Key Learnings from one of the best Investing Letters that I have read this year from @rohitchauhan

Time for a thread with SOIC Key Takeaways 🧵🧵🧵🧵

Time for a thread with SOIC Key Takeaways 🧵🧵🧵🧵

First Key Learning:

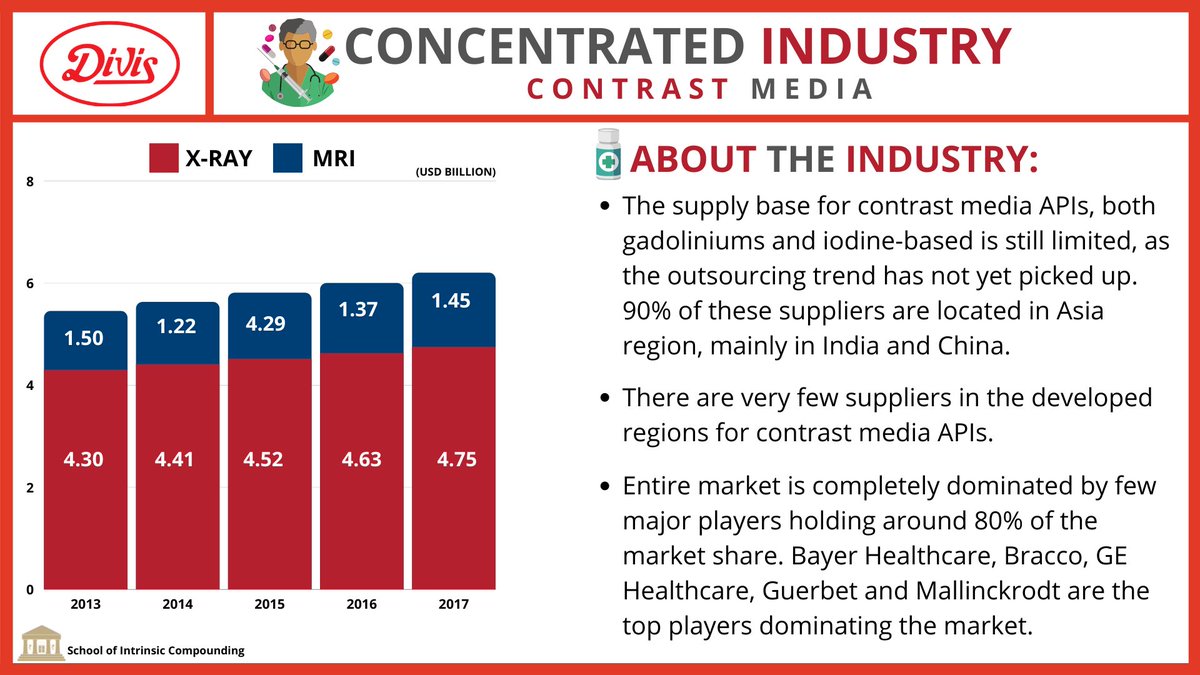

The first is the importance of getting the trend and its timing right. No business does well in isolation, it is a part of a much bigger trend. For eg:In sectors like API/CDMO/Chemicals, many businesses have created wealth. As they are going through tailwinds

The first is the importance of getting the trend and its timing right. No business does well in isolation, it is a part of a much bigger trend. For eg:In sectors like API/CDMO/Chemicals, many businesses have created wealth. As they are going through tailwinds

Thus,It becomes important to identify long-term trends like manufacturing, Financialization of saving, or Formalization of sector (think PVC/CPVC Pipes) and to be patient. Long-term trends keep offering opportunities. Just think about it- if its truly long term, then the

Opportunity will exist for a long period of time no?

Second Key Learning:

Look at Valuation in a broader context and not in isolation. When a sector catches fancy of the markets, and earnings growth is strong in the entire sector. Most of the time, markets start discounting

Second Key Learning:

Look at Valuation in a broader context and not in isolation. When a sector catches fancy of the markets, and earnings growth is strong in the entire sector. Most of the time, markets start discounting

the earnings and reward the business with a high multiple. As long as the trend holds and management is executing, one should hold the stock and be tolerant of higher valuations 💯💯💯

Third Key Learning: Boredom is the enemy

Unlike cyclical stocks,, timing the purchase is not critical. Most of these trends last for a long time. Betting on the right management and holding through periods where the business keeps moving forward, but the stock price remains

Unlike cyclical stocks,, timing the purchase is not critical. Most of these trends last for a long time. Betting on the right management and holding through periods where the business keeps moving forward, but the stock price remains

stagnant is the key. This reminds me of Pi Industries and Syngene. Pi went through a stagnant period between 2016-2018 and Syngene is going through one right now. Given the trends last for a long period, it is okay to hold through and to reap the rewards as markets are non-linear

Fourth Key Learning: Diversification is not just about position size, but also the underlying economic drivers behind each company. Suppose if you own a Building Material co and a Real estate company. The underlying economic drivers remain the same. If you are looking to

diversify properly. Then even the underlying economic drivers of the business have to be different. An example that comes to mind is Navin Fluorine and Prince Pipes. Both the businesses have different underlying economic drivers, which leads to proper diversification.

Last Key Learning: Simplicity is the key

"When I started investing, I thought there is some magic formulae to grow your capital. After 10 years of search, I realized that the answer was staring me in the face.

"When I started investing, I thought there is some magic formulae to grow your capital. After 10 years of search, I realized that the answer was staring me in the face.

The key to wealth creation was very simple – Save aggressively and invest patiently." - @rohitchauhan

• • •

Missing some Tweet in this thread? You can try to

force a refresh