$MSFT is an interesting case study. Tech bubble, crash, wandered in the desert for years, got cheap and made it into the Magic Formula, mgmt change, pivot biz model and caught a secular trend, then quality/growth and momentum winner for years on end. Something for everyone. 1/n

https://twitter.com/vitaliyk/status/1268869824106520576

The original tweet pointed out how long it took for MSFT to regain its tech bubble high. What I find more remarkable is its performance since it stopped going sideways. Almost a straight line up and to the right.

Enough fundamentals have proved out to know it was wildly undervalued at least most of that time. Interesting that in hindsight one of the cheapest stocks in the past decade was a universally known megacap, and a momentum stock constantly hitting new all time highs.

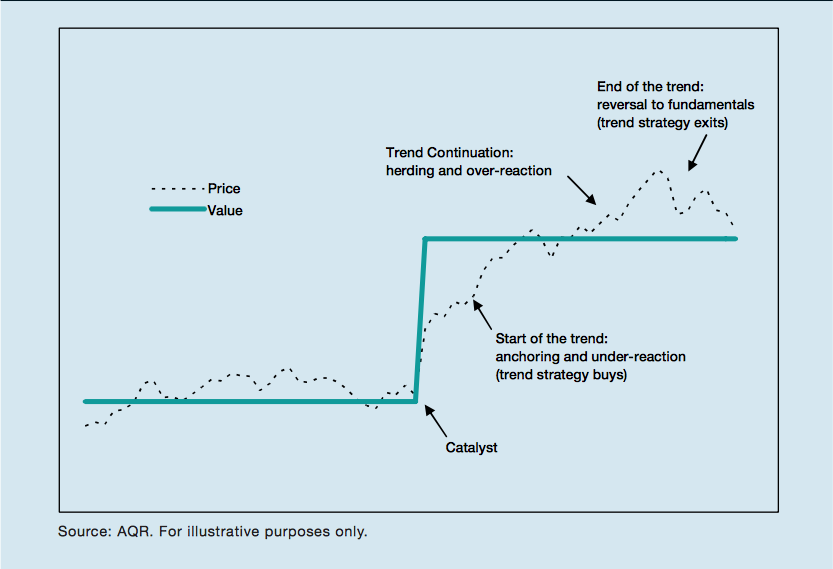

A perfect example of momentum caused by an underreaction to fundamentals. (blog.thinknewfound.com/2018/03/two-ce…)

If the market suddenly became efficient, MSFT would have gapped up a few hundred % so that returns going forward could have been something closer to its discount rate.

If the market suddenly became efficient, MSFT would have gapped up a few hundred % so that returns going forward could have been something closer to its discount rate.

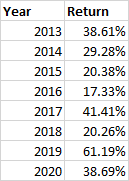

But stocks don't move like that, especially a sleepy megacap, and therein lies opportunity. Instead, it steadily gained ~35% annualized for 8 years, with a great return every single year.

Why so consistent? I think it's due to a "speed limit" in the minds of investors. If it's at ATH and up X% in the past year, they can't bring themselves to buy, reasoning it's gone up too much, putting a ceiling on price in the near term. X differs based on investor population.

As for a floor, there were enough investors lined up waiting to buy on a pullback. Crashes don't happen when all the small dips are bought. The presence of a ceiling and a floor on the stock combined with undervaluation resulted in the peculiar "straight line" price pattern.

I've seen people say technical analysis works because others are looking at the same things, and there's positive feedback. But I think it work best when FEW people are using it. The best trends form when most are trading counter-trend. Trend traders want dip buyers to sell to.

When something becomes crowded by trend followers, a dip can become a crash as selling begets more selling. A crash finds a bottom where counter-trend traders will buy. So a good assessment of value will limit downside if other value investors show up below that price.

Buffett doesn't think much of trying to predict the future with squiggly lines and obviously I disagree with him, but there's nothing wrong with not playing on that axis. And his style is much more momentum driven than people think.

His buys are at great prices but he makes most of his money in holding the stocks, not in buying them. His best winners have spent much of their lives as great momentum stocks over decades, and so has Berkshire itself. Business momentum reflected in price momentum.

So to his credit, he hasn't harmed himself by reacting to price, which I think many fundamental investors do - deride technical analysis and then be influenced by price because they're human. And if they're doing it in a systematic way, technical traders can take advantage of it.

My takeaways - if you're a fundamental investor, and your thesis is playing out, do not fear ATHs and a price chart that's a straight line up and to the right. This is how you get from point A to point B if A and B are very far apart, as you correctly thought.

If you're a technical trader, it still makes sense to pay attention to fundamentals. Undervalued high quality stocks limit your downside and make for beautiful trends.

• • •

Missing some Tweet in this thread? You can try to

force a refresh