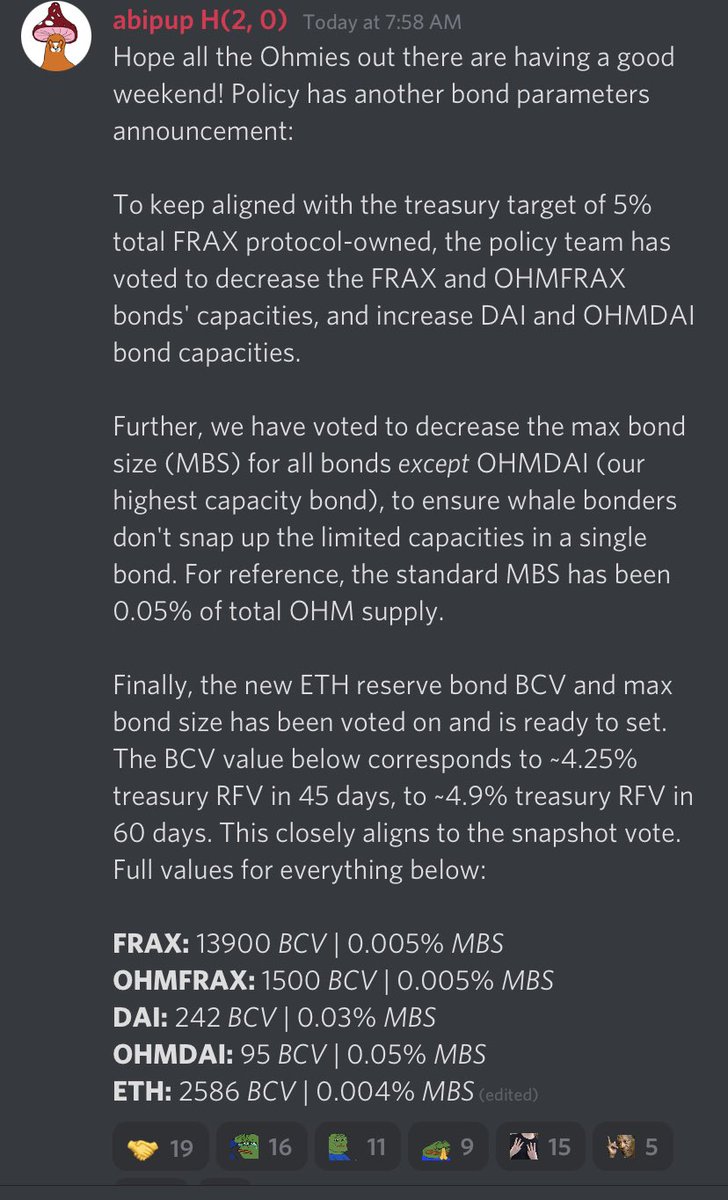

Hi Ohmies, the policy team at @OlympusDAO made an announcement today that you should check out.

Here’s a brief thread explaining the levers used to put these policies in action and also a bit of rationale/explanation behind each statement.

Here’s a brief thread explaining the levers used to put these policies in action and also a bit of rationale/explanation behind each statement.

1. To decrease bond capacity, a bond’s Bond Control Variable (BCV) is increased.

Bond Price = 1 + debtRatio x BCV

By drastically increasing FRAX BCV from 690 -> 13,900, bond price for a given debt ratio will rise.

This is how FRAX capacity gets reduced.

Bond Price = 1 + debtRatio x BCV

By drastically increasing FRAX BCV from 690 -> 13,900, bond price for a given debt ratio will rise.

This is how FRAX capacity gets reduced.

2. However, these BCV targets are gradually changed.

You can track their change progress on the policy dashboard.

Over time you will see FRAX intake dramatically reducing.

duneanalytics.com/shadow/Olympus…

You can track their change progress on the policy dashboard.

Over time you will see FRAX intake dramatically reducing.

duneanalytics.com/shadow/Olympus…

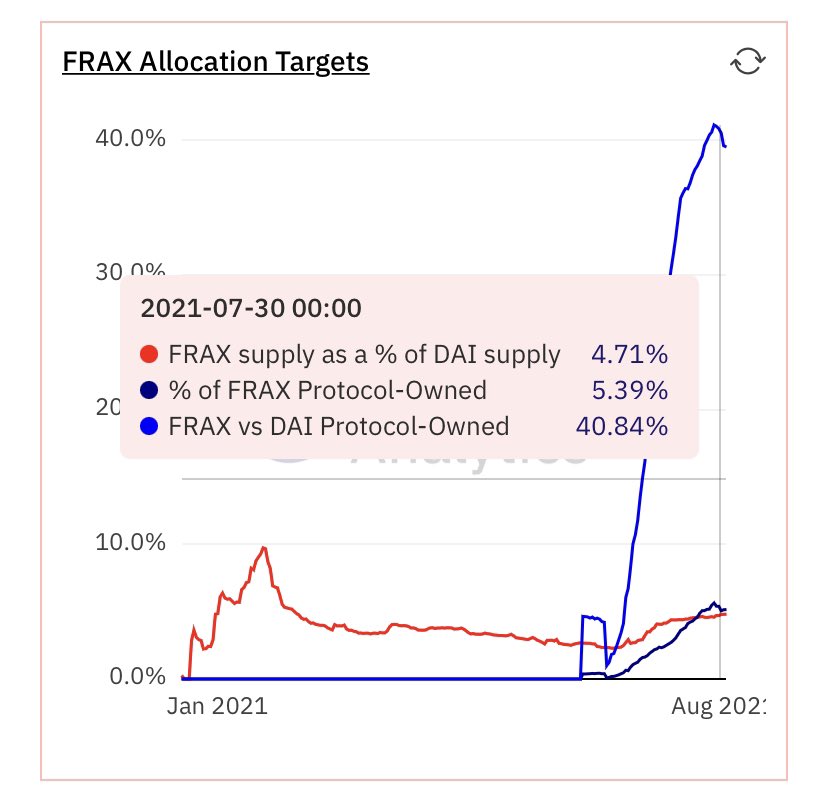

3. Why was FRAX in take limited?

Because we already own ~5% of FRAX supply. Slowing FRAX in take is prudent risk management.

$OHM treasury owns $7.2 mm of FRAX, with another $6.5 mm in the liquidity pool.

FRAX total supply is $260 mm.

Because we already own ~5% of FRAX supply. Slowing FRAX in take is prudent risk management.

$OHM treasury owns $7.2 mm of FRAX, with another $6.5 mm in the liquidity pool.

FRAX total supply is $260 mm.

4. What’s max bond and why decrease it?

Max bond used to be 0.05% x total supply.

Now it is 0.005% x total supply for all bonds except the OHM-DAI liquidity bond.

You won’t see $200k+ DAI bonds anymore. More like $20k bonds or a 10x reduction in max bond size.

Max bond used to be 0.05% x total supply.

Now it is 0.005% x total supply for all bonds except the OHM-DAI liquidity bond.

You won’t see $200k+ DAI bonds anymore. More like $20k bonds or a 10x reduction in max bond size.

5. Finally coming to ETH bonds. As you know $OHM is ready to buy $ETH through bonds.

Goal is to have ETH hit 5% of treasury RFV. Roughly $1.2 mm of ETH will be purchased.

Max Bond = 0.004% of supply or about 40 $OHM = $18k or roughly 7 ETH / bond.

Goal is to have ETH hit 5% of treasury RFV. Roughly $1.2 mm of ETH will be purchased.

Max Bond = 0.004% of supply or about 40 $OHM = $18k or roughly 7 ETH / bond.

6. The policy dashboard is the engine of $OHM.

Take time to understand it and the mechanics.

I believe we have already built a shared mental model of $OHM monetary policy.

More people understanding it better will help us win.

#OHMISNERDY

duneanalytics.com/shadow/Olympus…

Take time to understand it and the mechanics.

I believe we have already built a shared mental model of $OHM monetary policy.

More people understanding it better will help us win.

#OHMISNERDY

duneanalytics.com/shadow/Olympus…

• • •

Missing some Tweet in this thread? You can try to

force a refresh