SM | How Entrepreneurs became Millionaire (Mln)

26 Jul,

24 tweets, 5 min read

The pandemic-related disruption impacted most consumer companies but weighed heavily on ITC which reported a sharp earning decline in FY21. ITC enjoys low base benefit but 1Q performance has been sharply ahead led by cigarettes (& paperboards); FMCG EBIT was also ahead.

(2/n)

(2/n)

Management showed agility during times of disruption and has presented a fairly positive outlook. We raise EPS by 2-4% and view ITC as a high conviction Buy with a price target of Rs275.

(3/n)

(3/n)

1Q performance:

Op. EBITDA grew 51% YoY to Rs40bn, 12% ahead of our estimates. On a 2-yr CAGR, EBITDA still declined 6%, which is understandable in the context of restrictions during the quarter.

(4/n)

Op. EBITDA grew 51% YoY to Rs40bn, 12% ahead of our estimates. On a 2-yr CAGR, EBITDA still declined 6%, which is understandable in the context of restrictions during the quarter.

(4/n)

1Q performance:

Net earnings grew 29% YoY to Rs30bn, which was 6% ahead (lower beat at net level partially due to falling yields, impacting other income).

(5/n)

Net earnings grew 29% YoY to Rs30bn, which was 6% ahead (lower beat at net level partially due to falling yields, impacting other income).

(5/n)

Recovery in cigarette:

Net revenues grew 33% YoY which was entirely led by volumes. EBIT grew 37% YoY, 7% ahead - beat was led by higher volumes & margins. On a 2-yr CAGR, EBIT declined 9% and volumes also contracted. Covid impact was higher in markets of south, metros etc.

(6/n)

Net revenues grew 33% YoY which was entirely led by volumes. EBIT grew 37% YoY, 7% ahead - beat was led by higher volumes & margins. On a 2-yr CAGR, EBIT declined 9% and volumes also contracted. Covid impact was higher in markets of south, metros etc.

(6/n)

Cigarette outlook:

There has been steady improvement from mid-Jun'21 with most markets returning to normalcy and the recovery has been faster than the first wave although certain markets of Kerala, Odisha & north-east remain partially impacted.

(7/n)

There has been steady improvement from mid-Jun'21 with most markets returning to normalcy and the recovery has been faster than the first wave although certain markets of Kerala, Odisha & north-east remain partially impacted.

(7/n)

Management outlook on Cigarette:

Management has also shown agility and has been focusing on expanding cigarette presence in grocery which may add to medium-term potential, in our view.

(8/n)

Management has also shown agility and has been focusing on expanding cigarette presence in grocery which may add to medium-term potential, in our view.

(8/n)

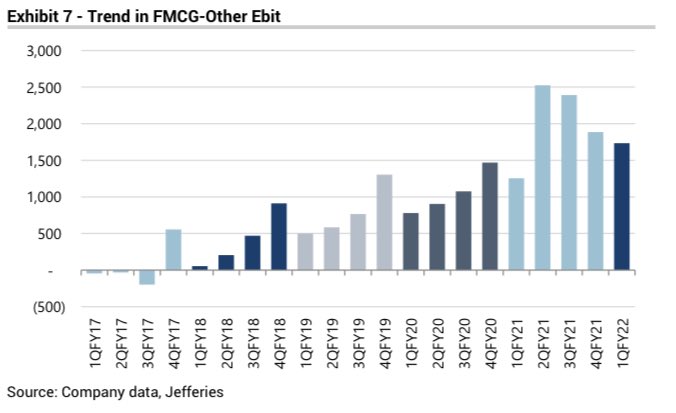

FMCG EBIT better:

FMCG revenues grew 10%- the modest growth has been due to a high base of last year as categories like staple/foods benefited from pantry loading coupled with disruption in the current quarter; hygiene portfolio bounced-back post normalization in 2HFY21.

(9/n)

FMCG revenues grew 10%- the modest growth has been due to a high base of last year as categories like staple/foods benefited from pantry loading coupled with disruption in the current quarter; hygiene portfolio bounced-back post normalization in 2HFY21.

(9/n)

FMCG contd

FMCG EBITDA grew 16% YoY while EBIT was up 38% to Rs1.7bn which was 14% ahead. However, there are concerns on the input price front particularly on vegetable oil, packaging etc.

10/n

FMCG EBITDA grew 16% YoY while EBIT was up 38% to Rs1.7bn which was 14% ahead. However, there are concerns on the input price front particularly on vegetable oil, packaging etc.

10/n

Blockbuster paperboards:

Revenue grew 54% YoY - while low base helped, this was still significantly ahead of our estimates. EBIT margins rose to an all-time high at c.25% which drove EBIT 2.5x YoY to Rs3.9bn.

11/n

Revenue grew 54% YoY - while low base helped, this was still significantly ahead of our estimates. EBIT margins rose to an all-time high at c.25% which drove EBIT 2.5x YoY to Rs3.9bn.

11/n

Paper boards contd

The strong performance was partially led by higher global pulp prices which actually benefited ITC given its investments in the back-end, and we believe this is likely to continue for the next couple of quarters.

12/n

The strong performance was partially led by higher global pulp prices which actually benefited ITC given its investments in the back-end, and we believe this is likely to continue for the next couple of quarters.

12/n

Others: Hotels' revenues were impacted although increased multi-fold YoY off a low base. However, business remained in losses due to sub-par revenue trend. Jun-21 trends improve as travel restrictions eased and ITC also ramped-up food takeaway/ home delivery segment.

13/n

13/n

Other contd ...

Agri revenues & EBIT grew 9-10% led by opportunities in wheat, rice & leaf tobacco.

14 /n

Agri revenues & EBIT grew 9-10% led by opportunities in wheat, rice & leaf tobacco.

14 /n

Raise EPS - Buy:

With better-than-expected results along with better commentary, we raise EPS forecasts by 2-4%. We retain our Buy rating with a slightly higher PT at Rs275.

15 / n

With better-than-expected results along with better commentary, we raise EPS forecasts by 2-4%. We retain our Buy rating with a slightly higher PT at Rs275.

15 / n

ITC 1q FY 22 summary

Op. Ebitda above estimate led by better- than expected performance in cigarette and paperboard business

16/n

Op. Ebitda above estimate led by better- than expected performance in cigarette and paperboard business

16/n

Cigarette volumes grew c.33% YoY, in our view. This implies a 7% decline on 2-yr Cagr vs. 2% decline seen in 4Q

18 / n

18 / n

Segment information

Both cigarettes and hotels business saw a QoQ drop in revenue/ Ebit, albeit performed better YoY given lower impact of the second wave

19/n

Both cigarettes and hotels business saw a QoQ drop in revenue/ Ebit, albeit performed better YoY given lower impact of the second wave

19/n

Trend in Cigarette EBIT

Cigarette EBIT grew 37% YoY, which implies a 9% decline on a 2-yr cagr vs. 2% decline in 4QFY21

20 / n

Cigarette EBIT grew 37% YoY, which implies a 9% decline on a 2-yr cagr vs. 2% decline in 4QFY21

20 / n

FMCG - Other - EBIT

Segment EBITDA grew 16%, with Ebitda margin up 40bps YoY. Excluding benefit of Sunrise acquisition, FMCG margins were largely flattish in our view

22 / n

Segment EBITDA grew 16%, with Ebitda margin up 40bps YoY. Excluding benefit of Sunrise acquisition, FMCG margins were largely flattish in our view

22 / n

SOTP

ITC's SoTP valuation yields a fair value of Rs275/share

Cigarette business accounts for 61% of SoTP value, while FMCG accounts for 22%

23 / n

ITC's SoTP valuation yields a fair value of Rs275/share

Cigarette business accounts for 61% of SoTP value, while FMCG accounts for 22%

23 / n

1 year forward PE

ITC trades at 16x 1-year forward consensus EPS; 1 SD below 5-year average

24 / end

ITC trades at 16x 1-year forward consensus EPS; 1 SD below 5-year average

24 / end

• • •

Missing some Tweet in this thread? You can try to

force a refresh