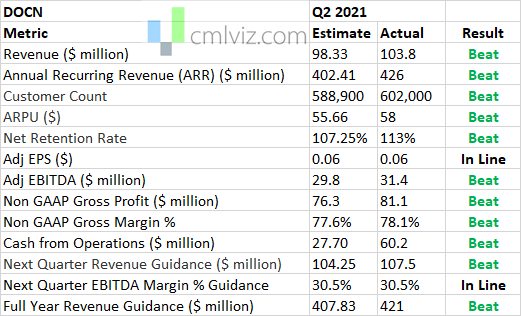

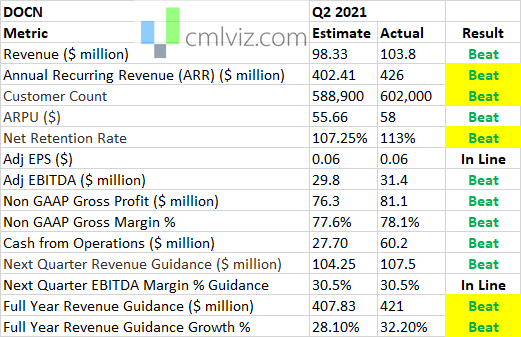

$DOCN The DBNR is a huge win.

2019: 100%

2020: 103%

2020 Q3: 104%

2020 Q4: 105%

2021 Q1: 107%

2021 Q2: 113%

/2

2019: 100%

2020: 103%

2020 Q3: 104%

2020 Q4: 105%

2021 Q1: 107%

2021 Q2: 113%

/2

$DOCN @digitalocean

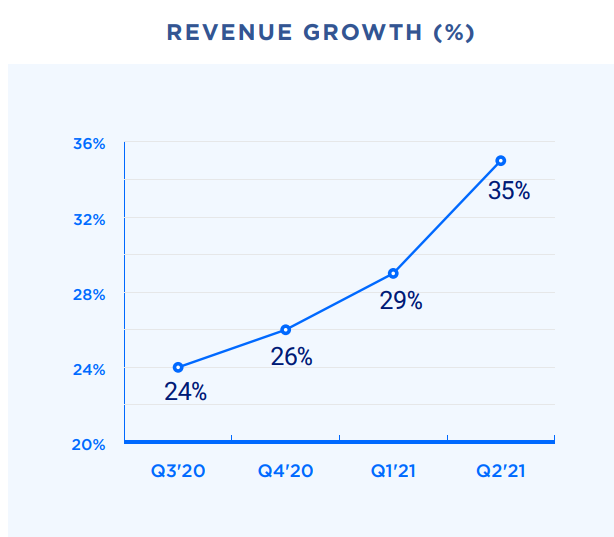

There was absolutely no room for this company to grow 35% and with DBNR at 113%.

No way. Zero analysts had these numbers.

Full year guided to 32.2% vs 28.1% est.

Thread /6

There was absolutely no room for this company to grow 35% and with DBNR at 113%.

No way. Zero analysts had these numbers.

Full year guided to 32.2% vs 28.1% est.

Thread /6

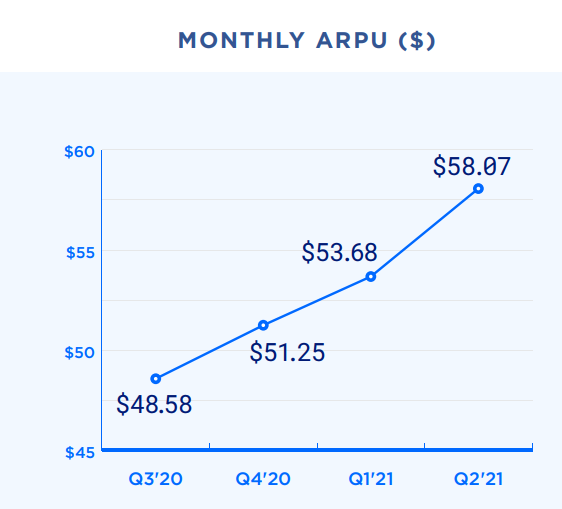

$DOCN @digitalocean

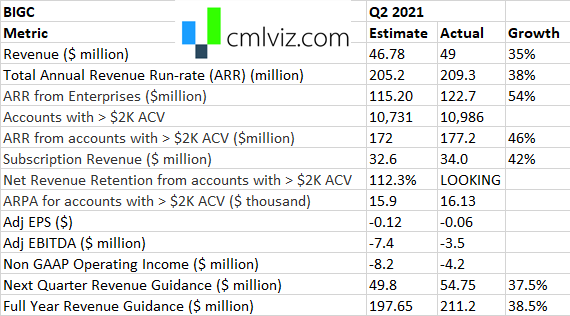

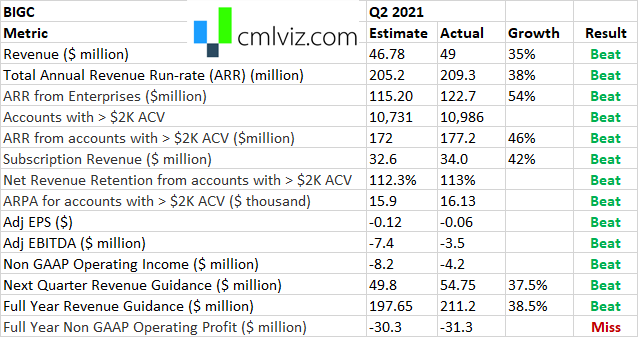

As I see it in total.

(Not sure about EPS bc the company didn't provide the full calculation)

/7

As I see it in total.

(Not sure about EPS bc the company didn't provide the full calculation)

/7

$DOCN @digitalocean

Algos using GAAP EPS of -0.02 but estimates are in non-GAAP.

Algos see -0.02 vs 0.06 est, but that's mistaken.

Non-GAAP was $0.062 (as I calculate).

The company did not share number. This is a young company mistake.

This is my rough (quick) take.

/8

Algos using GAAP EPS of -0.02 but estimates are in non-GAAP.

Algos see -0.02 vs 0.06 est, but that's mistaken.

Non-GAAP was $0.062 (as I calculate).

The company did not share number. This is a young company mistake.

This is my rough (quick) take.

/8

• • •

Missing some Tweet in this thread? You can try to

force a refresh