU $282k

$SOFI $279k

$AFTPY $260k

$DLO $198k

$MELI $126k

$LSPD $105k

$AFRM $63k

Gross Profit / Employee (FY 2020)

$COIN $888K

$V $859K

$KPLT $612K

$SQ $499K

$MA $481k

$UPST $475k

$PYPL $431k

$FUTU $282k

$SOFI $279k

$AFTPY $260k

$DLO $198k

$MELI $126k

$LSPD $105k

$AFRM $63k

Social Media and Digital Ads

Gross Profit / Employee (FY 2020)

$FB $1,181k

$MTCH $934k

$GOOGL $733k

$PINS $496k

$TTD $427k

$TWTR $425k

$SNAP $339k

$ROKU $299k

$MGNI $256k

$PUBM $203k

Gross Profit / Employee (FY 2020)

$FB $1,181k

$MTCH $934k

$GOOGL $733k

$PINS $496k

$TTD $427k

$TWTR $425k

$SNAP $339k

$ROKU $299k

$MGNI $256k

$PUBM $203k

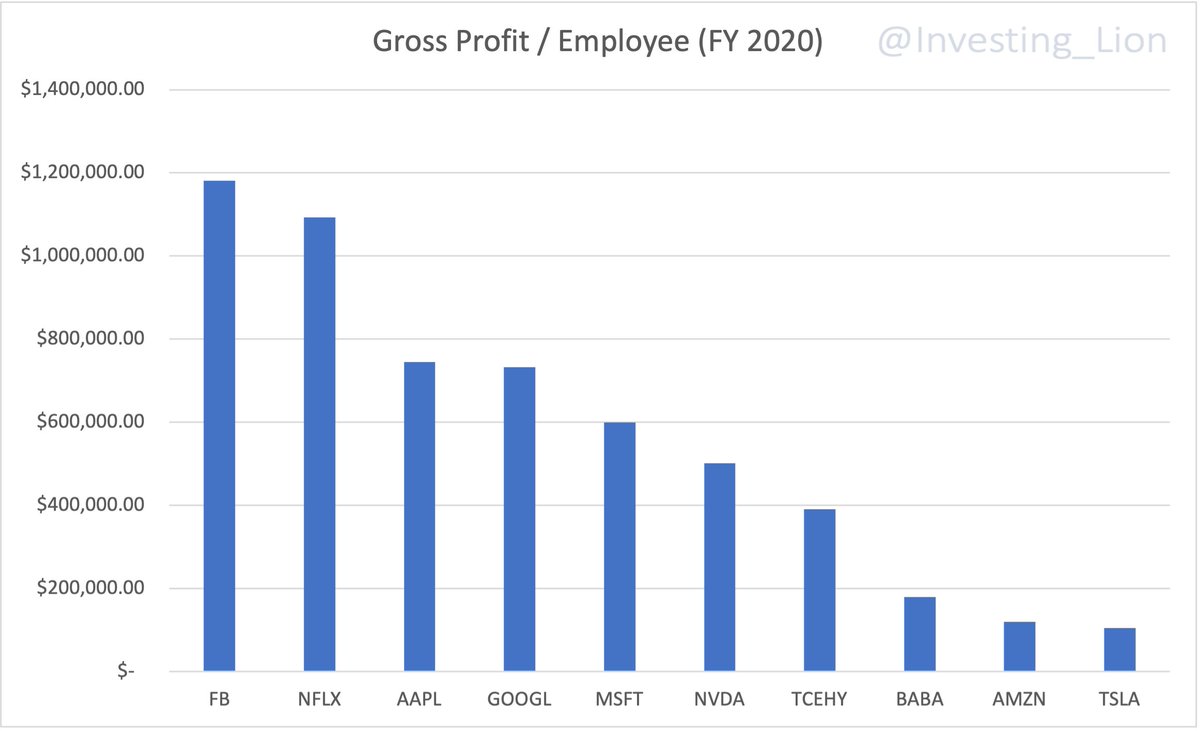

Mega Cap

Gross Profit / Employee (FY 2020)

$FB $1,181k

$NFLX $1,092k

$AAPL $745k

$GOOGL $733k

$MSFT $600k

$NVDA $501k

$TCEHY $391k

$BABA $180k

$AMZN $120k

$TSLA $105k

Gross Profit / Employee (FY 2020)

$FB $1,181k

$NFLX $1,092k

$AAPL $745k

$GOOGL $733k

$MSFT $600k

$NVDA $501k

$TCEHY $391k

$BABA $180k

$AMZN $120k

$TSLA $105k

SAAS

Gross Profit / Employee (FY 2020)

$ZM $733k

$OLO $603k

$ADBE 502k

$CRM $322k

$SPLK $286k

$TEAM $277k

$PD $271k

$NOW $271k

$ESTC $232k

$DDOG $214k

$TWLO $195k

$NET $184k

$FSLY $169k

$SNOW $169k

$NTNX $167k

$OKTA $154k

$CRWD $154k

$DOCU $132k

$MDB $116k

Gross Profit / Employee (FY 2020)

$ZM $733k

$OLO $603k

$ADBE 502k

$CRM $322k

$SPLK $286k

$TEAM $277k

$PD $271k

$NOW $271k

$ESTC $232k

$DDOG $214k

$TWLO $195k

$NET $184k

$FSLY $169k

$SNOW $169k

$NTNX $167k

$OKTA $154k

$CRWD $154k

$DOCU $132k

$MDB $116k

Real Estate / Healthcare / Gig Economy / Gaming / Other

Gross Profit / Employee (FY 2020)

$GDRX 1,084k

$SKLZ $788k

$UPWK 501K

$ABNB $453k

$AMD $347k

$FVRR $289k

$Z $237k

$PTON $224k

$TDOC $164k

$EGLX $135k

$BZUN $82k

$RDFN 51k

$LTCH 18k

Gross Profit / Employee (FY 2020)

$GDRX 1,084k

$SKLZ $788k

$UPWK 501K

$ABNB $453k

$AMD $347k

$FVRR $289k

$Z $237k

$PTON $224k

$TDOC $164k

$EGLX $135k

$BZUN $82k

$RDFN 51k

$LTCH 18k

This is an interesting comparison metric (one of many) that can be analyzed to compare productivity between companies and industries at a point in time.

The trend of this ratio is probably more important than the current ratio. I may do a thread in the future based on trends.

The trend of this ratio is probably more important than the current ratio. I may do a thread in the future based on trends.

If you are more interested in valuation, I did a thread comparing these companies based on EV/GP NTM vs 3-year CAGR last week.

You can see that other thread here 👇

You can see that other thread here 👇

https://twitter.com/Investing_Lion/status/1415653929745059843?s=19

If you are still reading this, thank you! 🙏

Is there another metric that may interest you for future posts?

CC:

@skaushi @Soumyazen @caleb_investTML @PelotonHolder @qcapital2020 @StockMarketNerd @Prof_Kalkyl @IrnestKaplan

Is there another metric that may interest you for future posts?

CC:

@skaushi @Soumyazen @caleb_investTML @PelotonHolder @qcapital2020 @StockMarketNerd @Prof_Kalkyl @IrnestKaplan

• • •

Missing some Tweet in this thread? You can try to

force a refresh