Technofunda Study

Potential Upside (20-50% in 3-5 months)

Technocraft industries

KirloskarFerrous

Thread on business , details and chart are attached below.

This is not a buy/sell recommendation

Do ur own study before invest in it.

Don't buy in hurry , wait for opportunity

Potential Upside (20-50% in 3-5 months)

Technocraft industries

KirloskarFerrous

Thread on business , details and chart are attached below.

This is not a buy/sell recommendation

Do ur own study before invest in it.

Don't buy in hurry , wait for opportunity

Technocraft Industries was incorporated in 1992. It has presence in five main business industries viz., Drum Closures, Scaffolding systems, Cotton Yarn, Fabric, Garments and Engineering Services.

Company has manufacturing facilities in India and China

Company has manufacturing facilities in India and China

Scaffolding and Formwork (38%)

It is a temporary structure used to support people and material in the construction industries, real estate and any other large structures. It is a modular system of metal pipes or tubes , exports approximately 70% Scaffolding Formwork out of india

It is a temporary structure used to support people and material in the construction industries, real estate and any other large structures. It is a modular system of metal pipes or tubes , exports approximately 70% Scaffolding Formwork out of india

Yarn and fabric (32%)

Company produces a variety of products ranging from NE 20 to NE 40, Carded and Combed varieties of Cotton Yarn. Company exports approx. 71% of Yarn products mainly in Europe, Asia, Latin America etc.

Company produces a variety of products ranging from NE 20 to NE 40, Carded and Combed varieties of Cotton Yarn. Company exports approx. 71% of Yarn products mainly in Europe, Asia, Latin America etc.

It has vertically integrated textile division of manufacturing of Yarn, Fabric, Garments, it has facility of producing cotton yarn, mélange yarn, also having facility of knitting, dyeing and printing and garmenting.

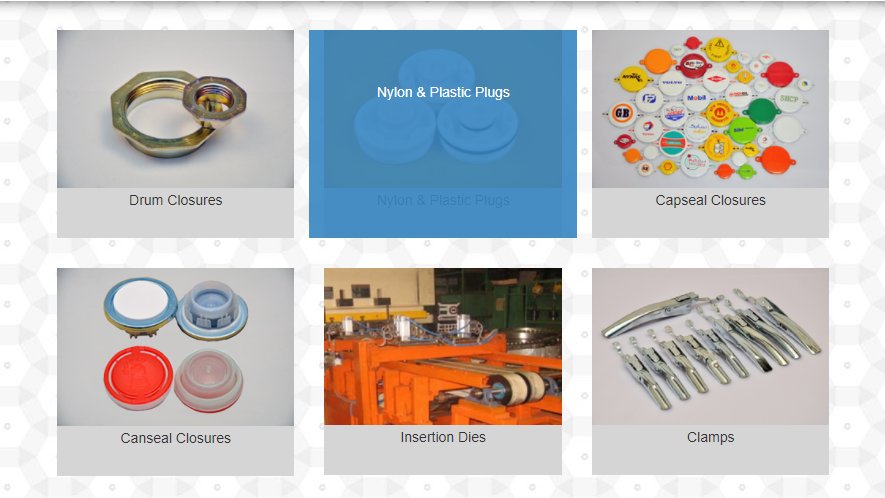

Drum Closures (26%)

one of the largest manufacturer of high precision and sophisticated Drum Closures Products. Out of the total revenue of the drum division approx 90% revenue comes from export sales.

It continues to enjoy a worldwide market share of about 36% excluding China.

one of the largest manufacturer of high precision and sophisticated Drum Closures Products. Out of the total revenue of the drum division approx 90% revenue comes from export sales.

It continues to enjoy a worldwide market share of about 36% excluding China.

Market Cap 1,661 Cr.

Current Price 679

Stock P/E 13.6

Book Value 438

ROCE 12.4 %

ROE 12.1 %

Investor Sunil singhania backed Abakkus Ewmerging Opportunities Fund hv stake around 2.5%

FII/DII increasing stake

Current Price 679

Stock P/E 13.6

Book Value 438

ROCE 12.4 %

ROE 12.1 %

Investor Sunil singhania backed Abakkus Ewmerging Opportunities Fund hv stake around 2.5%

FII/DII increasing stake

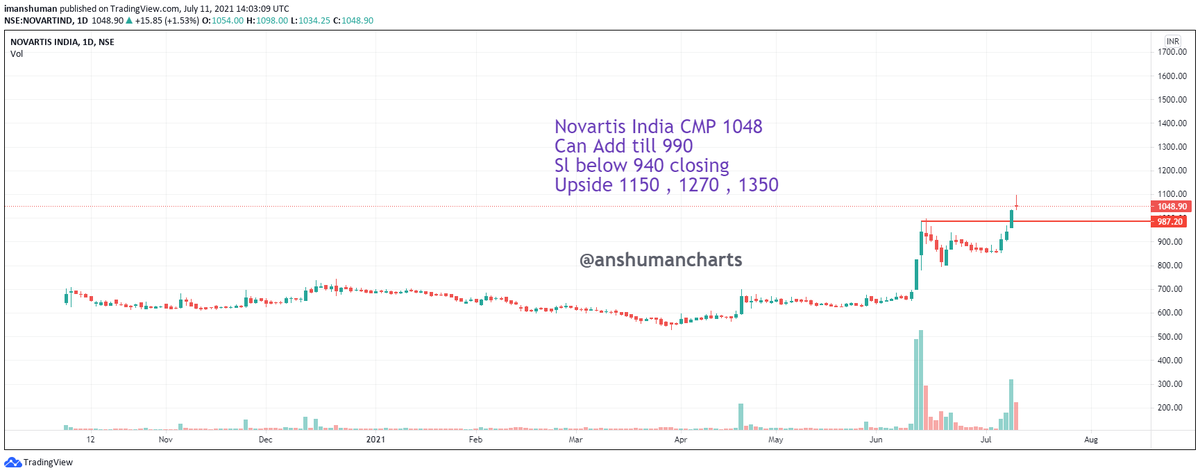

Technocraft Industries

Can enter with small quantity on CMP add more in dips as given

SL below 550

upside as given in chart

Can enter with small quantity on CMP add more in dips as given

SL below 550

upside as given in chart

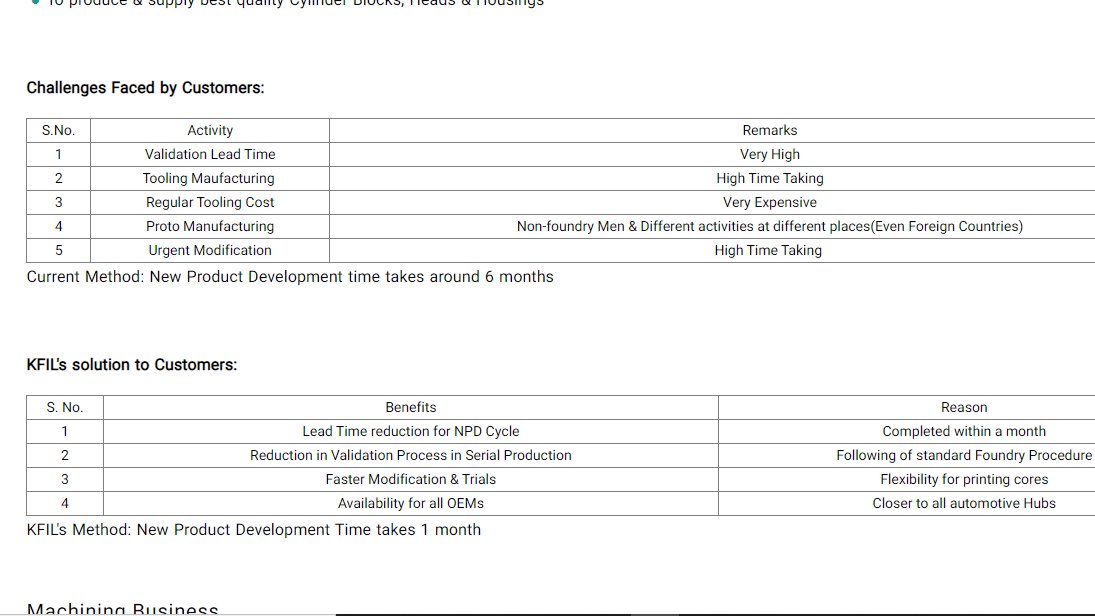

2. KFIL, incorporated in 1991, is a part of the Pune-based Kirloskar Group. KFIL manufactures pig iron and ferrous castings

such as cylinder blocks,cylinder heads, and transmission parts and different types of housings required by automobile, tractor and diesel engine industries.

such as cylinder blocks,cylinder heads, and transmission parts and different types of housings required by automobile, tractor and diesel engine industries.

It is one of the leading players in foundry-grade pig iron manufacturing and ferrous castings in the domestic market

Vision

Be a sustainable growing organisation creating value to all stakeholders

Mission: To become a Billion $ company by 2030

Vision

Be a sustainable growing organisation creating value to all stakeholders

Mission: To become a Billion $ company by 2030

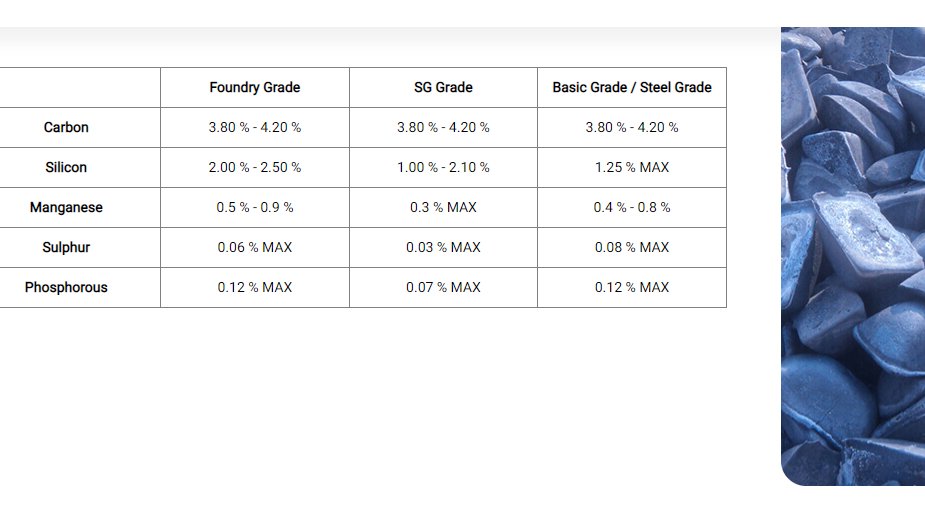

PIG IRON

To be a lowest cost producer

Expand in to value added products

To achieve 0.7 Million Tons of liquid metal by 2022

Casting

Exceed customer expectation in Product development, Quality & Delivery

To achieve 0.2 Million Tons casting sales by 2025

Expand into new segments

To be a lowest cost producer

Expand in to value added products

To achieve 0.7 Million Tons of liquid metal by 2022

Casting

Exceed customer expectation in Product development, Quality & Delivery

To achieve 0.2 Million Tons casting sales by 2025

Expand into new segments

The company's Pig iron division has a market share of 40-42% in its market & its castings division has a market share of 21% in its respective industry.

Manufacturing Capacities

The company owns 2 manufacturing facilities in Koppal, Karnataka & Solapur, Maharashtra. Capacities are:-

Pig Iron - 400,000 tonnes p.a.

Castings - 130,000 tonnes p.a.

Coke - 200,000 tonnes p.a.

The company owns 2 manufacturing facilities in Koppal, Karnataka & Solapur, Maharashtra. Capacities are:-

Pig Iron - 400,000 tonnes p.a.

Castings - 130,000 tonnes p.a.

Coke - 200,000 tonnes p.a.

With the future capex at Koppal plant & the commencement of Pig iron plant situated at Hiryur which is acquired from VSL Steel Ltd, pig iron capacity will increase to 680,000 tonnes p.a.

Expansion Plans

The company recently completed its capex towards solar power plant, railway sidings, acquisition of Hiryur plant & commencement of Coke Oven with Power Plant with investments of ~550 crores.

The company recently completed its capex towards solar power plant, railway sidings, acquisition of Hiryur plant & commencement of Coke Oven with Power Plant with investments of ~550 crores.

It has proposed capex outlay for major projects like operation of 2 iron ore mines, PCI & MBF-2 upgradation & phase 2 of its Coke Oven Plant from 200,000 TPA to 400,000 TPA. & Power from 20 MW to 40 MW.

• • •

Missing some Tweet in this thread? You can try to

force a refresh