Is nobody seeing this?

There are so many things lining up for $ETH, it’s hard for me to not expect a massive run up coming in the next few weeks.

$ETH is well on its way to becoming a multi-trillion dollar asset.

Let’s discuss… 🥐

There are so many things lining up for $ETH, it’s hard for me to not expect a massive run up coming in the next few weeks.

$ETH is well on its way to becoming a multi-trillion dollar asset.

Let’s discuss… 🥐

TVL in DeFi

Ever since the beginning of this year, the total value locked in DeFi has gone exponential.

On January 1st, 2021 the TVL was a modest $16B.

Today, this number is now a staggering $85B.

This would place $ETH at the 20th largest bank in the world by market cap

Ever since the beginning of this year, the total value locked in DeFi has gone exponential.

On January 1st, 2021 the TVL was a modest $16B.

Today, this number is now a staggering $85B.

This would place $ETH at the 20th largest bank in the world by market cap

https://twitter.com/CroissantEth/status/1424190328710606853

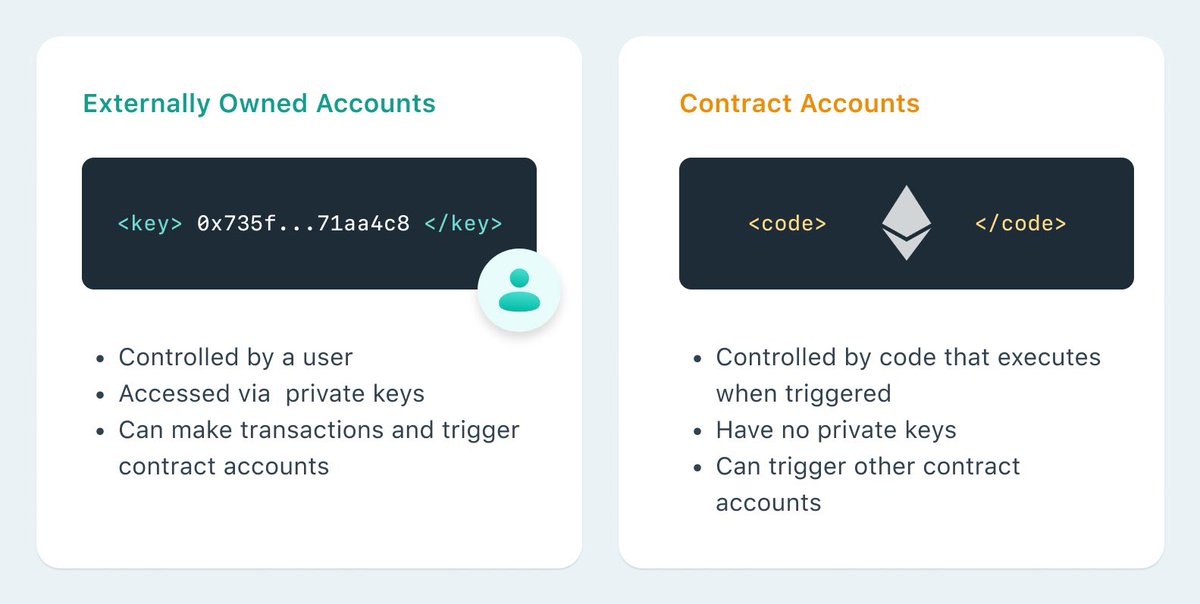

$ETH in smart contracts

Due to the outright explosion of DeFi, the amount of ether placed in smart contracts has similarly gone to all time highs.

In fact, an unbelievable 26% of all $ETH is in smart contracts at the moment.

We can only expect this trend to continue…

Due to the outright explosion of DeFi, the amount of ether placed in smart contracts has similarly gone to all time highs.

In fact, an unbelievable 26% of all $ETH is in smart contracts at the moment.

We can only expect this trend to continue…

https://twitter.com/croissanteth/status/1424095196363558921

Developers

$ETH is growing at a pace faster than even #Bitcoin in terms of active developers, and it’s not even close

Since Q3 of 2019, $ETH has averaged a gain of over 300+ devs a month

The ecosystem is undeniably attracting some of the world’s best innovators

$ETH is growing at a pace faster than even #Bitcoin in terms of active developers, and it’s not even close

Since Q3 of 2019, $ETH has averaged a gain of over 300+ devs a month

The ecosystem is undeniably attracting some of the world’s best innovators

Burnt $ETH (EIP-1559)

EIP-1559 has been nothing short of astounding.

It introduced fluctuating burns to $ETH acting like a dividend for all users, while simultaneously making tx fees smoother & faster for the network

More than 102,492 $ETH has been burnt since it went live 🔥

EIP-1559 has been nothing short of astounding.

It introduced fluctuating burns to $ETH acting like a dividend for all users, while simultaneously making tx fees smoother & faster for the network

More than 102,492 $ETH has been burnt since it went live 🔥

https://twitter.com/croissanteth/status/1423076166798389253

Staked $ETH

The amount of $ETH being staked for ETH 2.0 is now worth upwards of $23B

That’s approximately 6.1% of all $ETH.

This is expected to increase significantly after the merge to PoS

EIP-1559 & PoS account for more than 7.2M $ETH being taken out of the supply in months

The amount of $ETH being staked for ETH 2.0 is now worth upwards of $23B

That’s approximately 6.1% of all $ETH.

This is expected to increase significantly after the merge to PoS

EIP-1559 & PoS account for more than 7.2M $ETH being taken out of the supply in months

https://twitter.com/CroissantEth/status/1421194856479797253

DeFi users

Have you ever seen the total numbers of $ETH wallets having ever interacted with top DeFi protocols?

$UNI - 2.5M

$COMP - 328k

$SUSHI - 233k

$AAVE - 74k

$MKR - 73k

$CRV - 45k

$YFI - 31k

$SNX - 18k

Or ~3.2M. We haven’t even discovered what can be done on $ETH yet

Have you ever seen the total numbers of $ETH wallets having ever interacted with top DeFi protocols?

$UNI - 2.5M

$COMP - 328k

$SUSHI - 233k

$AAVE - 74k

$MKR - 73k

$CRV - 45k

$YFI - 31k

$SNX - 18k

Or ~3.2M. We haven’t even discovered what can be done on $ETH yet

Stablecoins

Stablecoins are growing some extraordinary value for $ETH as an asset

$USDC: $27B

$DAI: $5.8B

$TUSD: $1.4B

& more!

They are very popular for their easy use in DeFi, & VISA will soon accept tx settlement in $USDC

$USDC alone grew from $4B mcap, to $27B this year 👀

Stablecoins are growing some extraordinary value for $ETH as an asset

$USDC: $27B

$DAI: $5.8B

$TUSD: $1.4B

& more!

They are very popular for their easy use in DeFi, & VISA will soon accept tx settlement in $USDC

$USDC alone grew from $4B mcap, to $27B this year 👀

Network use

Ethereum is now regularly settling more value per day than #Bitcoin, the largest cryptocurrency by market capitalization

This will only continue to grow with upgrades like ETH 2.0

As block space has more demand with time and adoption, ether will become more scarce.

Ethereum is now regularly settling more value per day than #Bitcoin, the largest cryptocurrency by market capitalization

This will only continue to grow with upgrades like ETH 2.0

As block space has more demand with time and adoption, ether will become more scarce.

Supply on exchanges

The balance of $ETH held by centralized exchanges continues to drop, nearing levels not seen since three years ago…

This indicates that many holders are not aiming to sell soon, and it may be a catalyst of its own if it happens to continue

The balance of $ETH held by centralized exchanges continues to drop, nearing levels not seen since three years ago…

This indicates that many holders are not aiming to sell soon, and it may be a catalyst of its own if it happens to continue

$ETH issuance

EIP-1559 & the merge to PoS will result in a massive sell pressure decrease for $ETH

Higher APY for staking upon the merge, along with a sudden surge of people locking their $ETH for the yield will result in unprecedented levels of volatility

h/t @drakefjustin 👏🏻

EIP-1559 & the merge to PoS will result in a massive sell pressure decrease for $ETH

Higher APY for staking upon the merge, along with a sudden surge of people locking their $ETH for the yield will result in unprecedented levels of volatility

h/t @drakefjustin 👏🏻

https://twitter.com/drakefjustin/status/1424039388548321283

With all of this information, it is clear there are inherent forces that will be driving up the price of $ETH

and I didn’t even mention potential trends like:

-NFTs

-Gaming

-Yield farming

-Lending

-DEXs

-Layer two

+ much more… but I hope you guys enjoy this thread! 🥐

and I didn’t even mention potential trends like:

-NFTs

-Gaming

-Yield farming

-Lending

-DEXs

-Layer two

+ much more… but I hope you guys enjoy this thread! 🥐

• • •

Missing some Tweet in this thread? You can try to

force a refresh