Devyani International - A QSR company

Let's understand everything about the business and its IPO!

Retweet for a wider reach!

#IPOwithJST #QSR

Let's understand everything about the business and its IPO!

Retweet for a wider reach!

#IPOwithJST #QSR

1/

About Devyani -

- Largest franchisee of Yum Brands in India (+Costa Coffee brand/stores in India)

- Among the largest Indian operators of chain QSR

- 696 stores across 166 cities in India(June 30, 2021)

- Operated 284 KFC & 317 Pizza Hut stores in India (June 30, 2021)

About Devyani -

- Largest franchisee of Yum Brands in India (+Costa Coffee brand/stores in India)

- Among the largest Indian operators of chain QSR

- 696 stores across 166 cities in India(June 30, 2021)

- Operated 284 KFC & 317 Pizza Hut stores in India (June 30, 2021)

2/

Yum! Brands operate brands such as KFC, Pizza Hut, and Taco Bell and have a presence globally with 50,000+ restaurants in 150+ countries, as of December 31, 2020.

Issue Details

Price - ₹86-90

Date - 4 to 6 August

Size - Rs 1838 Cr

Yum! Brands operate brands such as KFC, Pizza Hut, and Taco Bell and have a presence globally with 50,000+ restaurants in 150+ countries, as of December 31, 2020.

Issue Details

Price - ₹86-90

Date - 4 to 6 August

Size - Rs 1838 Cr

3/

Split – 440 Cr Fresh issue + 1398 Cr OFS (65 mn shares by Dunearn, 90 mn by RJ Corp, the promoter)

Market cap Post issue - 10427 Cr

Dunearn has 163 mn shares, so 65 mn sale means 40% of total holding

Split – 440 Cr Fresh issue + 1398 Cr OFS (65 mn shares by Dunearn, 90 mn by RJ Corp, the promoter)

Market cap Post issue - 10427 Cr

Dunearn has 163 mn shares, so 65 mn sale means 40% of total holding

4/

Objectives of Issue – From fresh issue - debt repayment of 324 cr and general corporate purposes

Objectives of Issue – From fresh issue - debt repayment of 324 cr and general corporate purposes

5/

Classification -

Core Brands - KFC, Pizza Hut, and Costa Coffee

International Business - KFC and Pizza Hut stores in Nepal and Nigeria

Other business - other operations in the F&B industry, stores of own brands such as Vaango and Food Street

Classification -

Core Brands - KFC, Pizza Hut, and Costa Coffee

International Business - KFC and Pizza Hut stores in Nepal and Nigeria

Other business - other operations in the F&B industry, stores of own brands such as Vaango and Food Street

7/

Summing up the operational performance of Devyani International in one word - SSSG

Same-Store Sales growth aka SSSG is very bad for their stores. The rise in revenue is also due to an increase in restaurants. This shows that the restaurants are operationally inefficient.

Summing up the operational performance of Devyani International in one word - SSSG

Same-Store Sales growth aka SSSG is very bad for their stores. The rise in revenue is also due to an increase in restaurants. This shows that the restaurants are operationally inefficient.

8/

FY21 numbers will be bad due to Lockdowns, but look at other players in QSR and their SSSG– (Src Burger king RHP)

Dominos SSG in FY21 was -17.7%

FY21 numbers will be bad due to Lockdowns, but look at other players in QSR and their SSSG– (Src Burger king RHP)

Dominos SSG in FY21 was -17.7%

9/

An interesting image from Burger King RHP

Check out the Margins, avg daily sales, CAPEX for the format of KFC vs others

Jubilant scores high of course on all fronts!

An interesting image from Burger King RHP

Check out the Margins, avg daily sales, CAPEX for the format of KFC vs others

Jubilant scores high of course on all fronts!

10/

Risks -

In dining revenue – Rs 542 Cr (48.85% of revenue) declined to 284 Cr (29.8% of revenue) in FY21

Core Brands Business decreased 13.98%

International Business also decreased 22.63%

Other Businesses decreased 76.39%

Risks -

In dining revenue – Rs 542 Cr (48.85% of revenue) declined to 284 Cr (29.8% of revenue) in FY21

Core Brands Business decreased 13.98%

International Business also decreased 22.63%

Other Businesses decreased 76.39%

11/

The majority of stores operate on leased properties - exposed to the market conditions of the retail rental market

Material uncertainty related to going concern in the auditors’ report on audited consolidated financial statements for Fiscals 2019

The majority of stores operate on leased properties - exposed to the market conditions of the retail rental market

Material uncertainty related to going concern in the auditors’ report on audited consolidated financial statements for Fiscals 2019

12/

Poor Capital Allocation in the past - Invested in tea trading - TWG (India and UK)

During Fiscal 2021, the TWG stores in India were sold by way of a slump sale to Corporate Promoter and Company’s entire shareholding in DIL UK to a subsidiary of Corporate Promoter

Poor Capital Allocation in the past - Invested in tea trading - TWG (India and UK)

During Fiscal 2021, the TWG stores in India were sold by way of a slump sale to Corporate Promoter and Company’s entire shareholding in DIL UK to a subsidiary of Corporate Promoter

13/

Net Net after the inflows of the sale, the company still made a loss of 67 Cr over the above mentioned past 3 periods. (119.6 Cr loss and 52 cr inflows on the sale of business)

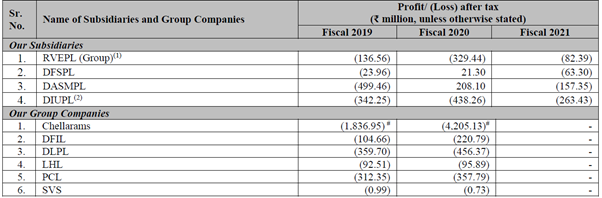

Group Companies and Subsidiaries incurred losses

Net Net after the inflows of the sale, the company still made a loss of 67 Cr over the above mentioned past 3 periods. (119.6 Cr loss and 52 cr inflows on the sale of business)

Group Companies and Subsidiaries incurred losses

14/

Very High levels of attrition – 40.11% at the corporate office and regional offices and 73.66% in stores as of FY21

Very High levels of attrition – 40.11% at the corporate office and regional offices and 73.66% in stores as of FY21

15/

Subsidiary Devyani International (Nigeria) was unable to comply with financial covenants under facility agreements with a lender and also defaulted in its debt repayment, resulting in a restructuring of a loan of Naira 2,167.02 million. (loan amt has come down now)

Subsidiary Devyani International (Nigeria) was unable to comply with financial covenants under facility agreements with a lender and also defaulted in its debt repayment, resulting in a restructuring of a loan of Naira 2,167.02 million. (loan amt has come down now)

16/

Financials

- Debt to Equity of 0.24x post issue

- Revenue CAGR of -5.8%

- EBITDA CAGR of 3.5%

- Loss widened

Financials

- Debt to Equity of 0.24x post issue

- Revenue CAGR of -5.8%

- EBITDA CAGR of 3.5%

- Loss widened

17/

Valuation & Conclusion -

Devyani will be valued at 8.7x P/S on FY21 sales and 6.8x P/S on FY20 sales. Burger King trades at 14x P/S with Jubilant at 13x. I believe the numbers are not comparable as SSSG is really better for Jubilant and Burger King

Valuation & Conclusion -

Devyani will be valued at 8.7x P/S on FY21 sales and 6.8x P/S on FY20 sales. Burger King trades at 14x P/S with Jubilant at 13x. I believe the numbers are not comparable as SSSG is really better for Jubilant and Burger King

18/

The QSR space is growing, but the growth numbers are not visible in Devyani’s stores (SSSG). The competition also is growing with food aggregators, cloud kitchens, new formats of QSRs, and foreign brands coming in too.

SSSG and growth is the main thing to watch in Devyani!

The QSR space is growing, but the growth numbers are not visible in Devyani’s stores (SSSG). The competition also is growing with food aggregators, cloud kitchens, new formats of QSRs, and foreign brands coming in too.

SSSG and growth is the main thing to watch in Devyani!

19/

Brand Arrangements -

KFC and Pizza hut - Continuing fee of 6.3% of revenues of each KFC/ Pizza Hut store to Yum as consideration for the right to use the restaurant formats and operating systems.

Brand Arrangements -

KFC and Pizza hut - Continuing fee of 6.3% of revenues of each KFC/ Pizza Hut store to Yum as consideration for the right to use the restaurant formats and operating systems.

20/

Also required to pay Yum a non-refundable one-time fee upon the opening of each store and a renewal fee each time they renew the TLA/ TMA for a particular store.

Also required to pay Yum a non-refundable one-time fee upon the opening of each store and a renewal fee each time they renew the TLA/ TMA for a particular store.

21/

Also required to pay 6.00% of gross revenues per store (excluding applicable taxes) for each KFC and Pizza Hut store to Yum, towards marketing and advertising expenses.

Costa IDA - obligated to spend min 2.00% of sales (excluding GST) on local marketing activities.

Also required to pay 6.00% of gross revenues per store (excluding applicable taxes) for each KFC and Pizza Hut store to Yum, towards marketing and advertising expenses.

Costa IDA - obligated to spend min 2.00% of sales (excluding GST) on local marketing activities.

22/

Royalty and continuing fees in Fiscals 2019, 2020, and 2021 were ₹ 727.66 million, ₹ 840.39 million, and ₹ 724.99 million, respectively, and represented 5.55%, 5.54%, and 6.39% of revenue from operations in such periods, respectively.

Royalty and continuing fees in Fiscals 2019, 2020, and 2021 were ₹ 727.66 million, ₹ 840.39 million, and ₹ 724.99 million, respectively, and represented 5.55%, 5.54%, and 6.39% of revenue from operations in such periods, respectively.

23/

More on Sector below.

End of thread! Thanks for reading!

Stay tuned for more threads on the upcoming IPOs :)

More on Sector below.

End of thread! Thanks for reading!

Stay tuned for more threads on the upcoming IPOs :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh