1/ A lot of people have been talking about Gamma recently. So I thought I'd offer a few thoughts.

I want to explain gamma in the simplest way possible. So lets just start with what it is. Gamma is a second order derivative, essentially, it measures the rate of Deltas change.

I want to explain gamma in the simplest way possible. So lets just start with what it is. Gamma is a second order derivative, essentially, it measures the rate of Deltas change.

2/ Remember last weeks thread, Delta is the rate of change of your Option contracts price. I'll link that thread below.

For this thread, just remember, Gamma dictates how Delta changes.

For this thread, just remember, Gamma dictates how Delta changes.

https://twitter.com/ResearchVariant/status/1419014829625413636

3/ Lets quickly look at a simple example. If you have a Option contract worth $10, a delta of .50, and a gamma of .05, what would happen if the underlying ( $BTC ) moved up $1? Your Option would be worth $10.5 (adding the delta) and your new delta would be .55 ( +.05 gamma).

4/ Check it out and do the math. Here we have an ATM strike (42k) with a delta of .53 and a gamma of .0004. If you look at the lower strike (40k) the delta is .62. So a 2,000 $BTC move * .0004 = .08.

Delta .53 + Gamma .08 = New delta .61

@laevitas1

Delta .53 + Gamma .08 = New delta .61

@laevitas1

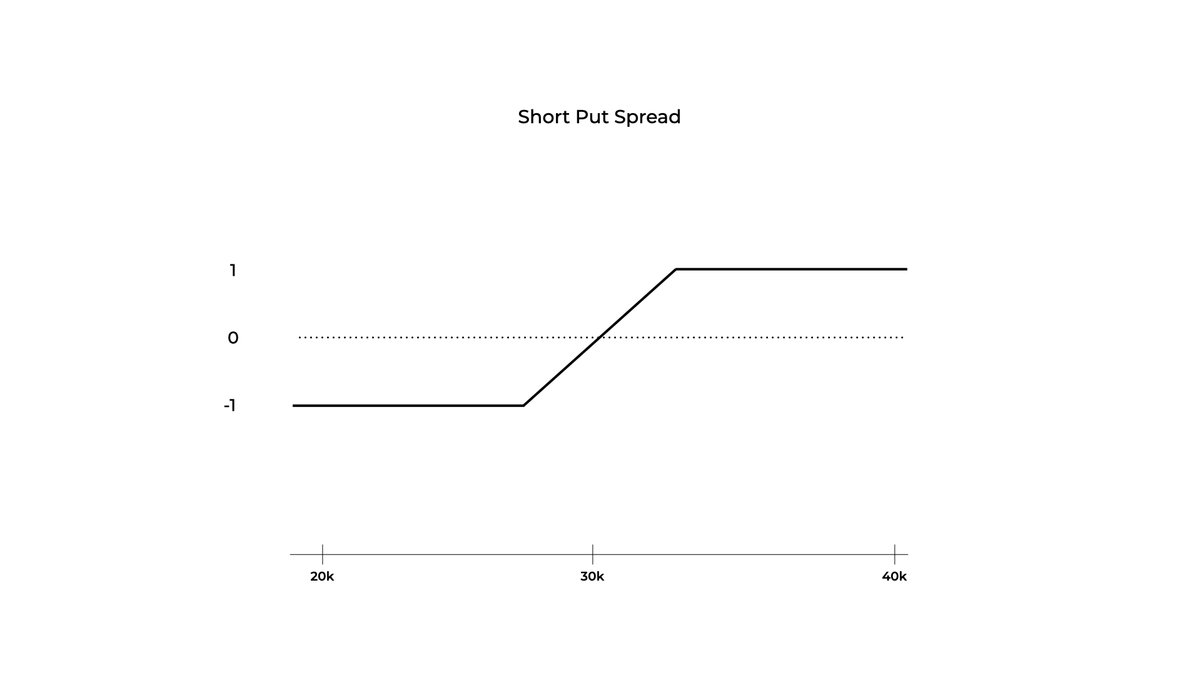

5/ Something important to note, Your position can also have negative gamma. Look at the sold Call below, negative gamma and delta.

6/ So why is this important? Gamma is really the speed at which your position makes (or more likely, loses) money. Market Makers (and others) use this knowledge to balance their positions.

7/ Keep in mind their goal is to be delta neutral, meaning price agnostic. The screen shot below shows how you do that. If I were short a 42k call, I would have -.45d, and -.000044 gamma. To hedge out those deltas I would have to long the perp (or spot) 16k worth of $BTC.

8/ Here is where it gets interesting. If the price moves up 2k, what happens to delta? -.45 + (2k*-.000044) = -.53 delta. So I have just "picked up" extra negative delta. How do I hedge that out? By buying more $BTC, either spot of perp. Now we just added to the buying pressure.

9/ (This isn't the same position, I just wanted to illustrate, don't @ me.)

You can see that same 16k $BTC which made us delta neutral no longer cuts it, we have to add deltas by buying more of the perp.

You can see that same 16k $BTC which made us delta neutral no longer cuts it, we have to add deltas by buying more of the perp.

10/ Conversely, if the price of $BTC is moving down we have to sell the perp (or spot) in order to gain back deltas that we have lost, adding to the sell pressure. All this to say, negative gamma in the market exacerbates moves. So watch gamma exposure.

11/ The exact opposite happens when MM positions are Gamma positive. If $BTC is moving up, they need to sell spot, and if $BTC is moving down they need to buy. This stifles moves, and if there is a massive amount of positive gamma around 1 strike (see 40k over the last week)...

12/ price tends to get "pinned" to that strike.

I don't know why I wrote all this, @SqueezeMetrics wrote an awesome paper on GEX, which you can read here.

squeezemetrics.com/download/white…

I don't know why I wrote all this, @SqueezeMetrics wrote an awesome paper on GEX, which you can read here.

squeezemetrics.com/download/white…

13/ Another way to visualize this idea is to look at Gamma bands. But this has already taken way to much of my Saturday, so that's best saved for another time.

14/ As always, feel free to chime in, I need all the help I can get. :)

@Mtrl_Scientist @laevitas1 @samchepal @macrohedged @DeribitExchange @pankaj_delta_ex @SqueezeMetrics @MrBenLilly.

@Mtrl_Scientist @laevitas1 @samchepal @macrohedged @DeribitExchange @pankaj_delta_ex @SqueezeMetrics @MrBenLilly.

• • •

Missing some Tweet in this thread? You can try to

force a refresh