Global Macro Review 07/25/2021

1/16

Hedge funds rattled by $RUT @Mike_Taylor1972 and active participants confused by the phase transition price action @PatrickCeresna

Let’s review what has been working/failing on trade and Trend durations for clues

t = 1-month, T = 3-months

1/16

Hedge funds rattled by $RUT @Mike_Taylor1972 and active participants confused by the phase transition price action @PatrickCeresna

Let’s review what has been working/failing on trade and Trend durations for clues

t = 1-month, T = 3-months

2/16

Domestic equities bounced off Monday’s ↘️ day with $COMPQ +2.84%, $IWM +2.14%, and $SPX +1.96% for the week. But 👀 (t) + (T)

SPX +3.06% (t), +5.54% (T) ♉️

COMPQ +3.32% (t) +5.85% (T) ♉️

IWM -5.48% (t), -2.75% (T) 🐻

Domestic equities bounced off Monday’s ↘️ day with $COMPQ +2.84%, $IWM +2.14%, and $SPX +1.96% for the week. But 👀 (t) + (T)

SPX +3.06% (t), +5.54% (T) ♉️

COMPQ +3.32% (t) +5.85% (T) ♉️

IWM -5.48% (t), -2.75% (T) 🐻

3/16

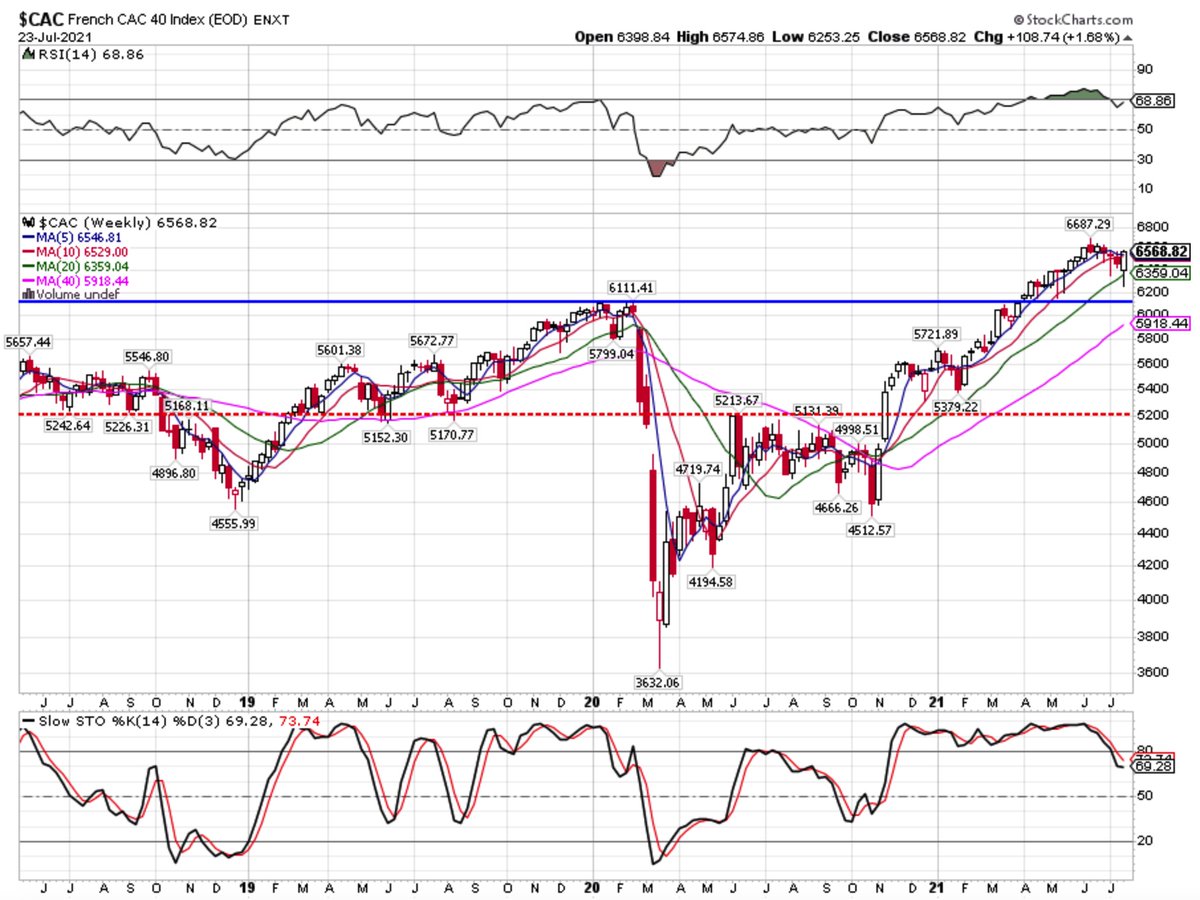

International equities a little less sanguine with $CAC +1.68% and $HSI -2.44% for the week

CAC -0.82% (t) +4.97% (T)

DAX +0.39% (t) + 2.55% (T) ♉️

SSEC -1.33% (t) +2.45% (T)

KOSPI -1.47% (t, +2.14% (T)

NIKK -5.22% (t) -5.07% (T) 🐻

HSI -6.73% (t) -6.04% (T) 🐻

International equities a little less sanguine with $CAC +1.68% and $HSI -2.44% for the week

CAC -0.82% (t) +4.97% (T)

DAX +0.39% (t) + 2.55% (T) ♉️

SSEC -1.33% (t) +2.45% (T)

KOSPI -1.47% (t, +2.14% (T)

NIKK -5.22% (t) -5.07% (T) 🐻

HSI -6.73% (t) -6.04% (T) 🐻

4/16

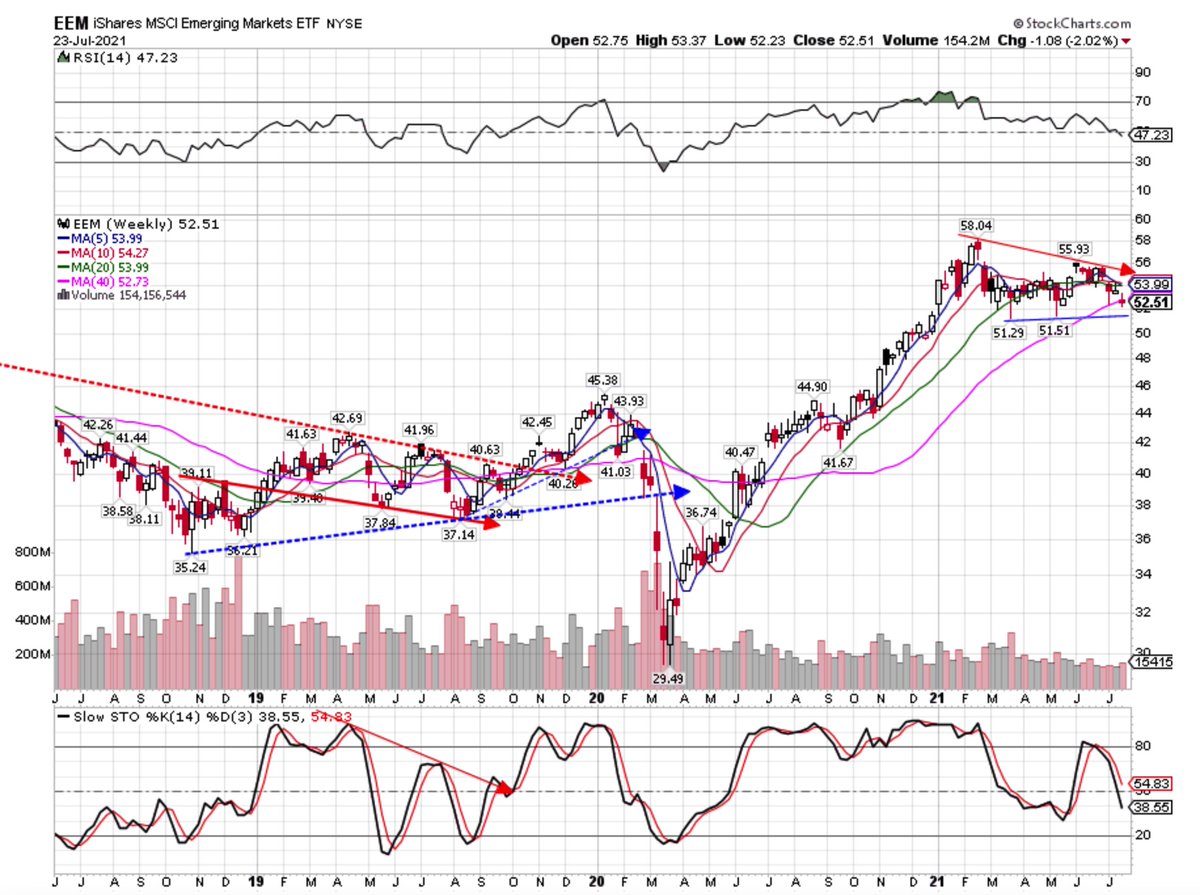

With the exception of VXEEM, equity vol came in for the week…

$VIX 17.20 -6.78%

$VXN 19.06 -9.5%

$RVX 25.12 -4.99%

$VXEEM 20.63 +7.22%

… notable, as $EEM -2.02% for the week and -5.39% (t), -3.88% (T) 🐻

With the exception of VXEEM, equity vol came in for the week…

$VIX 17.20 -6.78%

$VXN 19.06 -9.5%

$RVX 25.12 -4.99%

$VXEEM 20.63 +7.22%

… notable, as $EEM -2.02% for the week and -5.39% (t), -3.88% (T) 🐻

5/16

$WTIC 72.07 +0.72% sold off hard, touching 65.01 before closing ↗️ on the week

WTIC -2.67% (t) +15.98% (T)

BRENT -2.39% (t) + 12.21% (T)

GASO unch (t) +12.44% (T)

$OVX 34.05 -8.34% for the week after touching 71.52 on the #OPEC+ 😱

$WTIC 72.07 +0.72% sold off hard, touching 65.01 before closing ↗️ on the week

WTIC -2.67% (t) +15.98% (T)

BRENT -2.39% (t) + 12.21% (T)

GASO unch (t) +12.44% (T)

$OVX 34.05 -8.34% for the week after touching 71.52 on the #OPEC+ 😱

7/16

$COPPER +1.78% led metals ↗️ as PLAT -4.25% 🪠

COPPER +2.56% (t) +1.38% (T) ♉️

GOLD +1.35% (t) + 1.35% (T) ♉️

SILVER -3.3% (t) -6.45% (T) 🐻

PLAT -3.82% (t) - 13.92% (T) 🐻

$GVZ 14.53 -0.48%

$VXSLV 27.44 -4.00%

$COPPER +1.78% led metals ↗️ as PLAT -4.25% 🪠

COPPER +2.56% (t) +1.38% (T) ♉️

GOLD +1.35% (t) + 1.35% (T) ♉️

SILVER -3.3% (t) -6.45% (T) 🐻

PLAT -3.82% (t) - 13.92% (T) 🐻

$GVZ 14.53 -0.48%

$VXSLV 27.44 -4.00%

8/16

↔️💰 with🌾🌽

SUGAR +2.6% while $CORN -1.63%, WHEAT -1.23%, and SOYB -2.87%

SUGAR +2.6% (t) +4.97% (T) ♉️

CORN +4.57% (t) -14.15% (T)

SOYB +6.46% (t) -10.83% (T)

WHEAT +6.75% (t) -3.97% (T)

↔️💰 with🌾🌽

SUGAR +2.6% while $CORN -1.63%, WHEAT -1.23%, and SOYB -2.87%

SUGAR +2.6% (t) +4.97% (T) ♉️

CORN +4.57% (t) -14.15% (T)

SOYB +6.46% (t) -10.83% (T)

WHEAT +6.75% (t) -3.97% (T)

9/16

The USD +0.26% is the only major currency ♉️ t+T

USD +1.19% (t) +2.3% (T) ♉️

GBP -1.08% (t) -0.94% (T) 🐻

EUR -1.42% (t) -2.66% (T) 🐻

AUD -3.03% (t) -5.03% (T) 🐻

The USD +0.26% is the only major currency ♉️ t+T

USD +1.19% (t) +2.3% (T) ♉️

GBP -1.08% (t) -0.94% (T) 🐻

EUR -1.42% (t) -2.66% (T) 🐻

AUD -3.03% (t) -5.03% (T) 🐻

10/16

After dropping to < 100 BPS early in the week, the 10/2s 108.1 BPS +0.84% ↗️ for the first time in July.

2Y -25.37% (t) + 25.79% (T)

5Y -22.92% (t) -12.62% (T) 🐻

10Y -15.94% (t) - 17.88% (T) 🐻

30Y -10.6% (t) -13.96% (T) 🐻

MOVE 65.28 +12.09% ⚠️

After dropping to < 100 BPS early in the week, the 10/2s 108.1 BPS +0.84% ↗️ for the first time in July.

2Y -25.37% (t) + 25.79% (T)

5Y -22.92% (t) -12.62% (T) 🐻

10Y -15.94% (t) - 17.88% (T) 🐻

30Y -10.6% (t) -13.96% (T) 🐻

MOVE 65.28 +12.09% ⚠️

11/16

With the steepening, $IVOL + 1.22% ↗️

TLT +4.57% (t) +6.03% (T)

LQD +1.72% (t) + 2.37% (T)

IEF +2.03% (t) + 2.37% (T)

TIP +1.61% (t) +2.37% (T)

BNDX +1.51% (t) + 1.1% (T)

CWB -0.91% (t) +0.07% (T)

IVOL +1.08% (t) -1.33% (T)

With the steepening, $IVOL + 1.22% ↗️

TLT +4.57% (t) +6.03% (T)

LQD +1.72% (t) + 2.37% (T)

IEF +2.03% (t) + 2.37% (T)

TIP +1.61% (t) +2.37% (T)

BNDX +1.51% (t) + 1.1% (T)

CWB -0.91% (t) +0.07% (T)

IVOL +1.08% (t) -1.33% (T)

12/16

Top performing sector funds on the week

XLC +3.26% | +3.53% (t) +9.22% (T)

XLY +2.95% | +3.0% (t) +3.06% (T)

XLK +2.81% | +6.4% (t) +8.28% (T)

Les miserable

XLU -0.85% | +2.7% (t) -1.31% (T)

XLE -0.33% | -12.82% (t) +2.06% (T)

Noteworthy

XLRE +3.56% (t) +9.56% (T)

Top performing sector funds on the week

XLC +3.26% | +3.53% (t) +9.22% (T)

XLY +2.95% | +3.0% (t) +3.06% (T)

XLK +2.81% | +6.4% (t) +8.28% (T)

Les miserable

XLU -0.85% | +2.7% (t) -1.31% (T)

XLE -0.33% | -12.82% (t) +2.06% (T)

Noteworthy

XLRE +3.56% (t) +9.56% (T)

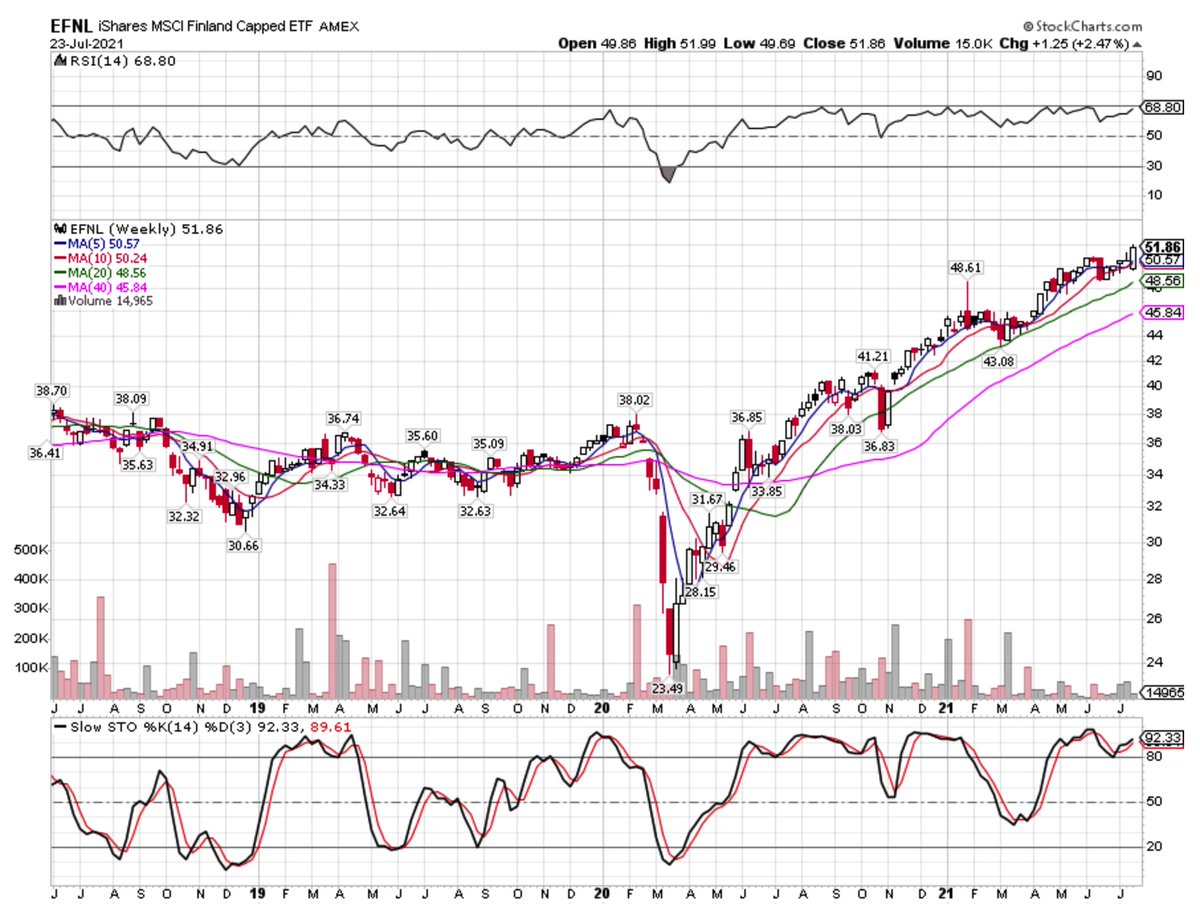

Northern European country funds outperformed

EFNL + 2.49% | +3.95% (t) +4.98% (T)

EWD +2.67% | + 2.34% (t) +1.16% (T)

EWN +3.41% | + 1.43% (t) +0.79% (T)

Asian shorts abound

FXI -3.65% | -9.19% (t) -10.11% (T)

THD -2.06% | -6.63% (t) -6.57% (T)

EWH -0.71% | -1.33% (t) -2.98% (T)

EFNL + 2.49% | +3.95% (t) +4.98% (T)

EWD +2.67% | + 2.34% (t) +1.16% (T)

EWN +3.41% | + 1.43% (t) +0.79% (T)

Asian shorts abound

FXI -3.65% | -9.19% (t) -10.11% (T)

THD -2.06% | -6.63% (t) -6.57% (T)

EWH -0.71% | -1.33% (t) -2.98% (T)

14/16

There is also confusion among macro advisors from a growth & inflation regime perspective.

@Hedgeye is calling for a quad 2 > 3 pivot during this transition while @42macro calling for Goldilocks > Deflation.

The common denominator = decline in the ROC of growth

There is also confusion among macro advisors from a growth & inflation regime perspective.

@Hedgeye is calling for a quad 2 > 3 pivot during this transition while @42macro calling for Goldilocks > Deflation.

The common denominator = decline in the ROC of growth

15/16

So, what we have is a traders' market.

The strategy is to #BTFD in bull trends and #STFR and vice-versa for bear trends.

Assuming no deep #quad4 / deflation, trading around core long allocations in TLT, GLD, XLU, SPLV QUAL and short XLF, XLB, IWM, HYG makes sense.

So, what we have is a traders' market.

The strategy is to #BTFD in bull trends and #STFR and vice-versa for bear trends.

Assuming no deep #quad4 / deflation, trading around core long allocations in TLT, GLD, XLU, SPLV QUAL and short XLF, XLB, IWM, HYG makes sense.

16/16

Personally, I am not in the #deflation camp with SPX COMPQ CRB making ATHs

MTUM SPYG DBA DBB DBC all continue to work but keeping 👀 on commodities for 🚧 of trouble

The last FOMC meeting certainly caused problems with the $CRB -3.01%

Have a super profitable 💰 week!

Personally, I am not in the #deflation camp with SPX COMPQ CRB making ATHs

MTUM SPYG DBA DBB DBC all continue to work but keeping 👀 on commodities for 🚧 of trouble

The last FOMC meeting certainly caused problems with the $CRB -3.01%

Have a super profitable 💰 week!

• • •

Missing some Tweet in this thread? You can try to

force a refresh