There are several things leading up to an extraordinary supply shock for $ETH

It’s getting to the point where it doesn’t even matter who sells, there is simply too much demand for block space on Ethereum

Let’s discuss! 🥐

It’s getting to the point where it doesn’t even matter who sells, there is simply too much demand for block space on Ethereum

Let’s discuss! 🥐

In order to understand the extent of what’s about to come, you’ll have to first take a look at figures coming out of EIP-1559

Implemented in early August, the upgrade introduced a base fee (burnt) that varies based on network congestion per block

It has already burnt 287k $ETH

Implemented in early August, the upgrade introduced a base fee (burnt) that varies based on network congestion per block

It has already burnt 287k $ETH

https://twitter.com/CroissantEth/status/1423076290039537669

Even more interestingly though, this 287,413 $ETH represents $931M that would have gone into the hands of miners previously

Miners who are infamously known for selling to cover expenses from energy intensive Proof of Work

The effects of this will be shown exponentially soon

Miners who are infamously known for selling to cover expenses from energy intensive Proof of Work

The effects of this will be shown exponentially soon

Then we have things like staking.

If you didn’t believe EIP-1559 would make $ETH deflationary, just wait until the transition to Proof of Stake next year

There is already 7.6M $ETH staked inside the deposit contract, or $25B worth earning yield…

If you didn’t believe EIP-1559 would make $ETH deflationary, just wait until the transition to Proof of Stake next year

There is already 7.6M $ETH staked inside the deposit contract, or $25B worth earning yield…

With both staking and EIP-1559 combined, a total of ~7.9M $ETH has been taken out of the supply in less than a year, and issuance is set to decrease (even more)

But these figures don’t even begin to account for the merge, which will significantly increase the yield for staking

But these figures don’t even begin to account for the merge, which will significantly increase the yield for staking

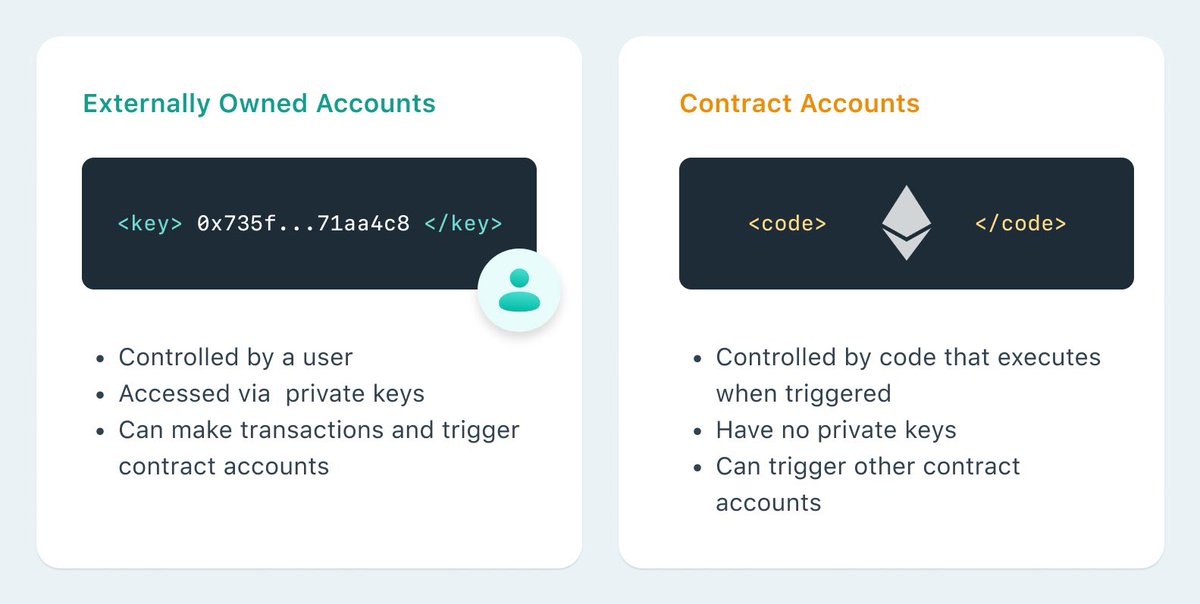

Why? Well, the merge refers to the “merge” of the Ethereum mainnet with the beacon chain, becoming its own shard which uses PoS instead of PoW.

This also means that immediately after this occurs, transaction fees will go to validators rather than to miners

This also means that immediately after this occurs, transaction fees will go to validators rather than to miners

https://twitter.com/drakefjustin/status/1384124998084792324

APY for stakers on $ETH will shoot up significantly

Where this gets even more interesting is when taking a look at the validator queue

Without getting too technical, the validator queue exists for security reasons…

Where this gets even more interesting is when taking a look at the validator queue

Without getting too technical, the validator queue exists for security reasons…

A flood of validators can’t come into a system and leave immediately in a proof of stake model

Therefore, Ethereum has a rate limit set for the pace at which validators can join the network

Right now it takes about a week to become activated…

Therefore, Ethereum has a rate limit set for the pace at which validators can join the network

Right now it takes about a week to become activated…

But this number will increase with a flood of people rushing to stake… So what does this mean?

-> merge

-> apy shoots up

-> flood of users rush to stake

-> eth gets locked

-> queue fills

-> weeks/months of 20%+ apy?

This is extremely attractive for both security and efficiency

-> merge

-> apy shoots up

-> flood of users rush to stake

-> eth gets locked

-> queue fills

-> weeks/months of 20%+ apy?

This is extremely attractive for both security and efficiency

My point is that I believe EIP-1559, staking & the merge will contribute to a supply shock never seen before on $ETH

We also have factors like:

-27% of $ETH locked in smart contracts

-$85B TVL in DeFi

-NFT hype

-Stablecoins growing more than $60B this year

I hope you enjoy! 🥐

We also have factors like:

-27% of $ETH locked in smart contracts

-$85B TVL in DeFi

-NFT hype

-Stablecoins growing more than $60B this year

I hope you enjoy! 🥐

• • •

Missing some Tweet in this thread? You can try to

force a refresh