What's going on at @RocketLab? Apart from a seemingly toxic work environment, two recently published financial reports give us a hint of @RocketLab economics and how it is losing money consistently on every launch, despite NZ government financial support. A thread. 1/14

First a look at the financials of @RocketLab USA and of @ Rocketlab NZ in USD, and in NZD (in 2020 1 NZD=0,63 USD) 2/14

The notes to the NZ financial statements explain that @Rocketlab NZ provides services at a margin cost to the USA parent company. And indeed we have 66 MUSD worth of expenditures at @RocketLab US that match the 90 MNZD worth of revenues of @RocketLab NZ (at 2020 rates). 3/14

There is a lot of information here. First, the average price of launch service sold by @RocketLab is 5 MUSD in 2020 8 MUSD in 2019. 4/14

But the average launch service full cost (including amortisation, sales and administration) of @RocketLab was 13,6 MUSD in 2020 and 14 MUSD in 2019. 5/14

This is putting the real cost per kg in orbit of @RocketLab at almost 100 kUSD/kg in 2020, i.e. 5 times more than Vega & 20 times more than Falcon 9. This is absolutely not driving down the cost of access to space. 6/14

The average launcher production cost of @RocketLab (in NZ) was 6,7 MUSD in 2020 and 8.1 MUSD in 2019 per launcher. 7/14

At the level of @RocketLab in NZ, the launcher production costs are split as follows: raw materials and other external acquisitions represent 40%, workforce is 52% and the remainder 8% is the amortisation of assets. 8/14

This means that @Rocketlab NZ there are little to no margins for cost reduction, except putting more pressure on personnel. There may be limits for that: businessdesk.co.nz/article/techno… 9/14

@RocketLab the US parent company is suffering all the loss, while the NZ subsidiary is in survival mode, and keeps its head above the water (also thanks to 5 MNZD of government subsidy). 10/14

@RocketLab US has 24 MUSD of sales and administrative costs for total revenues of 35 MUSD in 2020. The amount seems completely extravagant to me. In average these costs add 3,4 MUSD of costs to each launch in 2020. 11/14

This means that if @RocketLab can't drive down the sales and administration costs, the company is practically doomed. 12/14

Let's recall that the SPAC values @Rocketlab at 4.1 Billion USD on the principle that it is driving down the cost of access to space and, as a result, will attract many new customers and grow its sales exponentially. Looking at this data I think this is not happening. 13/14

The sources: (app.companiesoffice.govt.nz/companies/app/…) and (spaceintelreport.com/seeking-financ…) 14/14

@threadreaderapp compile

Reading through the SEC filings I stumble upon this stamement: "Our independent auditors have expressed substantial doubt about our ability to continue as a going concern."

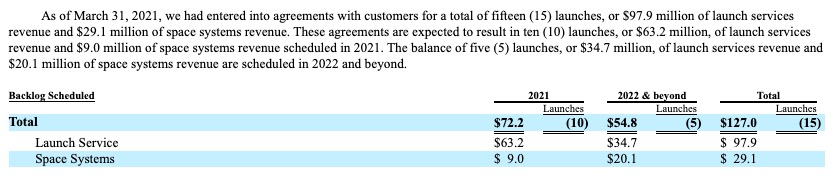

The backlog is nothing to be excited about. The only positive point is that Electron price is up a notch, with an average price point of 6MUSD/launch. Will this help covering costs? I doubt it. Note that @Rocketlab only considers variable production costs in its statements.

But with a higher price point I keep having doubts on a potential for demand growth in sufficient volumes to justify the post IPO valuation. Particularly considering the high share of workforce costs in launcher production. How can this be scaled down with higher volumes?

• • •

Missing some Tweet in this thread? You can try to

force a refresh