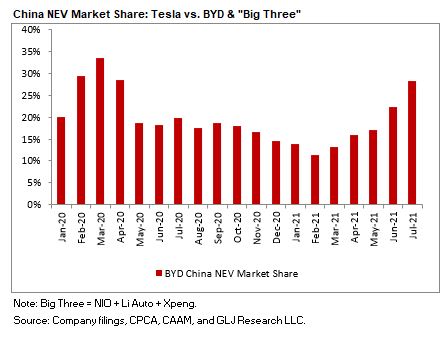

1/4 TSLA's market share in China is collapsing to both the big legacy vendor (i.e., BYD) and the new EV start up IPOs (i.e., NIO + Li Auto + Xpeng). While many are quick to point to TSLA's exports from China to Europe as a reason for this, TSLA isn't gaining share in the EU...

https://twitter.com/HaydonTDG/status/1426287478760087553

2/4... either. In fact, it's fair to say TSLA is maintaining JUST 6-7% share in the EU NEV market (from 22% share in 3Q19); keep in mind that TSLA exported just 8.210K MIC Model Y cars to the EU in July, or ~32.6K/yr (TSLA ships its full quarter's worth of demand from Shanghai...

3/4... in the first month of the qtr), meaning a 500K car/yr plant in Germany may be ILL ADVISED. While one bull argument is the dominant player (BYD in this case) in a rapidly growing market loses market share as competitors flood the space, the data simply does not agree...

4/4... this. Why? BYD has unveiled 10 new EVs & has began delivering 6 of them already. So what happens when Ford's/GM's ~20-30 new EVs hit the US market? - H/T @TaylorOgan. For those analyzing TSLA's mkt shr, you should look at NEV share NOT BEV share (PHEVS compete w/ NEVs).

• • •

Missing some Tweet in this thread? You can try to

force a refresh