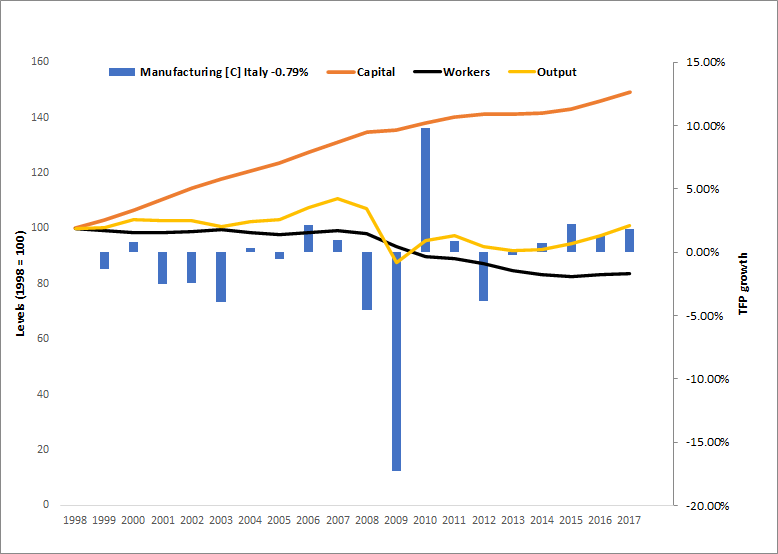

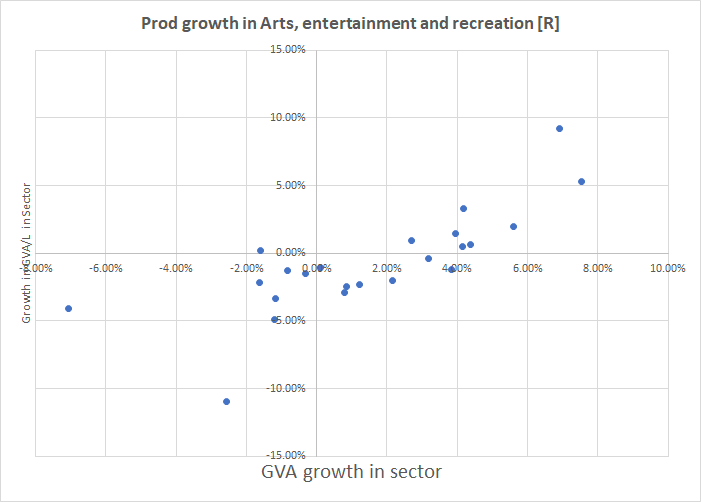

This morning I have mostly been investigating the thesis of @billwells_1 - that UK employment usually changes/rises in a way largely independent of GVA. And I find he is right, which may have implications for productivity ... See these sectors, for example: 1/4

If employment is just "doing its thing", rather than (quickly) responding to GVA or GDP, it means that GDP/L, the measure we most often use for productivity, on any one year will be v correlated with GDP. And look - easy to see 2/4

I am wisely warned not to over-interpret these patterns. I also warn others not to act like you can just pull a lever and increase demand in sector X or Y. But in the short term, it does justify Bill's saying - productivity is just a residual. And ... 3/4

... this also warns us against seeing it as 'stuck'. It doesn't mean there is an easy demand-side solution, though. And it is worth investigating Bill's observation. Why, e.g., does employment rise in the arts sector despite a lack of similar demand growth there? 4/4

(My answer, fwiw: we imagine the nature of jobs as more fixed than they are, but they respond endogenously to *the quantity of labour available*. Create an economy with abundant cheap labour , you create different kinds of job. See @MESandbu book and car-washing example)

• • •

Missing some Tweet in this thread? You can try to

force a refresh