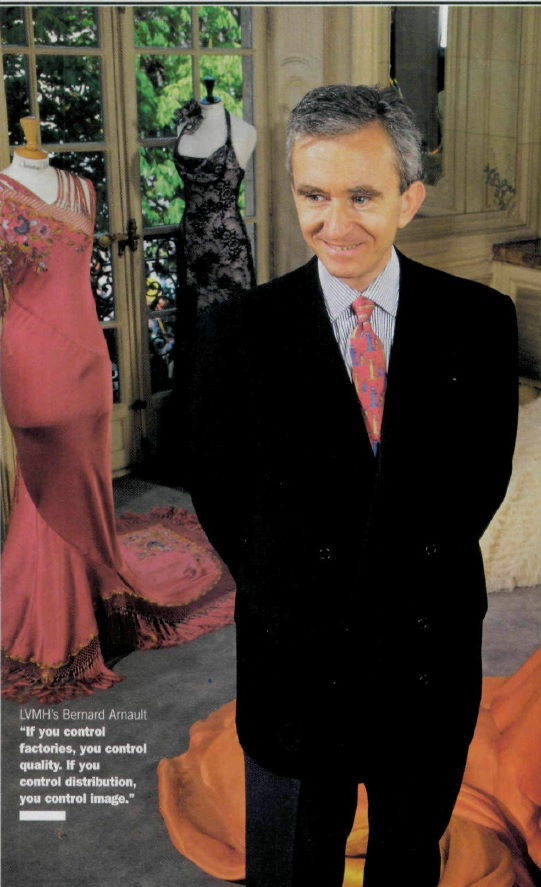

Bernard Arnault is famous for building LVMH and becoming the world's richest man.

However, key lessons of his life are buried deep in his past. With some family money and a powerful network, Arnault set out to become a takeover artist, known as “the wolf in the cashmere coat.”

However, key lessons of his life are buried deep in his past. With some family money and a powerful network, Arnault set out to become a takeover artist, known as “the wolf in the cashmere coat.”

Arnault was born in 1949 and grew up in northern France. After engineering school, he joined the family company. He sold its construction business and started developing real estate.

When a socialist government was elected in ’81, he emigrated to the US with his young family.

When a socialist government was elected in ’81, he emigrated to the US with his young family.

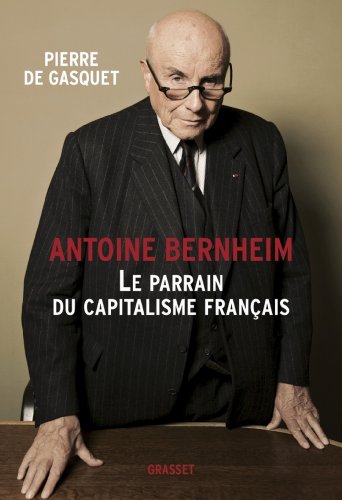

In NYC he made friends among powerful French expats and met his mentor, Antoine Bernheim of Lazard.

Building condos in Miami Beach however was no home run. "It's tough in the United States if you haven't moved in the right circles from the start.” Arnault was itching for a deal.

Building condos in Miami Beach however was no home run. "It's tough in the United States if you haven't moved in the right circles from the start.” Arnault was itching for a deal.

A chance encounter in a New York taxi gave him an insight. The driver knew nothing about France but “he knew Christian Dior”

“To build a name that transcends the individual happens very rarely. That's what got me into the luxury, when I understood the potential of that name.”

“To build a name that transcends the individual happens very rarely. That's what got me into the luxury, when I understood the potential of that name.”

A friend in the government was tasked with saving Boussac, a distressed conglomerate that had been taken over by two raiders. Now they were bankrupt and thousands of jobs at risk.

Boussac had aging textile mills, department stores, real estate - and the Dior fashion house.

Boussac had aging textile mills, department stores, real estate - and the Dior fashion house.

Arnault and Lazard hashed out a restructuring plan and convinced Boussac’s owners, the Willots.

Arnault would inject capital, negotiate with creditors, get government support. They would retain some equity upside, more than they could hope for in bankruptcy.

Arnault would inject capital, negotiate with creditors, get government support. They would retain some equity upside, more than they could hope for in bankruptcy.

Lazard was known as the “under-ministry of finance” due to the former officials in its ranks and was lobbying on Arnault’s behalf.

His simple pitch: “I‘m the only person who can get an agreement from the Willots and I'm the only one who has worked on the file 24 hours as a day.”

His simple pitch: “I‘m the only person who can get an agreement from the Willots and I'm the only one who has worked on the file 24 hours as a day.”

Arnault also needed Lazard’s money. Bernheim told him: "Put in what you can. I'll match it and I'm sure I can find the rest."

Arnault would invest $15mm and Lazard arranged the rest to get to $60mm.

Arnault would invest $15mm and Lazard arranged the rest to get to $60mm.

To win the deal again textile magnate Maurice Bidermann, Arnault hired an experienced CEO and agreed to preserve jobs.

After closing the deal, unsecured creditors were cut back to 60c on the dollar. And Arnault sold off the textile mills, leaving the new owners to shed the jobs.

After closing the deal, unsecured creditors were cut back to 60c on the dollar. And Arnault sold off the textile mills, leaving the new owners to shed the jobs.

Arnault sold assets and raised capital at various subsidiaries. His byzantine corporate structure allowed him to retain control but free up capital for his next move.

“The goal I have fixed for myself was to make our group the leading luxury group in the world.”

“The goal I have fixed for myself was to make our group the leading luxury group in the world.”

His eyes fell on Möet-Hennessy which owned the perfume license for Dior. Arnault wanted it back. But “parfums won't buy us,” he said, “we'll buy them.”

By 1987 however, it became part of a new luxury conglomerate: Louis Vuitton Möet-Hennessy.

By 1987 however, it became part of a new luxury conglomerate: Louis Vuitton Möet-Hennessy.

Möet-Hennessy was led by Alain Chevalier. He had persuaded the two families to merge because a joint distribution network would be more profitable.

He was looking for a friendly merger as protection from a hostile takeover.

He was looking for a friendly merger as protection from a hostile takeover.

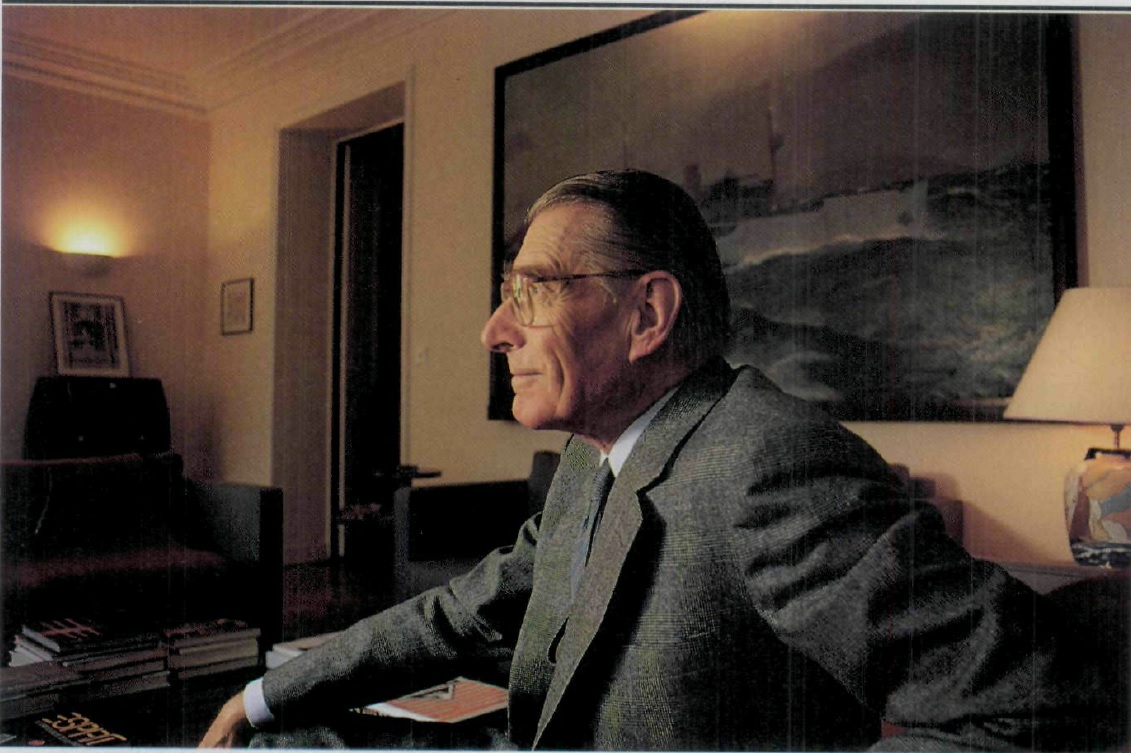

Louis Vuitton was headed by Henry Racamier who had married into the Vuitton family.

He took the sleepy company to a nearly a billion in sales in a decade. “The world of luxury products had changed. The clientele grew immensely in the 60s and 70s. We saw this sleeping potential.”

He took the sleepy company to a nearly a billion in sales in a decade. “The world of luxury products had changed. The clientele grew immensely in the 60s and 70s. We saw this sleeping potential.”

They merged and immediately clashed. Racamier wanted autonomy and hated being number 2.

Chevalier was still worried about a hostile takeover and issued convertible bonds with Lazard. Then he approached his old friend Sir Anthony Tennant at Guinness for a friendly investment.

Chevalier was still worried about a hostile takeover and issued convertible bonds with Lazard. Then he approached his old friend Sir Anthony Tennant at Guinness for a friendly investment.

Racamier felt threatened, “wine and spirits wanted to take the leading role.”

He needed an ally: Arnault. Too young to be a serious rival, or so he thought.

They agreed to jointly bid for 30 per cent in LVMH. Together with the Vuitton family stake this would be a majority.

He needed an ally: Arnault. Too young to be a serious rival, or so he thought.

They agreed to jointly bid for 30 per cent in LVMH. Together with the Vuitton family stake this would be a majority.

A few days before launching the bid, Racamier told Chevalier. Chevalier asked for a delay to consult with the families, which Racamier granted.

Arnault was furious! He called his mentor Bernheim at Lazard – who were Chevalier’s bankers as well.

Arnault was furious! He called his mentor Bernheim at Lazard – who were Chevalier’s bankers as well.

Bernheim warned him: "Racamier wants to use you. If you go along, he will have you in turn." Besides, Guinness had vast financial resources.

Instead, Bernheim arranged for a meeting between Arnault and Chevalier. Arnault secretly switched sides.

h/t for the pic @mariogabriele

Instead, Bernheim arranged for a meeting between Arnault and Chevalier. Arnault secretly switched sides.

h/t for the pic @mariogabriele

He set up a JV in which he and Guinness bought LVMH stock – controlled by him.

Racamier didn’t figure it out until it was too late. Arnault had bought stock after the ’87 crash and now added quickly in the open market – and Lazard brought to him the convertible bonds.

Racamier didn’t figure it out until it was too late. Arnault had bought stock after the ’87 crash and now added quickly in the open market – and Lazard brought to him the convertible bonds.

As a major shareholder, Arnault asked for a new supervisory board with representatives from all blocks: Vuitton, Möet and Hennessy, and Dior.

Shortly before the first meeting, he aggressively bought stock, getting to 37.5% of votes – and was able to make his own father chairman.

Shortly before the first meeting, he aggressively bought stock, getting to 37.5% of votes – and was able to make his own father chairman.

Chevalier could only watch as Arnault gained control. Guinness had been neutered. Arnault informed them they could not buy shares independently, only through his JV.

A power struggle unfolded between Racamier and Arnault which the press called “young wolf versus the old lion.”

A power struggle unfolded between Racamier and Arnault which the press called “young wolf versus the old lion.”

Racamier proposed splitting up the company or a buyout of Vuitton.

Arnault quipped: “Some people say I'm a wolf. That's not at all true. Wolves break up companies. It was Racamier who wanted to cut the company into pieces. I was the only one who did not want to dismantle it.”

Arnault quipped: “Some people say I'm a wolf. That's not at all true. Wolves break up companies. It was Racamier who wanted to cut the company into pieces. I was the only one who did not want to dismantle it.”

Exhausted from the constant fighting, Chevalier resigned. Arnault now headed the company.

He managed to get the support of the Moet and Hennessy families and even made a truce with Guinness, offering them a board seat and more rights.

He managed to get the support of the Moet and Hennessy families and even made a truce with Guinness, offering them a board seat and more rights.

Arnault unsuccessfully tried to to force out Racamier with a mandatory retirement age.

In turn, Racamier attacked the voting rights associated with the convertible bonds that Arnault had bought from the banks. The issue was investigated by regulators, threatening Arnault.

In turn, Racamier attacked the voting rights associated with the convertible bonds that Arnault had bought from the banks. The issue was investigated by regulators, threatening Arnault.

But suddenly a small shareholder accused Racamier of double invoicing and shady contracts related to Vuitton’s exclusive Asian distributor.

Racamier’s house was searched by police and his name smeared in the press. "What do I have to do to make people believe me," he lamented.

Racamier’s house was searched by police and his name smeared in the press. "What do I have to do to make people believe me," he lamented.

Racamier’s last ditch effort was to raise capital for a new luxury company. He contemplated a takeover bid for LVMH in partnership with L’Oreal. But shares had climbed too high, it was too risky.

When courts upheld the convertible bonds, Racamier had run out of moves.

When courts upheld the convertible bonds, Racamier had run out of moves.

In 1990, he sold the Vuitton family’s shares and left to build his own luxury company.

Arnault’s journey had started with $15 million of family money. Now he controlled France’s leading luxury conglomerate – his platform for empire building.

Arnault’s journey had started with $15 million of family money. Now he controlled France’s leading luxury conglomerate – his platform for empire building.

If you’re interested in a detailed account of Arnault’s origin story, I wrote it up here:

(Subscribe if you enjoy learning about the rise and fall of business fortunes.)

neckar.substack.com/p/the-rise-of-…

(Subscribe if you enjoy learning about the rise and fall of business fortunes.)

neckar.substack.com/p/the-rise-of-…

For an overview of LVMH, check out threads by @TrungTPhan

https://twitter.com/TrungTPhan/status/1421496138255933449

@TrungTPhan @mariogabriele And you can find additional reading and sources here:

https://twitter.com/NeckarValue/status/1420117397646843914

• • •

Missing some Tweet in this thread? You can try to

force a refresh