Mega 🧵👇 on #Pix transmissions & what makes this company special.

TL;DR: Recession proof play on global capex cycle revival & mechanisation of indian agriculture.

TL;DR: Recession proof play on global capex cycle revival & mechanisation of indian agriculture.

First of all a huge shout out to ValuePickr. This is one of the hardest companies to research. Without ValuePickr I'd know almost nothing about Pix. Most of knowledge on this thread comes from VP

forum.valuepickr.com/t/pix-transmis…

forum.valuepickr.com/t/pix-transmis…

At one point in time, humans had to do all physical labor by hand. Physically making goods, through strenuous labor.

One of the largest revolutions in human existence was the invention of machines. Automation. Feed in energy (coal, electricity) & the machine would do the work for you. Most appropriately, this was known as the industrial revolution.

Fundamentally, most of these machines involve 3 parts:

1. A source of energy

2. Conversion of chemical energy (coal) or electricity into mechanical work done (movement, rotation & so forth) through a device.

3. A way to 'transfer' the movement from one part to another. Often to manipulate & control the rotations per second, speed etc

2. Conversion of chemical energy (coal) or electricity into mechanical work done (movement, rotation & so forth) through a device.

3. A way to 'transfer' the movement from one part to another. Often to manipulate & control the rotations per second, speed etc

1. Understanding the industry structure & tailwinds

It turns out, that one of the ways of doing #3 above is using rubber belts. These rubber belts called V-belts. These belts need to interact with gears and other machine parts.

It turns out, that one of the ways of doing #3 above is using rubber belts. These rubber belts called V-belts. These belts need to interact with gears and other machine parts.

So they need to be robust. They also need to be agile enough to not cause wear and tear in the machined (metallic) parts. The belts themselves get worn down due to friction due to movement. This makes these belts a consumable.

Thousands of types of machines which do physical movement, and so thousands of types of V-belts. Power sector. Cement sector. Agricultural equipment like Tractors, tillers all uses V-belts.

Some of these equipment need new v-belts once in 7-8 months. Some once in 2-3 years. You might have heard companies often saying that if there is a stoppage in production, restarting it takes a lot of time. For this reason, these belts have to be high quality.

These belts are a classic example of items which are critical for functioning of the system but do not cost a lot. This means, typically Pix clients would not want to squeeze pix on margins. This is why we see the awesome gross margins.

The other thing is, clients prefer to replace the belts proactively instead of waiting for it to break down because unanticipated breakdowns cause higher loss in productivity than a scheduled maintenance shutdown.

If you now look at Pix revenues over the last 10 years, the lack of growth will jump out both as a positive & a negative.

Looking at overall trend, Pix revenues do not dip. Because existing machines always need belts. Regularly. Like a clock work. Implies recession proof business

Looking at overall trend, Pix revenues do not dip. Because existing machines always need belts. Regularly. Like a clock work. Implies recession proof business

Pix cant grow its revenues unless there is a new capex cycle. Only when there is a new capex cycle, will there be new machines created, & larger demand for v-belts. I think this makes Pix a shallow cyclical. Or a semi-cyclical. Not a secular growth biz, but not a cyclical either.

By now, you must have realized that Pix is primarily into making synthetic rubber based belts for various end industries. Their two main segments are Agricultural equipment & industrial belts (Power & cement are eg industries).

Another concept in this space is manufacturing for OEM (original equipment makers) & replacement market. OEM is a lot more B2B with consolidated buyers so also lower margins & a difficult biz compared to replacement market.

Replacement market is also one where pix can build a brand for itself. They are insistent on building their own brand. Estimates are that they sell > 80% of belts under their own brand.

TL;DR: Strong global tailwinds for market leader. Able to pass on input price inflation. Accelerating industrial automation trends.

Also see unchain.gates.com/us/en/home

its amazing to see how market leader’s initiatives expand market (they are shifting cos from chains to belts) & smaller players like pix can also benefit now that market has been expanded.

its amazing to see how market leader’s initiatives expand market (they are shifting cos from chains to belts) & smaller players like pix can also benefit now that market has been expanded.

Would it be a stretch to call Pix a Branded FMCG (Fast moving capital goods) supplier? I dont know, the investor must make up their own mind. These are only labels at end of the day. Company definitely has characteristics of fast (ok not that fast) moving goods, & a brand as well

2. Financials

Pix currently does revenue of around 450cr. Split equally between domestic & exports. Very high gross margins of > 60% with ability to pass on raw material price increases (see last 2 Q results).

Pix currently does revenue of around 450cr. Split equally between domestic & exports. Very high gross margins of > 60% with ability to pass on raw material price increases (see last 2 Q results).

Very high operating margins (>20%) due to efficient operations optimized over decades. See this comparison of financials with global leader Gates. I created this table in May so it is little dated.

As i said earlier, a large number of possible machines means a large number of belts so a large number of SKUs (> 2000) that company has to maintain. This means maintaining large inventory. This is why their cash conversion is not that great.

Now this might understandably already be a deal breaker for some investors and that is alright. To my investing style, a fledgling microcap competing with billion dollar American giant Gates in Their home turf & winning is something to stand up and take notice of.

Cashflows follow, but it does take time. See the case of Bharat rasayan and how much noise investors made over cashflows and how they came all in 1 go.

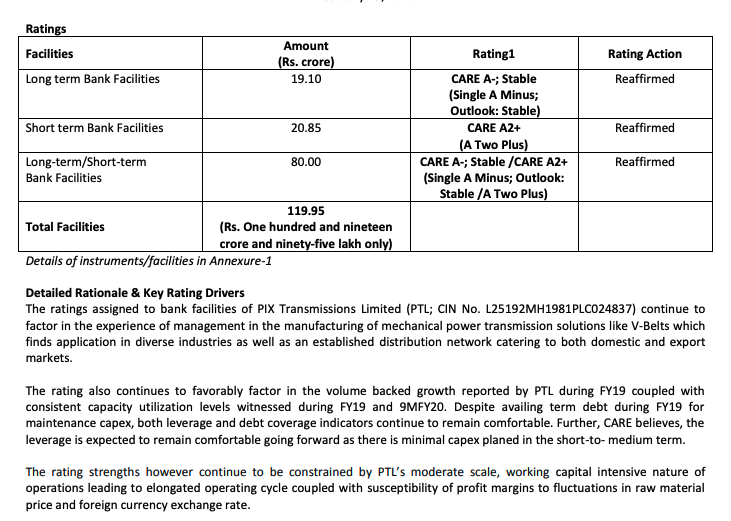

Company’s credit rating has also been improving because the credit rating agencies also recognize these same tailwinds (& risks) in the company’s business.

3. Key drivers of growth & profitability

Key driver for global revenue is pix's ability to sell a product which is as good as market leader Gates at lower prices, due to lower cost of manufacturing & operations.

Key driver for global revenue is pix's ability to sell a product which is as good as market leader Gates at lower prices, due to lower cost of manufacturing & operations.

Key drivers for domestic business are capex cycle revival, severe under-mechanisation of indian agriculture. Although India market is small and pix has estimated 30-40% of indian market share, it is growing fast. Global market is many billions of dollars.

Pix has embarked on a brownfield capex of 60cr which will increase capacities by at least 50-60% over next 2 years. Fairly high (36%) returns on incremental capital.

https://twitter.com/sahil_vi/status/1425704117024944129?s=20

Pix is estimated to have 30-40% of market share in domestic market. Domestic market will grow fast. Agriculture will get mechanised. Pix will benefit from it. Pix will gain market share in global market.

The brownfield capex will create a state of the art logistics hub which would be used to maintain inventory. This will free up space at their plants and enable larger brownfield capex runway.

Pix is also investing in automation & latest machineries. Higher scale + higher operating efficiencies should result in at least sustaining and possibly improving operating margins due to operating leverage + operating efficiency gains.

Company's focus on innovation & R&D is visible both in large market share & also their innovative ventures like virtual reality experience center: pixtrans.com/virtual/

Exports are possibly at higher margins. We dont know if management has plans to focus on exports but this is a clear area of opportunity for them. Could lead to higher margins.

4. Size of opportunity

Market leader gates did 2B$ of sales in v-belts segment. 64% of those were for replacement market. 48% of total sales came from north America (NA) market. This puts Gates' NA sales at 600M $. As per estimates, Gates has 40% market share in NA.

Market leader gates did 2B$ of sales in v-belts segment. 64% of those were for replacement market. 48% of total sales came from north America (NA) market. This puts Gates' NA sales at 600M $. As per estimates, Gates has 40% market share in NA.

This puts NA market at 1.5B$. Since we do not know Gates’ global market share, we cannot estimate the global market size.

However, if we just extrapolate the 40% market share which they have in NA to the world, we would estimate the global market size (for pix’s addressable market) to be 3B$

According to these calculations pix has a roughly 1.5% global market share. This shows us the size of opportunity for pix to grow their exports and capture global market share.

5. Durable competitive Advantages

Thousands of machine types implies thousands of molds & all machines required to maintain these 2500 SKUs means there is a steep learning curve. This also means a requirement to have large inventory.

Thousands of machine types implies thousands of molds & all machines required to maintain these 2500 SKUs means there is a steep learning curve. This also means a requirement to have large inventory.

A certain high quality is necessary to operate in this industry. These factors reflect in the concentrated nature of the industry with only 3-4 large players in Indian market (Pix, Fenner, Gates are 3 i know of).

Due to the consumable nature of products, there is always repeat demand. Recession proof biz. Due to branded sales and sizable fraction going to direct consumers (agri sector sales are to farmers), there is definitely a brand advantage.

Concentrated industry structure and concentrated profit pools with brand advantage.

6. Anti-thesis

Global capex revival not panning out. Lack of growth in agriculture incomes in India leading to lower spending on mechanisation. High requirement for inventory leading to stretched working capital cycle leading to low cash conversion.

Global capex revival not panning out. Lack of growth in agriculture incomes in India leading to lower spending on mechanisation. High requirement for inventory leading to stretched working capital cycle leading to low cash conversion.

Competitors like gates setting up plants in India and taking away market share.

Some investors might also be concerned over the high promoter remuneration. This is a 1st generation entrepreneur run biz with next 2 generations also involved in the biz. Promoter remuneration as % of PAT has been coming down over years.

We can see promoters took a pay cut even though overall employee remuneration was roughly the same. This is despite 30%+ revenue growth. promoter remuneration as % of PAT has come down drastically both due to pay cut and due to huge growth in PAT

7. Valuations

I personally find pix undervalued. a TTM p/e of 14 for a business of this quality is fairly undervalued. Market probably believes margins are not sustainable. I have a variant perception.

I personally find pix undervalued. a TTM p/e of 14 for a business of this quality is fairly undervalued. Market probably believes margins are not sustainable. I have a variant perception.

I generally dont give too much importance to who else is invested. But definitely have seen pattern that initially company is under-researched and under-owned. Ideally i want to invest where the institutions will be tomorrow.

That seems to be playing out here. HDFC securities recently started covering pix. hdfcsec.com/hsl.research.p…

Before someone tells me, i know this is retail research. But to me it signals that institutional investors might be taking notice too. To be this appears like it could result in rerating. Could have been reason for the 8% rise on friday.

8. Conclusion

A recession proof biz, partly branded, in a concentrated industry doing capex led growth enjoying tailwinds of capex revival + agro mechanisation. Large opportunity size. Undervalued. Already growing reasonably fast. Highly profitable.

A recession proof biz, partly branded, in a concentrated industry doing capex led growth enjoying tailwinds of capex revival + agro mechanisation. Large opportunity size. Undervalued. Already growing reasonably fast. Highly profitable.

Also want to emphasise the power of a community. I could not possibly have learned all this about pix alone. Some amazing community contributions on VP is the reason i know all this about pix. Special thanks to senior investors Ayush & rajeev sir who share selflessly on VP

Please do consider joining VP & helping grow the community through your contributions.

If you found the thread useful, please consider retweeting the very 1st tweet in the thread so that maximum investors can benefit.

• • •

Missing some Tweet in this thread? You can try to

force a refresh