This thread is to create awareness on how to use

valuepickr.com

Please note that i am not officially associated with website. Only an active contributor & hope to benefit from network effects of interested investors actively contributing on platform.

valuepickr.com

Please note that i am not officially associated with website. Only an active contributor & hope to benefit from network effects of interested investors actively contributing on platform.

https://twitter.com/urvish_shah2012/status/1431962838851981312

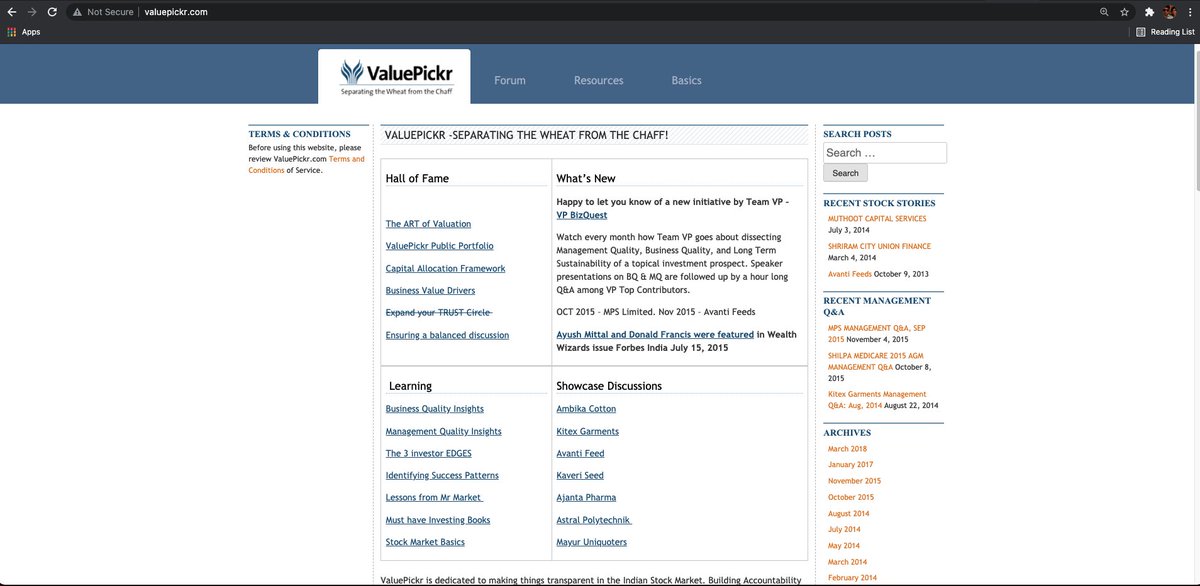

Valuepickr.com is above all else a community of like minded investors who wants to actively engage in understandin at a fundamental level & separate wheat from the chaff.

Develop an understanding of the biz, industry, competitive intensity, management, valuation

Develop an understanding of the biz, industry, competitive intensity, management, valuation

Website was created > 10 years ago. Early users are seasoned investors & i personally look to learn greatly by following their footprints across the website.

There are broadly speaking 4-5 types of "threads" or discussion places across the website.

1. Featured discussions (hall of fame, showcase discussions, learning).

These enable investor to level up the most. These discussions are a showcase for the website itself.

These are also a great starting point. Since VP is not a course, feel free to traverse them in any order

These enable investor to level up the most. These discussions are a showcase for the website itself.

These are also a great starting point. Since VP is not a course, feel free to traverse them in any order

Better to start with Showcase discussions first (read Avanti feeds thread

forum.valuepickr.com/t/avanti-feeds…

It has 2083 posts of this writing written since Sep 2012. Read all of them. Read the links, pdfs, videos embedded in this thread.

forum.valuepickr.com/t/avanti-feeds…

It has 2083 posts of this writing written since Sep 2012. Read all of them. Read the links, pdfs, videos embedded in this thread.

Understand how company evolved, how investors perception evolved, how investors were able to build conviction or hold on during tough times. How prices drive perception. Understand how people's valuation models changed as a function of time.

Then move on to hall of fame & learning. These are more advanced threads. If you dont understand them, dont worry. You just need to read more company threads (similar to avanti feeds, more on this later)

but aim to read "hall of fame" & "learning" too in some medium term horizon

but aim to read "hall of fame" & "learning" too in some medium term horizon

2. Company threads. If you click on the forum tab:

you are taken to the full set of threads on everything on the valuepickr forum.

you are taken to the full set of threads on everything on the valuepickr forum.

These different categories have their own rules and expectations.

Go to the "about" page and understand the rules and description of what this category is about.

Go to the "about" page and understand the rules and description of what this category is about.

Example:

forum.valuepickr.com/t/about-the-st…

forum.valuepickr.com/t/about-the-st…

VP has evolved over time. Earlier it used to be easy to create new thread for a company for which a thread does not already exist. Threshold is higher now, leading to higher quality discussions.

See this thread i started for indigo paints:

forum.valuepickr.com/t/indigo-paint…

See this thread i started for indigo paints:

forum.valuepickr.com/t/indigo-paint…

Remember please be respectful, fact driven, objective all the time.

Posts like "what is happening to the price" are borderline spam. Add posts which add value. Remain mindful & respectful. Focus on doing analysis & adding value.

Posts like "what is happening to the price" are borderline spam. Add posts which add value. Remain mindful & respectful. Focus on doing analysis & adding value.

3. Portfolio threads & general Q&A:

This category of threads is the ones with least restrictions.

forum.valuepickr.com/c/q-a-question…

Feel free to explore portfolio threads here or ask Qs on common beginner investor doubts thread.

This category of threads is the ones with least restrictions.

forum.valuepickr.com/c/q-a-question…

Feel free to explore portfolio threads here or ask Qs on common beginner investor doubts thread.

4. There is a special corner of website for highest data driven fact focussed collaborative investing posts where threshold to post is very high. this is to keep discussions as clean & useful as possible.

This is also more moderated than others. This is called collaborators corner

forum.valuepickr.com/c/collaborator…

Eg: see this collaborators corner thread on laurus labs:

forum.valuepickr.com/t/laurus-labs-…

forum.valuepickr.com/c/collaborator…

Eg: see this collaborators corner thread on laurus labs:

forum.valuepickr.com/t/laurus-labs-…

Another thing. You need to be logged in to post. Since VP is a platform, platforms can be misused. So it is pertinent for moderators to ensure platform is not misused. Even as interested users we do not want abuse of platform.

Thus, moderators insist on some level of identity check when signing up. I think this is reasonable. 99% users have no use case for hiding identity.

Provide as much info as you can when signing up.

Provide as much info as you can when signing up.

5. for each user, there is a use profile page.

Eg: see my page:

forum.valuepickr.com/u/sahil_vi/sum…

This is publicly visible to everyone.

one of biggest source of learning for me has been collaborative filtering:

Looking to learn from writings of those ahead of me in investing curve.

Eg: see my page:

forum.valuepickr.com/u/sahil_vi/sum…

This is publicly visible to everyone.

one of biggest source of learning for me has been collaborative filtering:

Looking to learn from writings of those ahead of me in investing curve.

End of thread.

PS: this is not an official take on VP. only writing as a user. (I am also a collaborator on VP, but dont benefit from it in any way).

My only intention is to motivate enough people to contribute good data driven analysis on platform.

PS: this is not an official take on VP. only writing as a user. (I am also a collaborator on VP, but dont benefit from it in any way).

My only intention is to motivate enough people to contribute good data driven analysis on platform.

Please retweet for maximum reach. 🙏🙏🙏

This is an informal unofficial guide to using the amazing resource that VP is.

This is an informal unofficial guide to using the amazing resource that VP is.

• • •

Missing some Tweet in this thread? You can try to

force a refresh