John Elkann is quietly transforming the fortune of one of Europe’s wealthiest families. Thrown into his role during an attempted management coup, he is now working on his own vision

This is his journey from novice to savvy capital allocator.

This is his journey from novice to savvy capital allocator.

Elkann heads Exor, the publicly-listed holding company controlled by the Agnelli family, the Italian industrial dynasty behind the automaker Fiat. In 2009, he merged the family’s holding companies and became chairman. Shareholders have done well.

“Agnelli is Fiat; Fiat is Turin; and Turin is Italy.”

Giovanni Agnelli was one of the founding members of Fiat. His grandson Gianni was a billionaire playboy before he became the family’s patriarch and powerful industrialist.

vanityfair.com/london/2021/02…

Giovanni Agnelli was one of the founding members of Fiat. His grandson Gianni was a billionaire playboy before he became the family’s patriarch and powerful industrialist.

vanityfair.com/london/2021/02…

The family had its share of tragedy. Gianni’s nephew and chosen successor died at 33 years old of cancer. Gianni picked then 21-year-old John Elkann and appointed him to the board of Fiat.

Elkann’s parents divorced when he was young. He grew up across the world before studying in Turin near his grandfather.

“My life was always about being confronted with an environment where you had to adapt.”

He was prepared with stints at Fiat plants and in GE’s audit department.

“My life was always about being confronted with an environment where you had to adapt.”

He was prepared with stints at Fiat plants and in GE’s audit department.

Fiat was losing money and struggling with high debt. Gianni’s brother Umberto wanted the car business sold. When Gianni died in 2003, he hired a CEO for his restructuring plan.

But Umberto passed away unexpectedly in 2004. Fiat and the family faced a leadership crisis.

But Umberto passed away unexpectedly in 2004. Fiat and the family faced a leadership crisis.

CEO Morchio “pushed the board to make him chairman,” Elkann recalled. “It got very dark. That first year-and-a-half was terrible.”

The CEO and Fiat’s creditor banks were planning a debt-to-equity conversion that would dilute the family. They would lose control of their company.

The CEO and Fiat’s creditor banks were planning a debt-to-equity conversion that would dilute the family. They would lose control of their company.

“The company was being mismanaged. The family was ageing and sick, the financial community didn’t support us anymore.”

The family’s hopes rested on Elkann who had to step up. He needed a credible solution; someone he could trust to fix Fiat.

The family’s hopes rested on Elkann who had to step up. He needed a credible solution; someone he could trust to fix Fiat.

Elkann flew to Geneva to meet Sergio Marchionne who had turned around another family company. He was experienced and “a truth-teller.”

Marchionne: “I had never made a car or a tractor, I really didn’t know shit.”

He told Elkann: “I sincerely hope you don’t need me.”

Marchionne: “I had never made a car or a tractor, I really didn’t know shit.”

He told Elkann: “I sincerely hope you don’t need me.”

But they did. And Marchionne could not refuse.

His turnaround of Fiat was a masterpiece: he stripped away layers of management, consolidated engineering and procurement, fixed customer service.

money.cnn.com/magazines/fort…

His turnaround of Fiat was a masterpiece: he stripped away layers of management, consolidated engineering and procurement, fixed customer service.

money.cnn.com/magazines/fort…

“This was a hierarchical, status- and relationship-driven organization. All that got blown up."

Marchionne bought bankrupt Chrysler, then separated Fiat along its verticals: luxury (Ferrari), automotive (merged with Chrysler and PSA), industrial (CNHI), and components (sold).

Marchionne bought bankrupt Chrysler, then separated Fiat along its verticals: luxury (Ferrari), automotive (merged with Chrysler and PSA), industrial (CNHI), and components (sold).

Marchionne’s track record across three companies is a sight to behold.

After his death, Elkann mourned the “incredible man and extraordinary leader” who had delivered a 590% gain during his tenure at Fiat.

After his death, Elkann mourned the “incredible man and extraordinary leader” who had delivered a 590% gain during his tenure at Fiat.

https://twitter.com/GWInvestors/status/1040695518043811840

In 2009, Elkann simplified the holding companies and became chairman.

He closed global offices, reduced staff, cut the board from 17 to 9, increased independent directors and female directors, and separated the roles of chairman and CEO for “healthy challenge and support.”

He closed global offices, reduced staff, cut the board from 17 to 9, increased independent directors and female directors, and separated the roles of chairman and CEO for “healthy challenge and support.”

From 2009 to 2020, much of Exor’s portfolio changed – except for “untouchable” holdings important to the family’s legacy, identity, and power. Fiat, the Juventus Football Club, and media interests.

“The advice my grandfather gave to me was very clear. No one’s expecting you to know or understand or contribute. So, the most important thing is for you to listen. Ask questions. And if you don’t understand, that is absolutely normal.”

Elkann studies the best. He quotes value investors, entrepreneurs, scientists. His network includes people in business, technology, politics, and members of the wealthiest families - Pritzkers, Ridleys, Wallenbergs, and Waltons.

His journey started in the value camp. In 2009, his criteria included people, financial results, competitive positioning, governance – and “the price must be right.”

Today, Exor’s message is much simpler: “Our purpose is to build great companies.”

Today, Exor’s message is much simpler: “Our purpose is to build great companies.”

After selling his private equity-like holdings and a basket of smaller stakes and funds, Elkann set his sights on reinvestment.

His first pitch was a decent business at a good price, Berkshire-style: in 2015, he bought reinsurer PartnerRe.

His first pitch was a decent business at a good price, Berkshire-style: in 2015, he bought reinsurer PartnerRe.

Who did he call for advice? Berkshire’s Ajit Jain, “to whom we owe a lot for sharing his insights.” Despite Jain’s warning of the industry’s deteriorating economics, Elkann went ahead. In addition, ‘Buffett’s banker’ Byron Trott acted as Exor’s advisor in the transaction.

But when Elkann received an offer for the company last year, he was a willing seller. While the transaction fell through, it’s notable that he was willing to let go at the right price. It’s not a forever holding.

Instead, he has integrated his structural advantages into a new strategy.

T

hey are defensive (long-term capital, stable shareholder), and offensive - they create differentiated deal flow (personal network, reputation, governance, flexibility across public/private and lifecycle)

T

hey are defensive (long-term capital, stable shareholder), and offensive - they create differentiated deal flow (personal network, reputation, governance, flexibility across public/private and lifecycle)

In 2015, he hired Matteo Scolari to manage a concentrated portfolio of public investments. In 2020, they passed one billion of gains and an annualized return of 28.5% per cent (vs benchmark return of 13.1%)

exor.com/sites/default/…

exor.com/sites/default/…

Based on a thesis that family-controlled businesses outperform long-term, Exor created an internal fund to invest in a selection a global selection of publicly-listed ones. Curious to see how this will play out.

He also started a venture program, called “partnerships” for bigger stakes like Via and Welltec (introduced by the family behind ISCAR) and “Exor Seeds” which has invested in 42 companies. Exor’s “strike zone” is mobility, fintech, healthcare, and the European startup ecosystem.

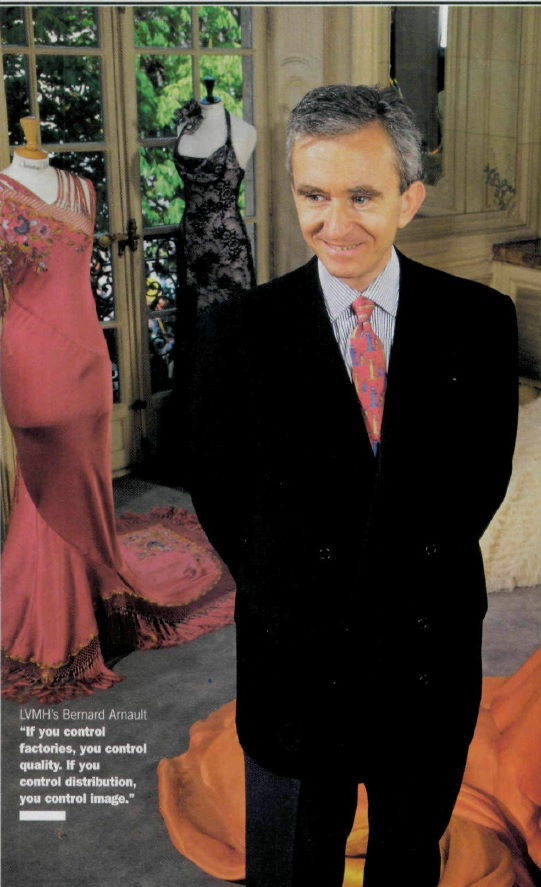

But the biggest lesson sat right under his nose: luxury. Ferrari, once trapped inside Fiat, is now a $39bn public company. Elkann knows Bernard Arnault and if there is one European company builder to learn from, Arnault might be it.

In 2020, Elkann acquired Chinese luxury brand Shang Xia. This year, he became a minority shareholder in Christian Louboutin. Most recently, Elkann reportedly held conversations with Armani.

Elkann is building an organization that is resilient, adaptive and that will compound capital for generations. He is a dedicated steward of his family’s fortune. It just so happens that we can join as shareholders. Or learn and watch his journey unfold in his annual letters.

“The true value of a leader is not measured by what he has gained during his career but rather by what he has given. It is not what you accomplish today, but the legacy you will leave behind."

Sergio Marchionne as quoted by John Elkann

Sergio Marchionne as quoted by John Elkann

I wrote about his journey for my premium subscribers. Follow and subscribe for more lessons and stories from the rise (and fall) of business fortunes.

neckar.substack.com/p/a-legacy-tra…

neckar.substack.com/p/a-legacy-tra…

• • •

Missing some Tweet in this thread? You can try to

force a refresh