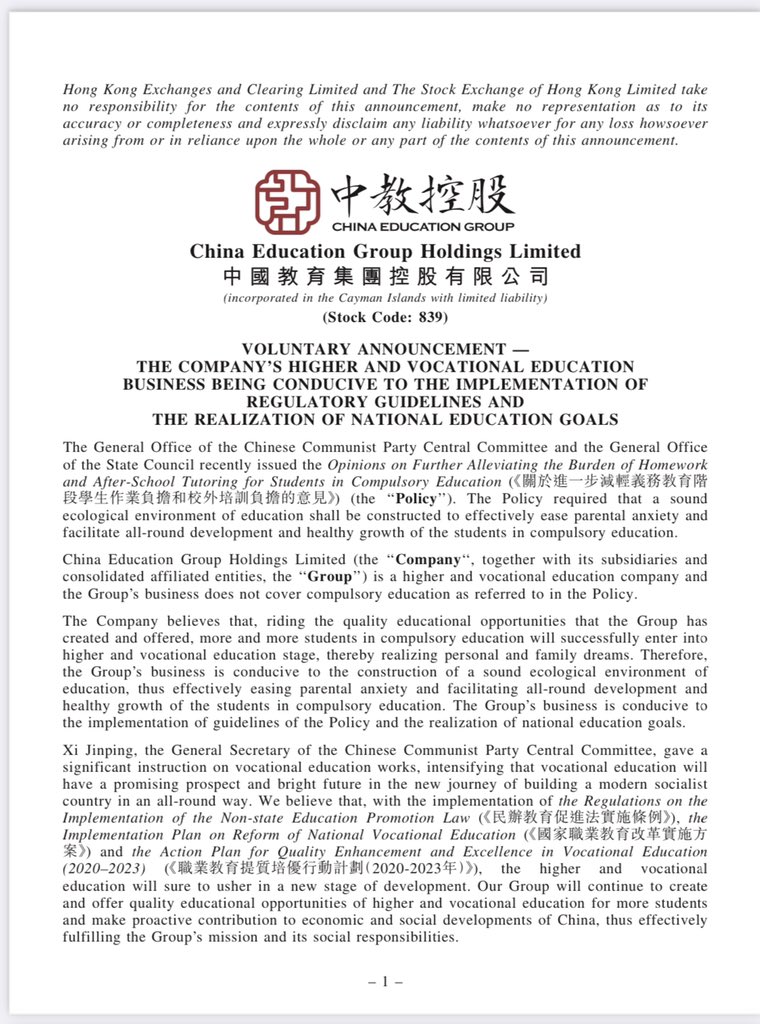

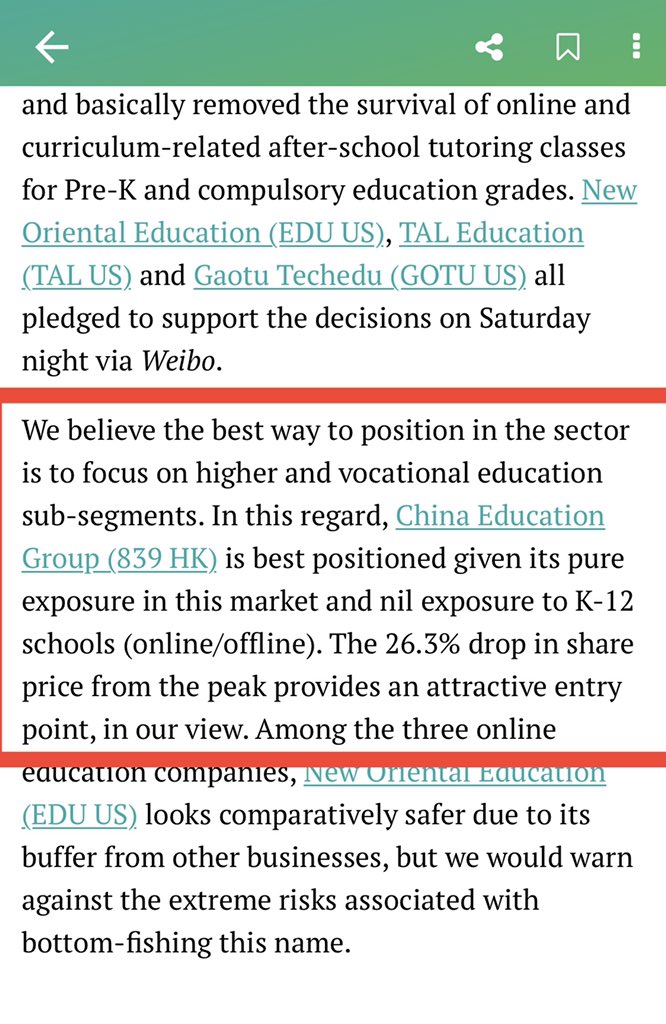

China Education: Time to put baby back in the bath water? Brick & mortar, tertiary / vocational education stocks also hammered despite no -ve policy implications. Now big guys are batting on the front foot. See o/n from $839.HK China Education Group www1.hkexnews.hk/listedco/listc…

Osbert Tang was highlighting this into market open, and again intraday yesterday. The dust will settle, and new leadership will emerge.

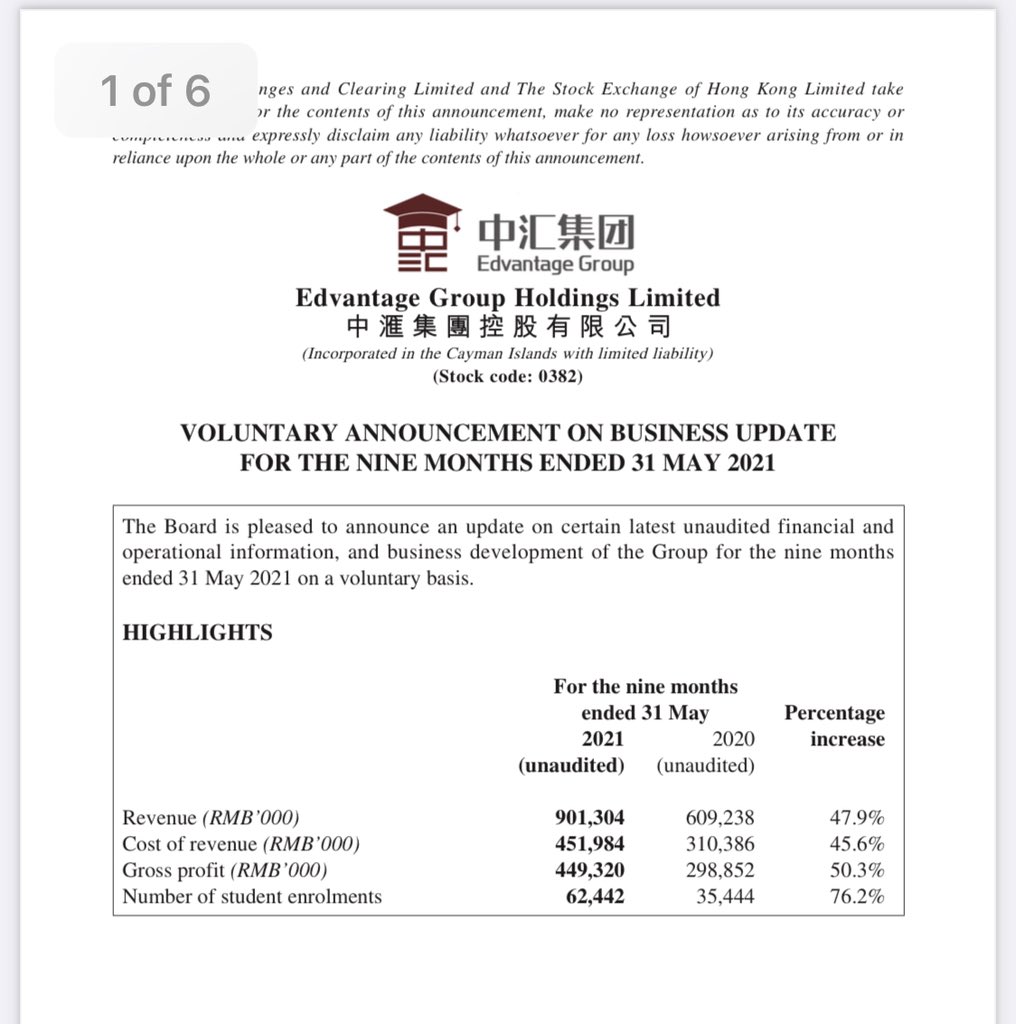

Guangdong focused Edvantage $382.HK - which is also tertiary / vocational education focused has also come out with similar affirmation along with a strong profit beat. www1.hkexnews.hk/listedco/listc…

Meanwhile SaaS provider to schools $KUKE was up 4pc overnight.

So it seems the worst price action might be behind us; and leadership shifting to a) brick & mortar b) tertiary & vocational c) regulated educational institutes given: a) pricing power b) supply gap and c) inability for Chinese students to go overseas / get visas of late

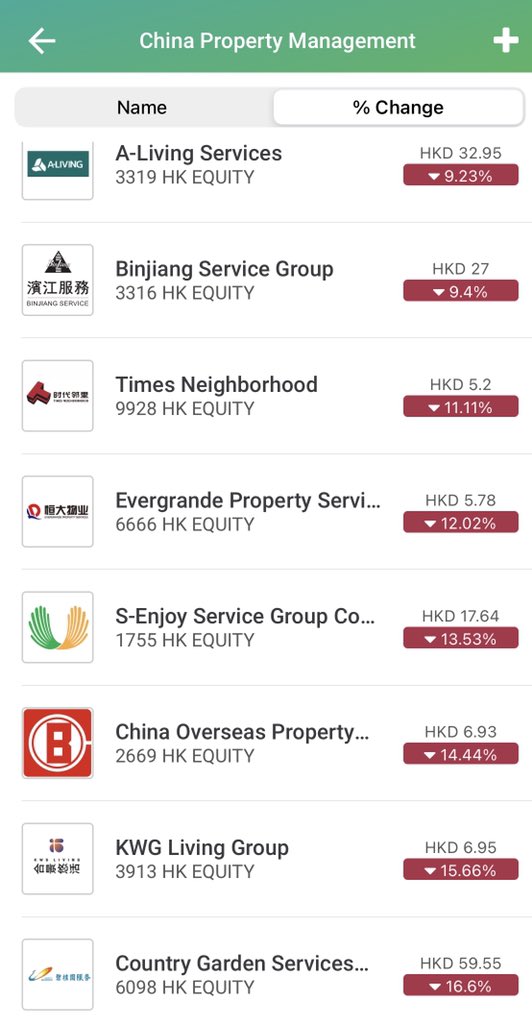

Other sector where companies are coming armed with buybacks and affirmatory narrative are the China Property Management Cos (PMCs) that got smacked in a skittish market on vague reg-risk around common area advertising (not more than 2-3% of revenue at best). Interesting times!

• • •

Missing some Tweet in this thread? You can try to

force a refresh