An analysis of #Sequent - India’s largest Animal Health Company

Like and retweet for more learnings 🐶🐕

A thread!🧵

1. Points covered :

2. Promoters and management

3. Company overview

4. Why is it different from human pharma

5. Opportunity size

6. Stability of business

Like and retweet for more learnings 🐶🐕

A thread!🧵

1. Points covered :

2. Promoters and management

3. Company overview

4. Why is it different from human pharma

5. Opportunity size

6. Stability of business

7. FMCG like business

8. Barriers to entry

9. Manufacturing facilities

10. Summary of financials

11. Major acquisitions

12. Capex Details

13. Reduced Debt

14. Future Growth prospects

15. Valuation

8. Barriers to entry

9. Manufacturing facilities

10. Summary of financials

11. Major acquisitions

12. Capex Details

13. Reduced Debt

14. Future Growth prospects

15. Valuation

Promoters and management

Carlyle Group - Private equity firm Carlyle Group acquired a majority stake in Sequent in 2020 and are the new promoters of the company. They have a lot of experience investing in the healthcare sector both in India and globally.

Carlyle Group - Private equity firm Carlyle Group acquired a majority stake in Sequent in 2020 and are the new promoters of the company. They have a lot of experience investing in the healthcare sector both in India and globally.

They have recently acquired a 20% stake in Piramal Pharma. They have a deep understanding of the sector and intend to use their knowledge, expertise and global connections to catapult Sequent to new heights.

The management indicated that they would be using the Carlyle Group’s connections to enter the Chinese and US markets. With Carlyle as the new promoters, Sequent has gained ability to make bigger acquisitions to enter key markets like US, Australia, Canada and China.

Manish Gupta - He has been the Managing Director of the company since 2014. He has over 23 years of experience in leading and managing businesses across the US, Europe and India to enhance performance. Before joining Sequent Scientific, he was the CEO of Strides Pharma.

Company overview :

Sequent is the largest animal health company in India and the 20th largest in the world. Their Animal health business is carried out under the brand name ‘ALIVIRA’.

Sequent is the largest animal health company in India and the 20th largest in the world. Their Animal health business is carried out under the brand name ‘ALIVIRA’.

Alivira has various subsidiaries in the biggest animal health markets in the world viz. USA, Europe, Turkey, Brazil and India.

They produce APIs which they sell to the top Animal Health companies in the world as well as Finished Formulations which they market directly through their various subsidiaries.

The formulations account for 65% of revenues whereas APIs account for 35%. They have also started a contract manufacturing business which is expected to grow substantially in the future. About 68% of their revenues come from regulated markets like US and Europe.

Different from Human Pharma :

Sequent operates in the animal pharma sector which is significantly different from human pharma. There are very few high value products and it is largely a branded generics market with very few products under patent(less than 20%).

Sequent operates in the animal pharma sector which is significantly different from human pharma. There are very few high value products and it is largely a branded generics market with very few products under patent(less than 20%).

It is a highly consolidated industry with the top 4 players making up more than 50% of the revenues. Competitive intensity is low and therefore there is less pricing pressure

Opportunity size :

Animal Health is still a largely untapped market with limited competition and lots of room to grow. Zoetis is the largest animal health company in the world with a market cap of $95.84Bn. (approx 71lakhCr). #Sequent is currently the 20th largest in the world.

Animal Health is still a largely untapped market with limited competition and lots of room to grow. Zoetis is the largest animal health company in the world with a market cap of $95.84Bn. (approx 71lakhCr). #Sequent is currently the 20th largest in the world.

Stability of business

Animal Health is a very stable business as the demand for meat is relatively constant throughout the year. The need for pet care is also year-round.

Animal Health is a very stable business as the demand for meat is relatively constant throughout the year. The need for pet care is also year-round.

During the COVID pandemic, the industry was classified as essential and was allowed to operate when the rest of the businesses faced severe lockdowns. Zoetis continued to show revenue growth and expanding margins through the pandemic.

FMCG like business

1.The demand for animal protein is year round and there is no element of cyclicality in the business.

2. It is a branded generics market where the brand awareness pulls demand for the product.

1.The demand for animal protein is year round and there is no element of cyclicality in the business.

2. It is a branded generics market where the brand awareness pulls demand for the product.

3. The products have to be marketed locally by setting up a field force in the region.

Barriers to entry

1. Regulatory requirements: The company operates in regulated markets like the US and Europe which have a lot of regulatory requirements in terms of the manufacturing facilities. The time and capital needed to get the facility upto the standards is very high.

1. Regulatory requirements: The company operates in regulated markets like the US and Europe which have a lot of regulatory requirements in terms of the manufacturing facilities. The time and capital needed to get the facility upto the standards is very high.

The Vizag plant is the only USFDA certified Animal Health plant in India and China. Other Indian players in the industry like #NGLFineChem and #LASA Supergenerics mainly operate in the unregulated markets .

2. High upfront investment: The pharma industry requires a high level of operating leverage to be competitive. The initial costs to set up a manufacturing facility is very high, this along with the low value products makes the industry unattractive to new players.

3. Products difficult to ship: Due to the bulkiness of the products in animal pharma(medicated feed), the costs to manufacture in India and ship worldwide is high. Therefore, it is easier to manufacture animal health products locally.

Manufacturing Facilities :

The company has a manufacturing footprint spread out over the world. The APIs are manufactured in India at their Vizag and Mahad facilities and they produce some intermediates in Tarapur. They produce formulations out of India(Ambernath, Maharashtra),

The company has a manufacturing footprint spread out over the world. The APIs are manufactured in India at their Vizag and Mahad facilities and they produce some intermediates in Tarapur. They produce formulations out of India(Ambernath, Maharashtra),

Spain, Brazil, Germany and Turkey. These facilities mostly cater to the local markets they are domiciled in and produce various dosage forms like intramammaries, injectables, oral solutions, powders and premixes,etc.

Summary of Financials

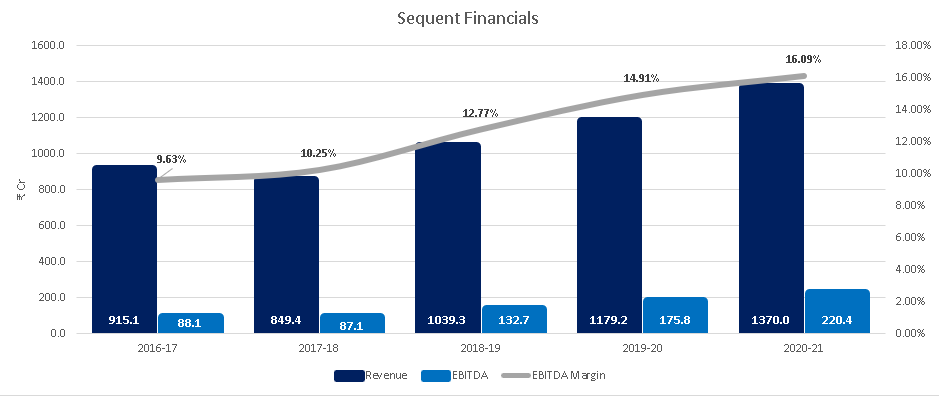

Revenue growth - 17%/18% (3yr/5yr CAGR)

Operating Profit Margin - 12%/14%/16% (2019/2020/2021)

EBITDA to cash conversion - 87%/64%/52% (2019/2020/2021)

Revenue growth - 17%/18% (3yr/5yr CAGR)

Operating Profit Margin - 12%/14%/16% (2019/2020/2021)

EBITDA to cash conversion - 87%/64%/52% (2019/2020/2021)

Major acquisitions

The company made acquisitions in key markets from 2014-18.The major acquisitions made were Provet and Topkim in Turkey, Karizoo Group in Spain, N-Vet and Fendingo in the Benelux region,Interchange/Evance in Brazil, Bremer in Germany and Lyka Labs in India

The company made acquisitions in key markets from 2014-18.The major acquisitions made were Provet and Topkim in Turkey, Karizoo Group in Spain, N-Vet and Fendingo in the Benelux region,Interchange/Evance in Brazil, Bremer in Germany and Lyka Labs in India

Capex Details

The company has indicated that it will be spending $30 million on upgrading it’s facilities in all geographies. Major chunk of this will be spent on the capacity expansion at the Vizag plant and increasing the Bremer facility’s injectable capacity by 4X.

The company has indicated that it will be spending $30 million on upgrading it’s facilities in all geographies. Major chunk of this will be spent on the capacity expansion at the Vizag plant and increasing the Bremer facility’s injectable capacity by 4X.

The company also acquired a major client for their CDMO business who will be co-investing in a facility for the CDMO business in Vizag.

Reduced debt :

The company has a high EBITDA to cash conversion ratio. They been generating a lot of cash for the past few years which they have been using to pay down their debt. The debt on the company’s balance sheet has reduced significantly the past few years.

The company has a high EBITDA to cash conversion ratio. They been generating a lot of cash for the past few years which they have been using to pay down their debt. The debt on the company’s balance sheet has reduced significantly the past few years.

Future Growth prospects :

The company will be leveraging the Carlyle Group’s network to enter Canada, China, Australia and US for the formulation business. They have also signed a major animal health company as a client for the CDMO business which will contribute to revenues

The company will be leveraging the Carlyle Group’s network to enter Canada, China, Australia and US for the formulation business. They have also signed a major animal health company as a client for the CDMO business which will contribute to revenues

from FY23. The company has doubled it’s product portfolio in India through an arrangement with #Zoetis to distribute their products in India. They are also going to be focusing on injectables and entering the pet segment which are higher margin businesses.

They are planning to launch 20 formulations in the US market over the next 5 years, the first filing has already been made and will commercialize from FY23.

Valuation :

Sequent is currently trading at a PE ratio of about 70. #Zoetis is trading at a PE of about 50. The market gives animal pharma companies an above average PE for these possible reasons:

Sequent is currently trading at a PE ratio of about 70. #Zoetis is trading at a PE of about 50. The market gives animal pharma companies an above average PE for these possible reasons:

1. No sudden shocks or volatility in earnings: The demand for meat is very stable, as a result there are no sudden drops in revenues.

2. Regulated industry: It is a highly regulated industry with high barriers to entry

2. Regulated industry: It is a highly regulated industry with high barriers to entry

3. No immediate substitute: There is no clear substitute for the medications provided by these companies.

These reasons combined result in a very strong business model that commands a higher PE than most seasonal or cyclical businesses.

These reasons combined result in a very strong business model that commands a higher PE than most seasonal or cyclical businesses.

• • •

Missing some Tweet in this thread? You can try to

force a refresh