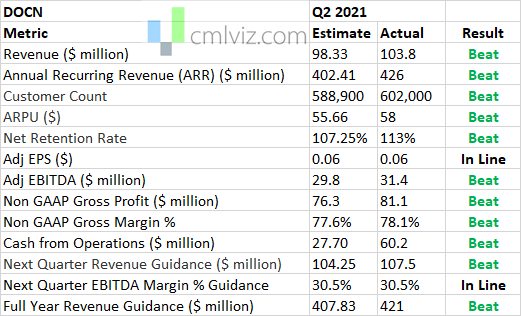

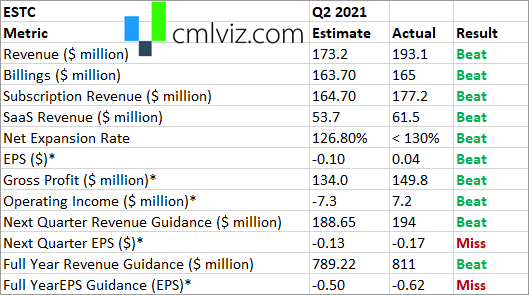

$ESTC

A huge beat and surprise profit

* Revenue: 193M vs 173 est

* EPS: $0.04 vs -$0.10 est

* Operating Income: $7.2M vs -7.2M est

1/n

A huge beat and surprise profit

* Revenue: 193M vs 173 est

* EPS: $0.04 vs -$0.10 est

* Operating Income: $7.2M vs -7.2M est

1/n

$ESTC

* Billings: $165M vs $163.7M

- Subscription Revenue: $177.2M vs 164.7M

- Gross Profit*: $149.8M vs $134.0M

- Next Q Revenue Guide: $194M vs $188.7M

- Full Year Revenue Guide: $811M vs $789.2M

* Non-GAAP

2/n

* Billings: $165M vs $163.7M

- Subscription Revenue: $177.2M vs 164.7M

- Gross Profit*: $149.8M vs $134.0M

- Next Q Revenue Guide: $194M vs $188.7M

- Full Year Revenue Guide: $811M vs $789.2M

* Non-GAAP

2/n

$ESTC

* Net Expansion Rate: 130% vs 126.8%

3/n

* Net Expansion Rate: 130% vs 126.8%

3/n

$ESTC @elastic

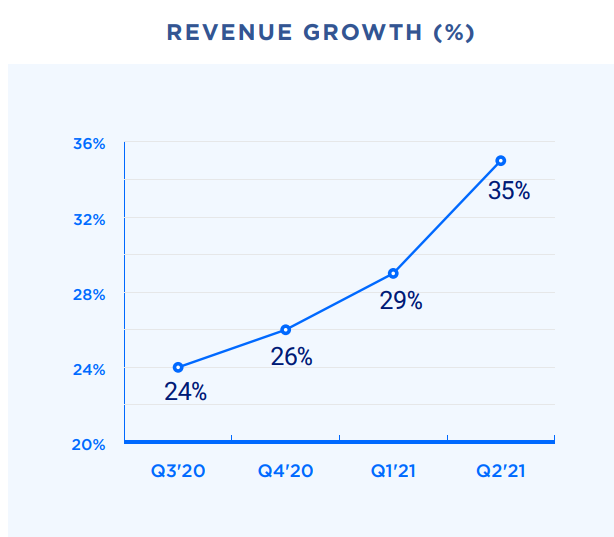

Big beats and surprise profit; 50% revenue growth and over 60% in Elastic Cloud.

Just a great quarter and a company that Wall Street has gotten wrong for far too long.

Big beats and surprise profit; 50% revenue growth and over 60% in Elastic Cloud.

Just a great quarter and a company that Wall Street has gotten wrong for far too long.

To top it off, Elastic received the Microsoft U.S. partner award in business excellence in the Commercial Marketplace this quarter and Elastic was named the 2020 Google Cloud technology partner of the year in the data management category.

The surprise upside was seen mostly from its Elastic Cloud product -- exactly where we would want to see it.

The questions that matter:

1. Was the revenue beat due to inorganic growth (from acquisitions)

2. Will we get next year guidance?

1. Was the revenue beat due to inorganic growth (from acquisitions)

2. Will we get next year guidance?

Perfect. The revenue beat was not due to acquisitions. A true beat.

• • •

Missing some Tweet in this thread? You can try to

force a refresh