How to get URL link on X (Twitter) App

https://twitter.com/galliano_victor/status/1667156293512200195

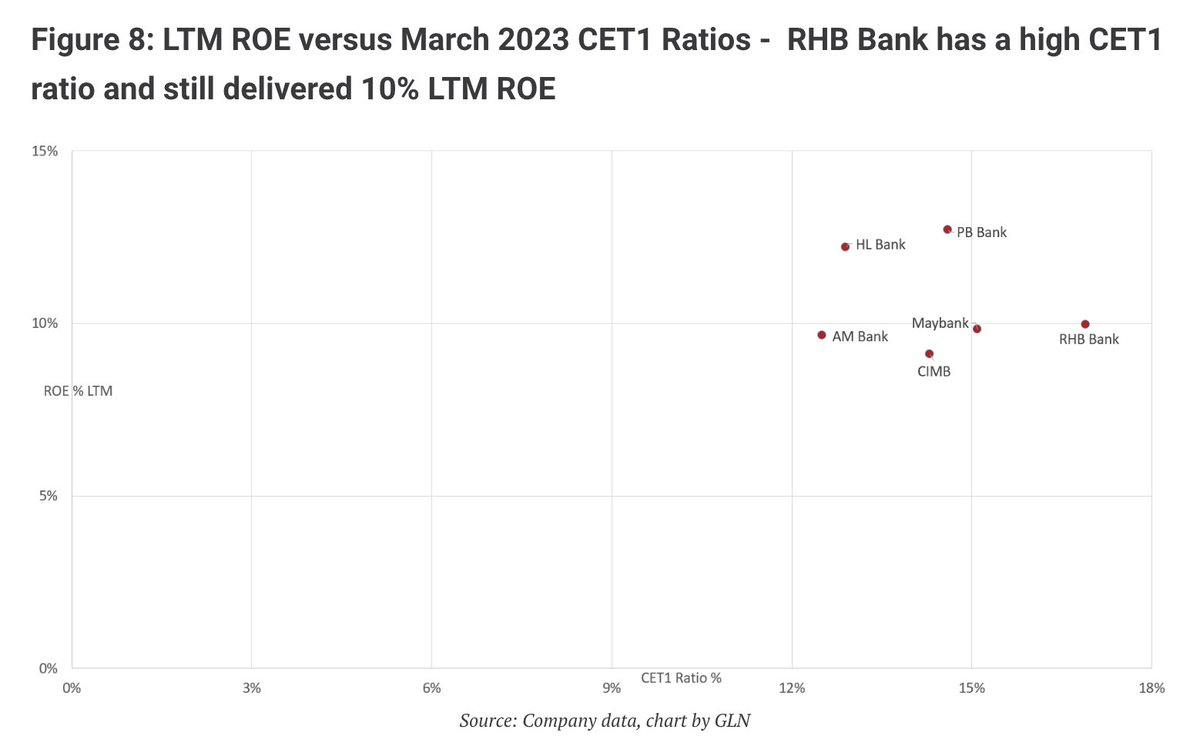

In terms of balance sheet, 4 out of 6 banks have sound capital adequacy ratios (which we define as December 2022 CET1 Ratio of 14%+).

In terms of balance sheet, 4 out of 6 banks have sound capital adequacy ratios (which we define as December 2022 CET1 Ratio of 14%+).

This deal is relatively straightforward with minimal preconditions, and there is little possibility of a proxy battle, so the spread will likely remain tight.

This deal is relatively straightforward with minimal preconditions, and there is little possibility of a proxy battle, so the spread will likely remain tight.

The U.S. Treasury market is expected to see a flood of new issuance which would draw liquidity from the financial system and create headwinds for the price of risk assets.

The U.S. Treasury market is expected to see a flood of new issuance which would draw liquidity from the financial system and create headwinds for the price of risk assets.

TSMC is back to an 11.8% ADR premium after dropping to 8%... potentially another good Long/Short point.

TSMC is back to an 11.8% ADR premium after dropping to 8%... potentially another good Long/Short point.

https://twitter.com/galliano_victor/status/1639159408612769793The smaller Mexican BanBajio and BanRegio have negligible AFS MtM hits and very healthy core capital.

2. Fed's balance sheet (via @biancoresearch)

2. Fed's balance sheet (via @biancoresearch)

https://twitter.com/Sanghyun063/status/1640199585279901696If this really gets completed before the June regular rebalancing AND before SK Oceanplant's transfer listing schedule, the top reserved issue in NICE's INDUSTRIALS sector will be included. 2/

https://twitter.com/Generic_Tina/status/1640319903461937152INDIA

https://twitter.com/CopleyFR/status/1640156765416488962Since then, a growing number of active EM strategies are buying back in, with average weights moving to 0.31% and 19.26% of funds invested. 2/

Why is Deutsche Bank suddenly selling off violently again without a trigger?

Why is Deutsche Bank suddenly selling off violently again without a trigger?

https://twitter.com/tradingarb/status/1638712684001755136The SGX Nikkei 225 Climate PAB Futures will be available for round the clock trading every day (except for New Years day).

Why is Deutsche Bank suddenly selling off violently again without a trigger?

Why is Deutsche Bank suddenly selling off violently again without a trigger?

European liquidity risks are smaller than US liquidity risks due to tighter legislation

European liquidity risks are smaller than US liquidity risks due to tighter legislation

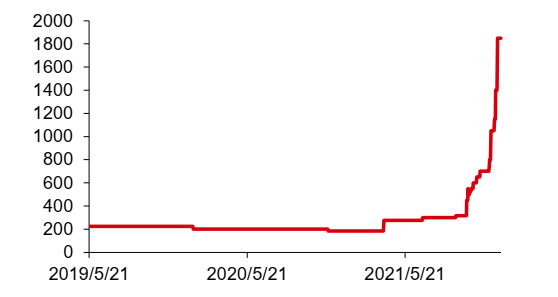

According to Baiinfo, the price of neon gas (with a content of 99.99%) in China has risen rapidly from RMB 300 yuan/cubic meter in early October 2021 to the current 1700-1800 yuan/cubic meter.

According to Baiinfo, the price of neon gas (with a content of 99.99%) in China has risen rapidly from RMB 300 yuan/cubic meter in early October 2021 to the current 1700-1800 yuan/cubic meter.

ABOUT

ABOUT

GJ STEEL PCL $GJS.TB

GJ STEEL PCL $GJS.TB