The single strongest deterring factor of the crypto industry is the lack of education on the subject…

Let’s change that.

Here are 24 things I wish I knew before starting crypto..🧁

Let’s change that.

Here are 24 things I wish I knew before starting crypto..🧁

1. Crypto is unforgiving

Crypto will wipe you out more often than it can make you rich.

In this space, thousands of people lose their hard-earned money due to human error, scams, or exploits.

Being your own custodian comes w great responsibility

Crypto will wipe you out more often than it can make you rich.

In this space, thousands of people lose their hard-earned money due to human error, scams, or exploits.

Being your own custodian comes w great responsibility

2. Traders don’t usually win

Ppl jump into this market thinking they need to be first to every speculative bubble, every meme hype train, or every large NFT drop

This strategy more often than not leaves you rekt. The majority of ppl are better off holding $BTC or $ETH long term

Ppl jump into this market thinking they need to be first to every speculative bubble, every meme hype train, or every large NFT drop

This strategy more often than not leaves you rekt. The majority of ppl are better off holding $BTC or $ETH long term

3. Crypto is the wild west

What is arguably one of its best aspects, can also be one of its worst

There’s no CEO of Bitcoin to call & complain to when your investment goes underwater

The lack of regulation has many potential upsides, but also brings about more responsibility

What is arguably one of its best aspects, can also be one of its worst

There’s no CEO of Bitcoin to call & complain to when your investment goes underwater

The lack of regulation has many potential upsides, but also brings about more responsibility

4. Keep it simple

Although this ecosystem may seem very confusing, it is important to know that it’s not.

With just basic knowledge of cryptocurrency, a whole new world of opportunities are at your disposal

It should not be a scary thing to become your own bank

Although this ecosystem may seem very confusing, it is important to know that it’s not.

With just basic knowledge of cryptocurrency, a whole new world of opportunities are at your disposal

It should not be a scary thing to become your own bank

5. Security/op-sec

When you delve into the world of crypto, you’re taking your finances into your own hands.

It is crucial to familiarize yourself with the concept of wallets, private keys, seed phrases etc. to not end up like the one of many traders who’ve lost their fortunes

When you delve into the world of crypto, you’re taking your finances into your own hands.

It is crucial to familiarize yourself with the concept of wallets, private keys, seed phrases etc. to not end up like the one of many traders who’ve lost their fortunes

6. Never trust anyone

Before taking advice from anyone in this space you must first ask yourself

“Does this person really have my best interests in mind?”

The majority of the time, this answer is no. Crypto is a zero-sum game, & nearly everyone acts in their own self interests

Before taking advice from anyone in this space you must first ask yourself

“Does this person really have my best interests in mind?”

The majority of the time, this answer is no. Crypto is a zero-sum game, & nearly everyone acts in their own self interests

7. We’re still early

Electricity & the telephone took decades before reaching 60% adoption.

Kids born nowadays are fully immersed in a digital era, & the way we perceive/transfer value is increasingly being digitized.

The adoption & network effects should not be underestimated

Electricity & the telephone took decades before reaching 60% adoption.

Kids born nowadays are fully immersed in a digital era, & the way we perceive/transfer value is increasingly being digitized.

The adoption & network effects should not be underestimated

https://twitter.com/CroissantEth/status/1418713129756856326

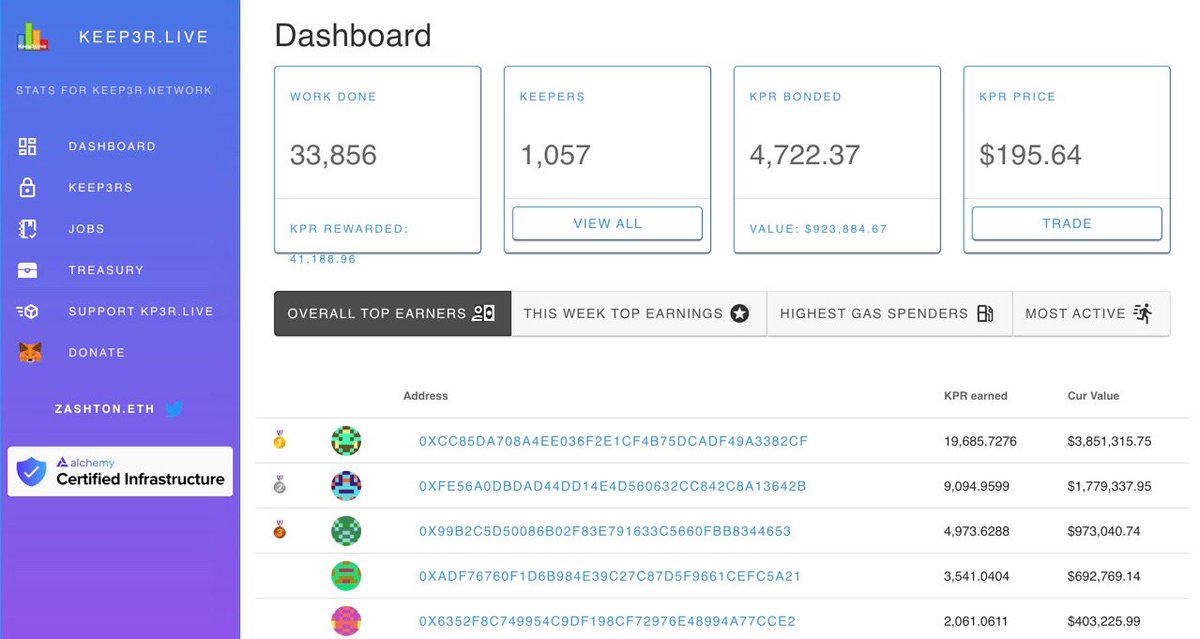

8. Follow the money

There’s no one that knows the current state of the market or it’s future better than the people that move it themselves

There are a # of analytical tools that can be used to find where money is flowing, & its best to position yourself among these top players

There’s no one that knows the current state of the market or it’s future better than the people that move it themselves

There are a # of analytical tools that can be used to find where money is flowing, & its best to position yourself among these top players

9. FUD is FUD

FUD is just what it’s name insinuates, Fear, Uncertainty, & Doubt.

More often than not the parties behind distributing such information have their own personal motifs, & sophisticated traders will prey on the opportunities given by emotional traders.

FUD is just what it’s name insinuates, Fear, Uncertainty, & Doubt.

More often than not the parties behind distributing such information have their own personal motifs, & sophisticated traders will prey on the opportunities given by emotional traders.

10. The market doesn’t sleep

I know you’ve heard the term “time is money” before, but crypto brings it to a diff level

While you’re asleep their may be a life another life changing opportunity

This may be scary, but it’s also exciting bc of how many opportunities there are

I know you’ve heard the term “time is money” before, but crypto brings it to a diff level

While you’re asleep their may be a life another life changing opportunity

This may be scary, but it’s also exciting bc of how many opportunities there are

11. Crypto cycles

$BTC has hard coded scarcity events that occur every 4 yrs

In these periods, the # of $BTC coming into circ. is “halved”, which leads to a shift in supply/demand & results in tremendous upward growth

Understanding this will give you an edge in the market

$BTC has hard coded scarcity events that occur every 4 yrs

In these periods, the # of $BTC coming into circ. is “halved”, which leads to a shift in supply/demand & results in tremendous upward growth

Understanding this will give you an edge in the market

12. $BTC vs $ETH

It’s hard to drown out noise coming from maxi’s on both sides of this spectrum

Ppl claim crypto is “winner takes all”, but that is not true

Before choosing which is best for you, 1st see what the core values of each are & go w the one you align w the most

It’s hard to drown out noise coming from maxi’s on both sides of this spectrum

Ppl claim crypto is “winner takes all”, but that is not true

Before choosing which is best for you, 1st see what the core values of each are & go w the one you align w the most

13. Market capitalization

Although not always reliable, Market capitalization is one of the most effective ways in gauging how much a particular currency is worth.

It is calculated by multiplying the price of a currency by the amount of coins in circulation.

Although not always reliable, Market capitalization is one of the most effective ways in gauging how much a particular currency is worth.

It is calculated by multiplying the price of a currency by the amount of coins in circulation.

14. Cheaper coins != better opportunity

All too often I see ppl that are new to crypto investing in coins that are <$1, simply bc they are “cheaper”.

While that may seem to be the case, a coin worth $1 with a 1,000 supply is a lot different from a coin worth $1 with 1B supply

All too often I see ppl that are new to crypto investing in coins that are <$1, simply bc they are “cheaper”.

While that may seem to be the case, a coin worth $1 with a 1,000 supply is a lot different from a coin worth $1 with 1B supply

15. The market is irrational

What you may think should be worth hundreds of millions of dollars, may not always turn out to be the case.

To this day, there are still literal scams or vaporware projects that exist comfortably in the top 100.

What you may think should be worth hundreds of millions of dollars, may not always turn out to be the case.

To this day, there are still literal scams or vaporware projects that exist comfortably in the top 100.

16. Adaptation is key

What happens in the stock market in one year happens in crypto within 24 hrs.

Narratives will change at the blink of an eye, & being fluid in your investments & mindset will lead to better performance as a trader.

What happens in the stock market in one year happens in crypto within 24 hrs.

Narratives will change at the blink of an eye, & being fluid in your investments & mindset will lead to better performance as a trader.

17. Listen to people smarter than you

There is an abundance of free content online from people w knowledge generations ahead of your own.

Being humble in this fact & accepting this info will not only help you become more like them, but will lead to more success in your future

There is an abundance of free content online from people w knowledge generations ahead of your own.

Being humble in this fact & accepting this info will not only help you become more like them, but will lead to more success in your future

18. Have conviction in your trades

Before investing in something, you should develop a thesis.

“Why do I think X is undervalued”

“Why should x go up”

Answering these simple questions will result in better outcomes on your trades

Before investing in something, you should develop a thesis.

“Why do I think X is undervalued”

“Why should x go up”

Answering these simple questions will result in better outcomes on your trades

19. Go outside your comfort zone

Separating yourself from CEX’s & delving into the world of decentralized finance was one of the greatest financial opportunities in decades.

It is only those that were able to step outside their comfort zones that profited from this.

Separating yourself from CEX’s & delving into the world of decentralized finance was one of the greatest financial opportunities in decades.

It is only those that were able to step outside their comfort zones that profited from this.

20. Intellect is an edge

The overwhelming majority of crypto investors have no idea what they’re investing in.

Informing yourself on certain aspects of different currencies will help you determine why some have succeeded, & why others have failed.

The overwhelming majority of crypto investors have no idea what they’re investing in.

Informing yourself on certain aspects of different currencies will help you determine why some have succeeded, & why others have failed.

21. You don’t need leverage

It’s my firm belief that anyone starting with even $500 has the chance to make it in this market

There is alpha waiting just around the corner for anyone who is willing to find it

Don’t be the guy that is forced to learn the hard way ab leverage

It’s my firm belief that anyone starting with even $500 has the chance to make it in this market

There is alpha waiting just around the corner for anyone who is willing to find it

Don’t be the guy that is forced to learn the hard way ab leverage

22. Take profits

If you’re up a significant amount of money from your original investment, take some profits

I don’t care if it continues to go up another 10x from there, profit is profit

Gains can & will be wiped within a blink of an eye, & there always be more opportunities

If you’re up a significant amount of money from your original investment, take some profits

I don’t care if it continues to go up another 10x from there, profit is profit

Gains can & will be wiped within a blink of an eye, & there always be more opportunities

23. Hindsight is 20/20

“I should of done this” or “I should have done that”

Sure, it would have been great to invest in $BTC when it was $1.

But that opportunity is gone now, and rather than beating ourselves up on it, we should instead focus on our next chance.

“I should of done this” or “I should have done that”

Sure, it would have been great to invest in $BTC when it was $1.

But that opportunity is gone now, and rather than beating ourselves up on it, we should instead focus on our next chance.

24. We’re on the brink of something incredible

$BTC & other crypto’s are seeing growth & adoption on a scale never seen before

For the 1st time in history, we have a chance to disrupt the largest bureaucratic institutions & replace them w decentralized versions owned by the ppl

$BTC & other crypto’s are seeing growth & adoption on a scale never seen before

For the 1st time in history, we have a chance to disrupt the largest bureaucratic institutions & replace them w decentralized versions owned by the ppl

• • •

Missing some Tweet in this thread? You can try to

force a refresh