Next up at #SmartCon is a presentation about the #Chainlink Grants Program with Brett Brody at Chainlink Labs

Grant funds creation of critical smart contract infrastructure, data, services, and new use cases

Funding, access to team members, ongoing support

Supporting an entire ecosystem

Funding, access to team members, ongoing support

Supporting an entire ecosystem

Bounty campaigns improve the security of the Chainlink network, reward community for securing the network

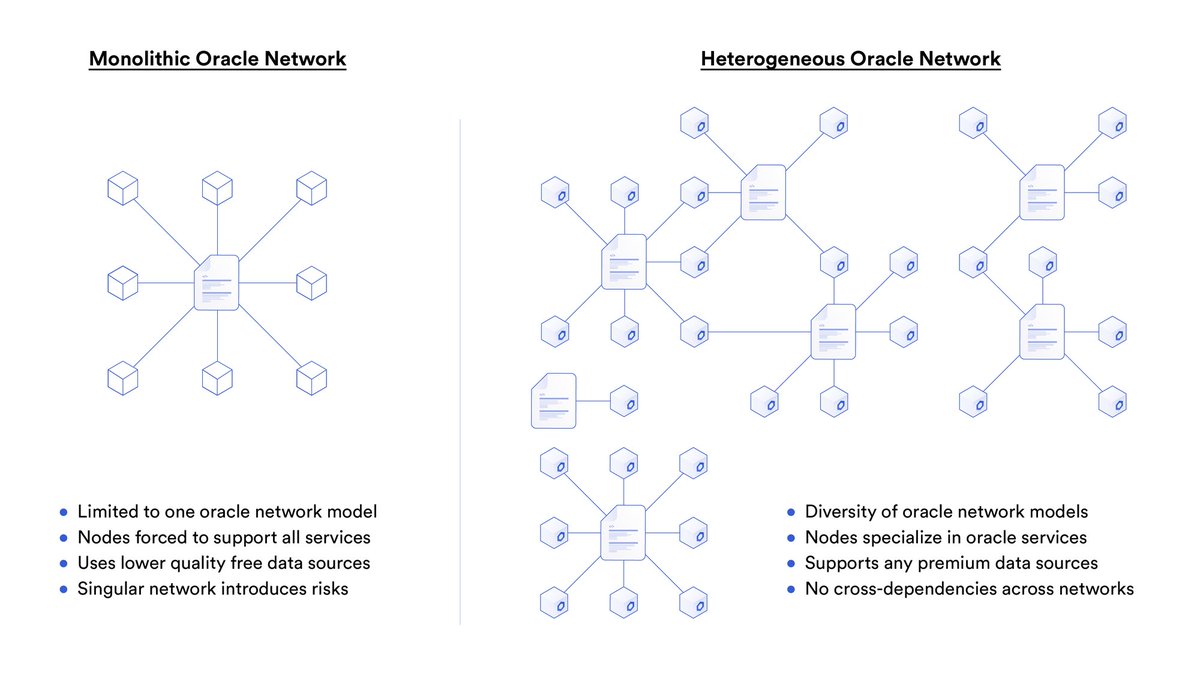

Blockchain agnostic integrations of Chainlink oracles into new blockchain networks

Bring data feeds to broader array to DeFi developers

Working with many teams to integrate Chainlink into chains the right way

Bring data feeds to broader array to DeFi developers

Working with many teams to integrate Chainlink into chains the right way

Large part of the grant program is supporting the community

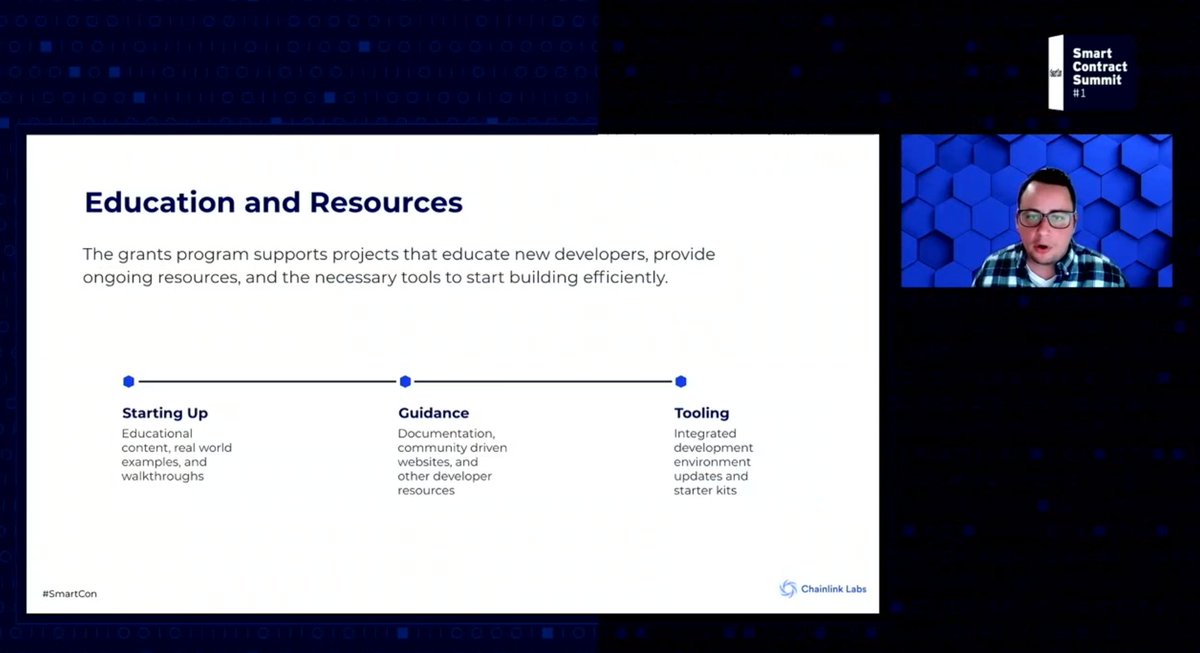

Supporting developers with education, guidance, and tooling

Updating infrastructure smart contract developers rely upon

Supporting new use cases and innovators

Supporting developers with education, guidance, and tooling

Updating infrastructure smart contract developers rely upon

Supporting new use cases and innovators

Social impact is another important goal

Supporting UNICEF and Open Earth Foundation

Supporting social innovations

Supporting UNICEF and Open Earth Foundation

Supporting social innovations

• • •

Missing some Tweet in this thread? You can try to

force a refresh