This is a fantastic question and thought exercise. Michael does not introduce a maturity or call/put features. This is essentially a perpetual bond. Price is coupon/discount rate. It’s not a business that retains earnings or grows. Price it like a perpetual bond. 1/

https://twitter.com/ignorenarrative/status/1432105900458840068

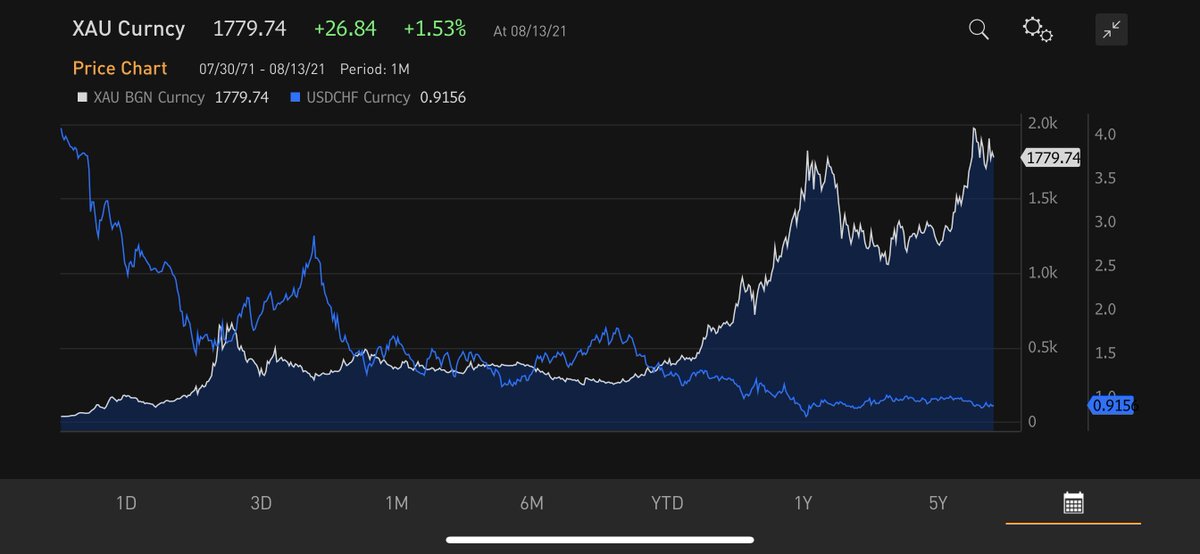

The average annual “coupon” is simply a probabilistically derived 54.5 cents. That’s the coupon. Win luck doesn’t matter. Now what’s the discount rate? The 30-year UST is less than 2%. If Janet sold a perpetual issue, some fool (read Jay Powell) would buy it at 3% or lower today.

Now introduce credit risk and inflation risk in setting a premium. If the borrower were a classy, reputable, credit-worthy guy like @IgnoreNarrative, you might demand a couple points. If it were a few of the yahoos here on Twitter, you should demand damn near 100%. Maybe more.

How much to add as an inflation risk premium? You decide. I’d also consider opportunity cost. You don’t have to buy a bond. You can buy Berkshire at an earnings yield of more than 7%. Again, that’s a business retaining/growing earnings, which is not the case with the perpetuity.

So what’s the price? If the issuer were the US Treasury and the buyer the Fed, the price would be $0.545/.03 = $18.17 (33.3x coupon). The @IgnoreNarrative high-quality price with 2% inflation premium would be $0.545/.07=$7.79. The high-credit risk anonymous Twitter price

would be $0.545/1.05=$0.52. So quite a range. The 3% UST yield is 1% real at a 2% inflation rate. Remember, at today’s 1.91% yield, the 30-yr trades at 52x earnings. Maybe the smart money thing to do would be to assign a $3,000 target price for 2025. At $700 the price is a steal.

• • •

Missing some Tweet in this thread? You can try to

force a refresh