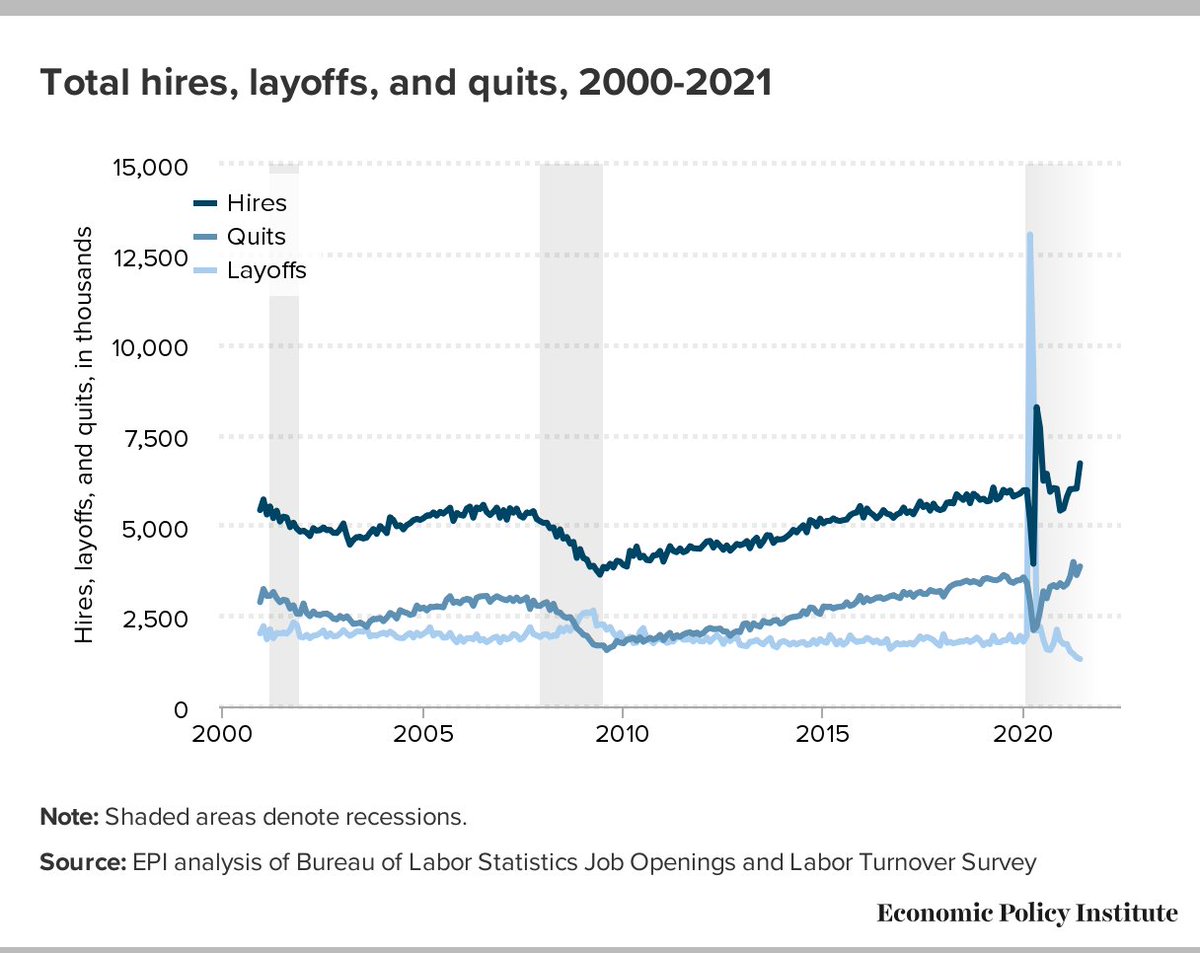

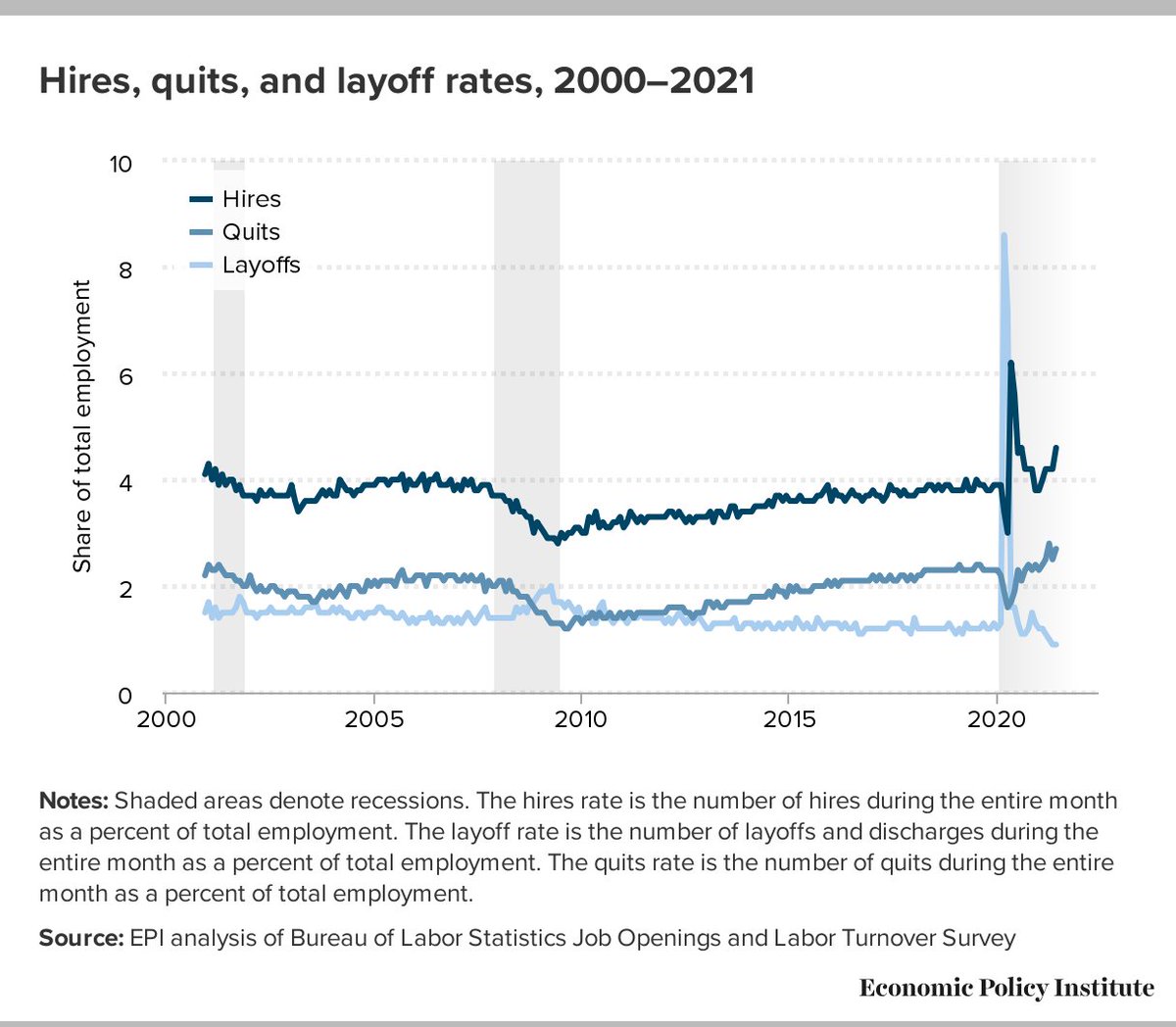

The latest #JOLTS report from the Bureau of Labor Statistics reveals a notable uptick in hires and the hires rate, up nearly 700k and 0.4 percentage points between May and June while layoffs continue to trend down. Altogether a promising sign for an economy continuing to recover.

The uptick in the quits rate is notable, likely due in part to increased opportunities for workers to find better job matches, potentially with higher wages or safer working conditions in the lingering pandemic (which had not worsening as much during the June reference period).

Using the last three months of data by sector to smooth data volatility, it's clear that there are still many sectors with more unemployed workers than job openings. To be clear, these comparisons only include those who are in the official measure of unemployment.

It cannot be emphasized enough that the official unemployment measure misses millions of workers that left the labor force, were misclassified as employed not at work, or experienced a drop in pay or hours because of the pandemic.

https://twitter.com/hshierholz/status/1423637002432303112

Remember today's #JOLTS data are for June. What we know from the latest jobs report for July is that the labor market grew by 943,000 jobs, a sign of continue strength in the recovery.

https://twitter.com/eliselgould/status/1423627864608579591

For the latest analysis and charts on the Job Openings and Labor Turnover Survey, please visit

@EconomicPolicy's #JOLTS landing page

epi.org/indicators/jol….

Thanks to @Dannperr for today's updates!

@EconomicPolicy's #JOLTS landing page

epi.org/indicators/jol….

Thanks to @Dannperr for today's updates!

• • •

Missing some Tweet in this thread? You can try to

force a refresh