NEW LAUNCH: @SushiSwap LP Tokens

With this initiative, the future swap fees of Sushi LPs can now be traded!

Captain PePendle has also found (Pe,P) - find out more below. 👇

With this initiative, the future swap fees of Sushi LPs can now be traded!

Captain PePendle has also found (Pe,P) - find out more below. 👇

The 2 initial @SushiSwap pools will be live on 19th Aug GMT 00:00

1️⃣ PENDLE/ETH LP tokens

2️⃣ ETH/USDC LP tokens

1️⃣ PENDLE/ETH LP tokens

2️⃣ ETH/USDC LP tokens

As swap fees are directly impacted by trading volume, traders can now speculate on the underlying trading activity or use it as a proxy for volatility.

Quick refresher: Pendle splits yield-bearing tokens into 2 components, YT (yield token) and OT (ownership token).

For SLP tokens, YT holders receive the swap fees of the underlying pool with negligible IL risk.

OT holders own the underlying assets and take on the IL risk.

For SLP tokens, YT holders receive the swap fees of the underlying pool with negligible IL risk.

OT holders own the underlying assets and take on the IL risk.

Traditionally, fees surge in times of high volatility, & liquidity providers take the greatest IL risk.

Traders anticipating high volatility can purchase YT to receive swap fees with negligible IL risk while retaining the flexibility to exit their YT position anytime.

Traders anticipating high volatility can purchase YT to receive swap fees with negligible IL risk while retaining the flexibility to exit their YT position anytime.

Existing SLP holders can lock in their future swap fee yield by selling YT.

The capital is received immediately and can be redeployed elsewhere.

The capital is received immediately and can be redeployed elsewhere.

Sushi LPs can also hedge against IL by selling OT while still receiving the swap fees by holding YT. They can re-enter their OT position anytime when they think IL risk has subsided.

Read the full piece on yield trading for LP token here: link.medium.com/mCJ8tR42Oib

Read the full piece on yield trading for LP token here: link.medium.com/mCJ8tR42Oib

Congratulations on making it this far!

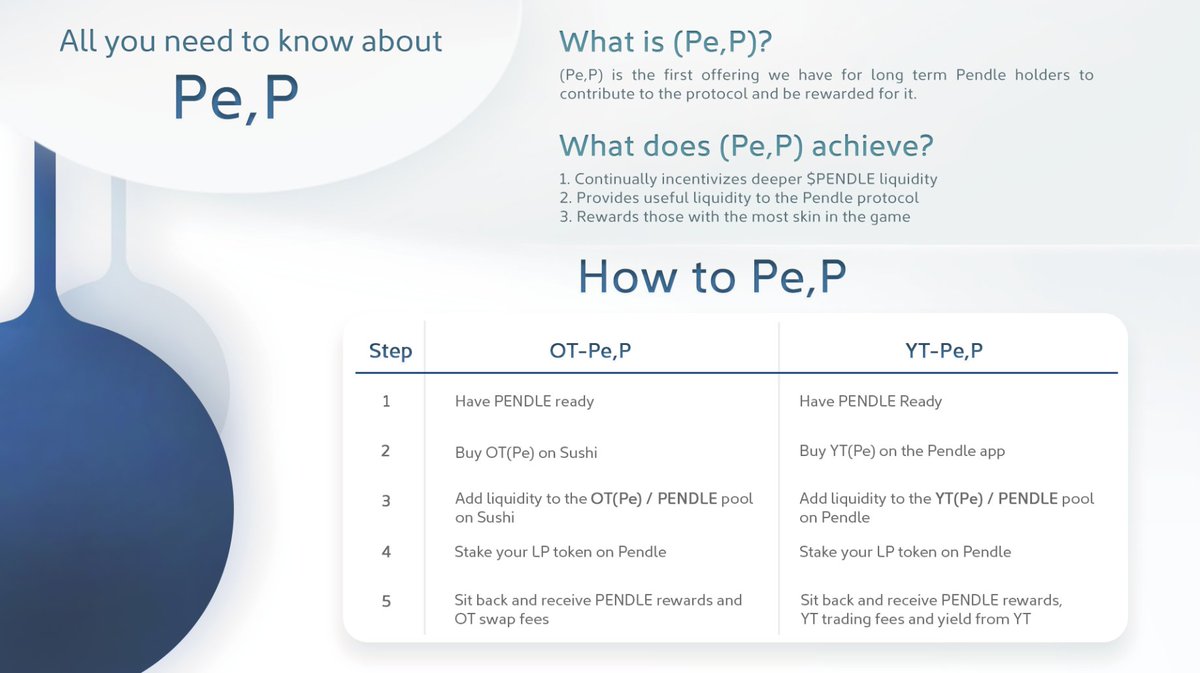

We’re pleased to share (Pe,P) - inspired by our friends across the metaverse @OlympusDAO and enabled by SLP tokenization, (Pe,P) is the first offering we have for long-term Pendle holders to contribute to the protocol and be rewarded.

We’re pleased to share (Pe,P) - inspired by our friends across the metaverse @OlympusDAO and enabled by SLP tokenization, (Pe,P) is the first offering we have for long-term Pendle holders to contribute to the protocol and be rewarded.

(Pe,P) achieves 3 things:

1️⃣Continually incentivizes deeper $PENDLE liquidity

2️⃣Provides useful liquidity to the Pendle protocol

3️⃣Rewards those with the most skin in the game

Find out more about (Pe,P) here: link.medium.com/PDjYxtf3Oib

1️⃣Continually incentivizes deeper $PENDLE liquidity

2️⃣Provides useful liquidity to the Pendle protocol

3️⃣Rewards those with the most skin in the game

Find out more about (Pe,P) here: link.medium.com/PDjYxtf3Oib

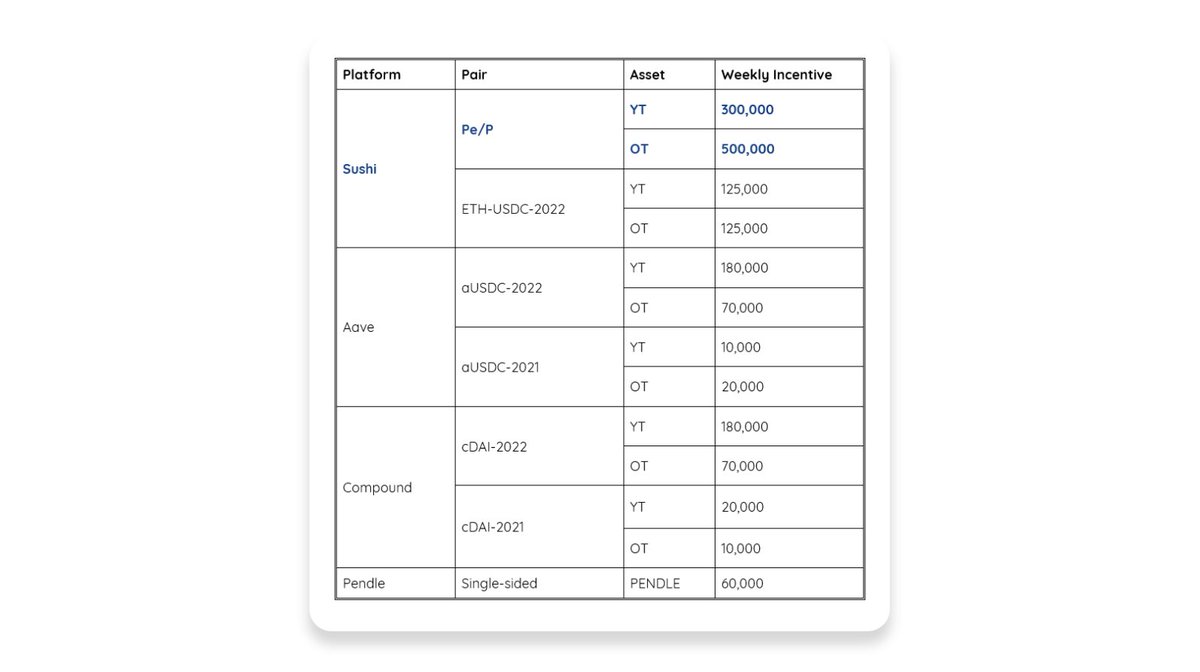

With the launch of (PE,P), we have new liquidity mining details.

Stay updated on incentives here: pendle.notion.site/Liquidity-Mini…

Stay updated on incentives here: pendle.notion.site/Liquidity-Mini…

1️⃣App: app.pendle.finance

2️⃣SLP Tokenization: link.medium.com/mCJ8tR42Oib

3️⃣LP Tokenization docs: docs.pendle.finance/core-mechanics…

4️⃣Resources Repository: pendle.notion.site/Resources-fe1f…

5️⃣(Pe,P): link.medium.com/PDjYxtf3Oib

2️⃣SLP Tokenization: link.medium.com/mCJ8tR42Oib

3️⃣LP Tokenization docs: docs.pendle.finance/core-mechanics…

4️⃣Resources Repository: pendle.notion.site/Resources-fe1f…

5️⃣(Pe,P): link.medium.com/PDjYxtf3Oib

• • •

Missing some Tweet in this thread? You can try to

force a refresh