The #Bitcoin network (uppercase B) is made up of participants opting-in to the same set of rules.

bitcoin (lowercase b) is the native asset transacted on this network.

Changes in ownership are recorded in a timestamped chain, secured by miners.

Let’s focus on the network.

bitcoin (lowercase b) is the native asset transacted on this network.

Changes in ownership are recorded in a timestamped chain, secured by miners.

Let’s focus on the network.

Innovation regularly births new ways of sending & receiving information.

Networks get built-out around the methods that are faster, cheaper, more accessible, more reliable or more precise.

These become additional layers for humans to coordinate, communicate and cooperate.

Networks get built-out around the methods that are faster, cheaper, more accessible, more reliable or more precise.

These become additional layers for humans to coordinate, communicate and cooperate.

Bitcoin’s key innovation was the creation of a transferable digital asset with a fixed quantity.

“That ability to create and transmit scarcity..through the internet is just as important as the ability to create and transmit abundance through the internet.” -@naval

“That ability to create and transmit scarcity..through the internet is just as important as the ability to create and transmit abundance through the internet.” -@naval

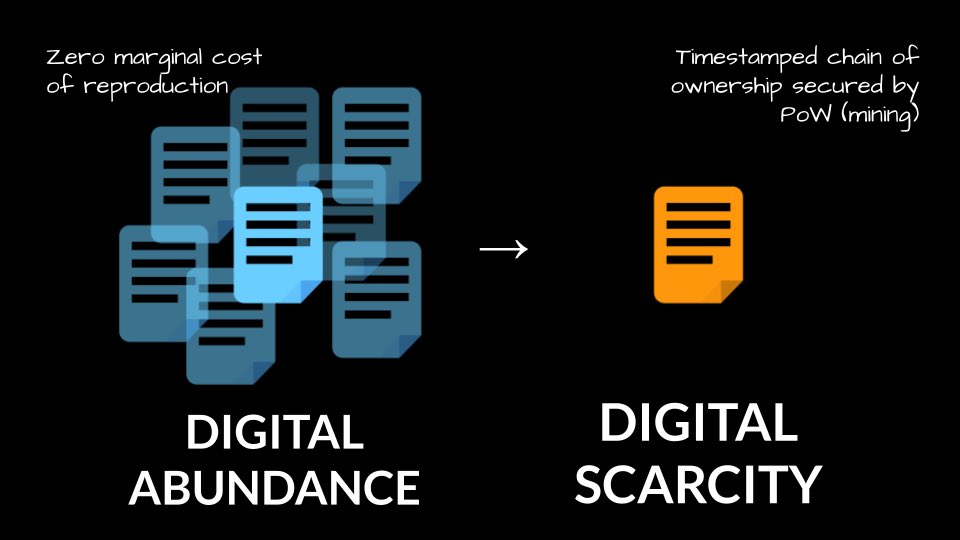

As people adopt the asset and hence opt-in to the ruleset, they become participants.

The structure formed when participants or nodes are connected by, and interact through, a common medium is a telecommunications network.

Credit: bitnodes.io

The structure formed when participants or nodes are connected by, and interact through, a common medium is a telecommunications network.

Credit: bitnodes.io

The role, function or visibility of each connected participant may vary- transmitting, receiving, relaying, creating, validating, etc.

A network structure might relay information when a direct line of communication with the recipient isn’t feasible or available.

However, some kind of check is required to ensure that a message was:

· actually from the recipient claimed

· delivered as intended, without tampering

However, some kind of check is required to ensure that a message was:

· actually from the recipient claimed

· delivered as intended, without tampering

For telecommunications networks to function, standards and rules need to be exist for purpose of compatibility and congruence (can be implicit or explicit).

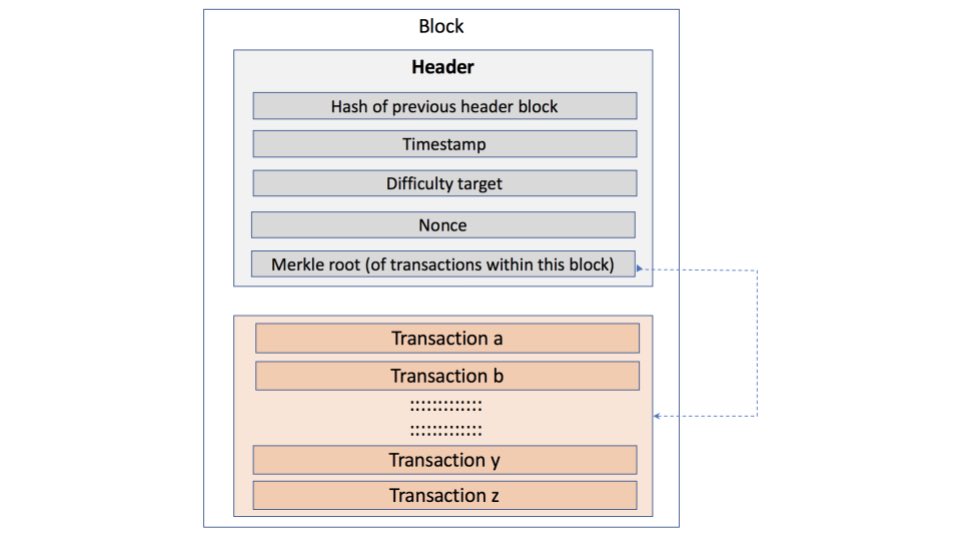

Bitcoin’s protocol rules clearly and publicly define various operations such as how blocks are structured..

via @LuxSci

Bitcoin’s protocol rules clearly and publicly define various operations such as how blocks are structured..

via @LuxSci

Rules need both enforcers and incentives.

“A node refers to client software that a user can run to verify the blockchain and help enforce consensus rules.” -@LynAldenContact

“A node refers to client software that a user can run to verify the blockchain and help enforce consensus rules.” -@LynAldenContact

https://twitter.com/anilsaidso/status/1353807144823386113

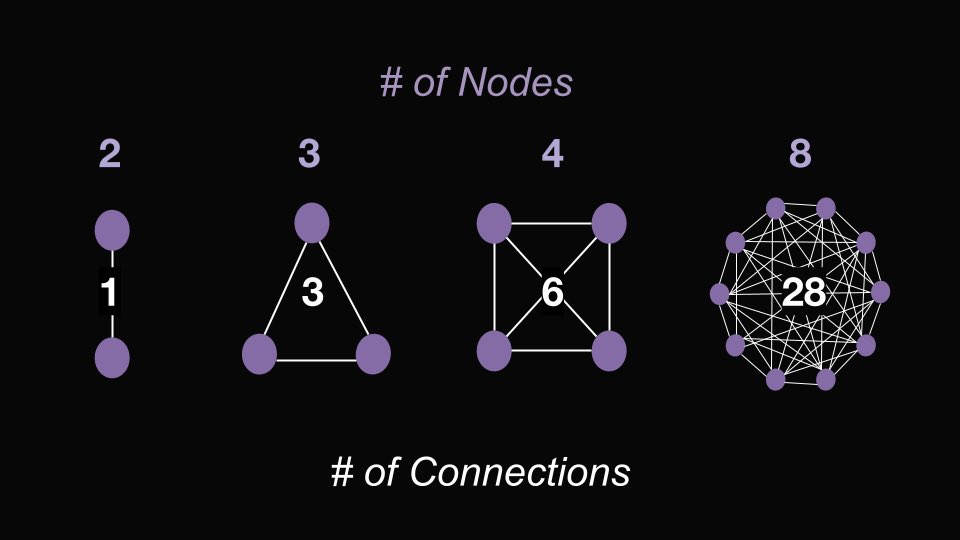

As the number of participants increase, the utility of the network grows disproportionately with each additional user. The equation for representing this phenomena is known as Metcalfe’s Law.

∝ (# of nodes)^2

∝ (# of nodes)^2

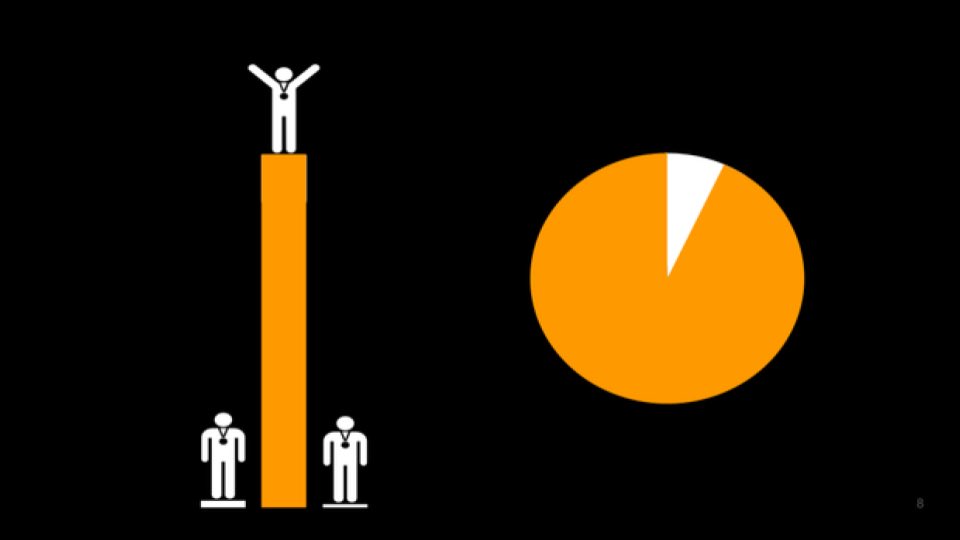

Converging on a standard set of rules for communicating is a naturally occurring phenomena, due to the opportunities and benefits afforded to participants that come with scale.

These network effects continue to compound resulting in winner-take-most outcomes.

These network effects continue to compound resulting in winner-take-most outcomes.

The most useful and resilient communication protocols get swapped into existing applications while spurring entirely new applications over time.

As confidence in their longevity grows they become the default choice, making them incredibly difficult to dislodge.

As confidence in their longevity grows they become the default choice, making them incredibly difficult to dislodge.

It should be noted that transacting in bitcoin is not wholly-dependent on any one single medium and therefore highly adaptable to a range of environments.

https://twitter.com/anilsaidso/status/1308873407916838916

The titans of the Digital Age saw network effects on steroids due to speed, reach and innovation.

“There's never been an example of a $100B monster digital network that was vanquished once it got to that dominant position.

Bitcoin is the monetary network.”

-@michael_saylor

“There's never been an example of a $100B monster digital network that was vanquished once it got to that dominant position.

Bitcoin is the monetary network.”

-@michael_saylor

/End

This thread is adapted from my newsletter- ‘Bitcoin x Mental Models’

Subscribe here: getrevue.co/profile/anilsa…

This thread is adapted from my newsletter- ‘Bitcoin x Mental Models’

Subscribe here: getrevue.co/profile/anilsa…

For further reading to compliment your understanding of the Bitcoin network, you may want to explore how bitcoin (the asset) is following a similar winner-take-all phenomena.

https://twitter.com/anilsaidso/status/1344037826971627520

• • •

Missing some Tweet in this thread? You can try to

force a refresh