$Fil Filo Review/Thread No.1

1/ 1 needs to spend time on the data, reading background reports, looking at plans etc. & I have been doing this while waiting for a couple of answers from the Co. on its dataset available on the website. Nothing major, just a couple of questions on

1/ 1 needs to spend time on the data, reading background reports, looking at plans etc. & I have been doing this while waiting for a couple of answers from the Co. on its dataset available on the website. Nothing major, just a couple of questions on

2/the differences between the RC & DDH drill survey data. If I have wonkey survey data, or bring the data in wrong, I'll get wrong sample positions, which would lead to wrong models &designs➡️different economic outcomes &then we know it could all end in tears➡️ not good.😁

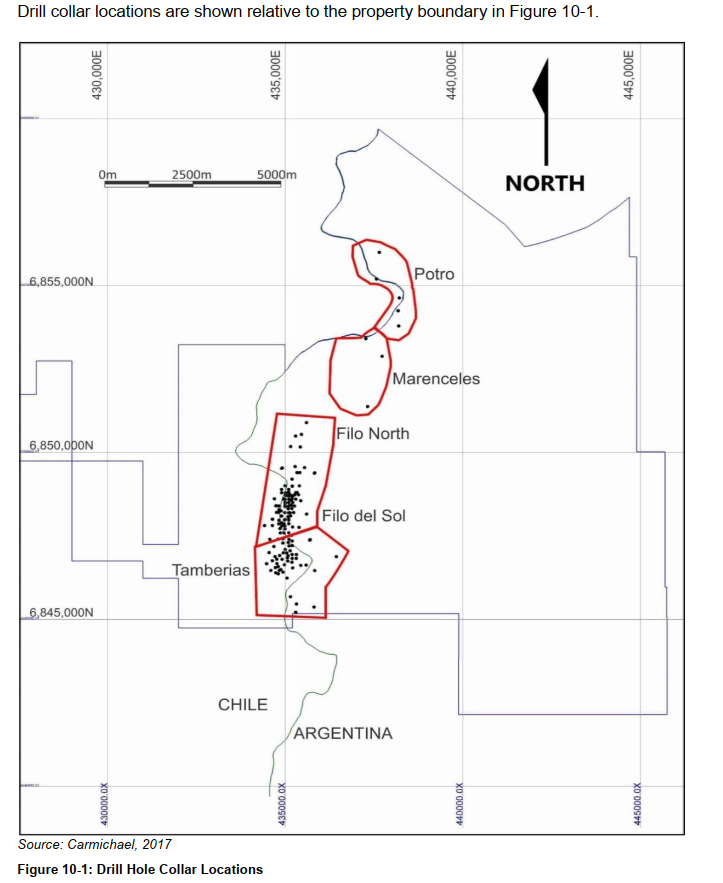

3/ So while we wait its a good time to review the PFS report by Ausenco. Very nicely presented, clear & professional it answered some of my initial doubts about water & land/sovereign risk. Need to spend more time on the Chilean vs Argentinian laws & its impact on a mine

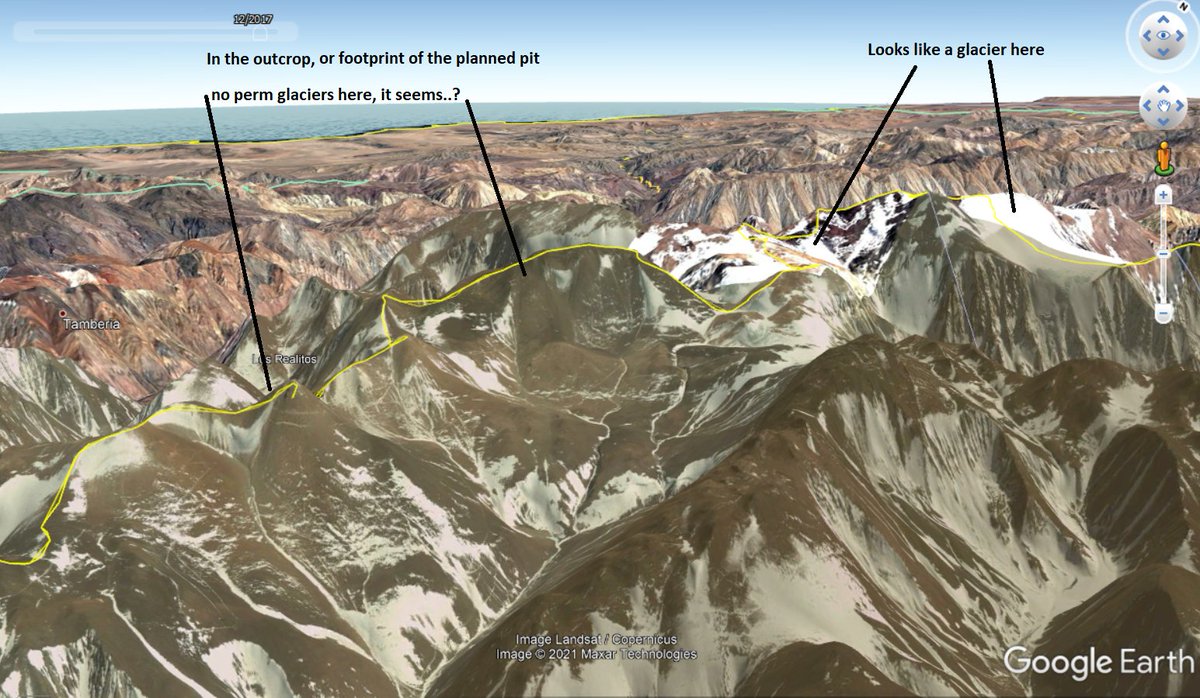

4/ straddling an international boundary. Well worth a read yourselves.👌 I also had a look at it on google earth (something I always do). In this case it was hard to find, using the GE photo in the technical report circa 2017. You can see the drill roads & also realize how high

5/ this project is. The tops of those hills are 5,600m or 18,000'👀Mining is really challenging at anything over 4,800m but nevertheless still doable, but its animal. There is also the worry about permanent glaciers (of Barrick lore), which seem absent in this NW view below.

6/ Access is going to be something else, the closest being a 50km gravel road pass up the mountain after a 2 hr drive along a tarred road from Copiapo. its 245km from port in Chile, which seems the logical place to ship cathode/conc.

7/ Looking at the site from the south, it really is quite isolated. In this 2x vertical exaggeration view, you can see the resource sits atop a mountain, with limited flat space around it for plant & dumps. I also imagine workers will live @ a lower elevation & be bussed in.

8/ I want to look at the existing plan to build a mine on the oxides & only then review the impact on the relatively recent big results on the deeper sulphides. This project will always be an oxide project first, so key is the success of that B4 we look at the deep hole Upside.

9/ But while you wait for that, I refer to you the $Fil presentation which puts in a "potential" category with lots of get-out-of-jail warnings containing avg. 119Mt of contained fine copper, worth just enough to pay off 1/3 of the US 2021 deficit at today's copper price. 😃😄

10/ 👆That's one ballsy slide!😁

The other side of the coin is that if this mine is to become a reality as pumped (it is being pumped), it would be big enough to put some downward pressure on the copper price, so lets just hold our horses & 1st work through things logically.

The other side of the coin is that if this mine is to become a reality as pumped (it is being pumped), it would be big enough to put some downward pressure on the copper price, so lets just hold our horses & 1st work through things logically.

11/ Back to the oxides, I managed to suck in the pit design in and drape it on the topo surface. Using this image I should be able to reconstruct the practical pit; then once/if the block model can be done; to compare things & look at a few scenarios. Takes a little time to do.😏

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh