A lot of people had questions on my last tweet about pre-seed valuations. How does valuation vary in the US? How does it vary across regions? How much are people raising? Let's answer them!

https://twitter.com/will_bricker/status/1422994341681901571

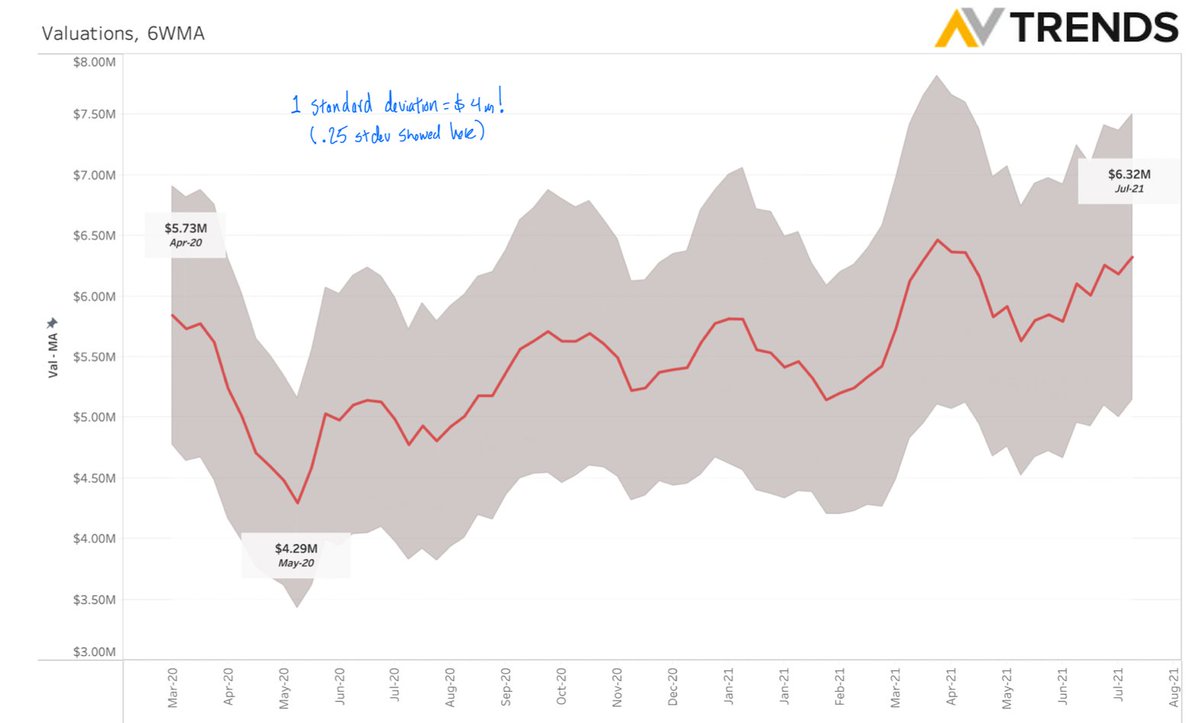

One key point I want to make is that while the market moves up or down, on the whole, there is still a lot of variation! Looking at the graph from last time, you can see that one standard deviation is $4M even within the US market.

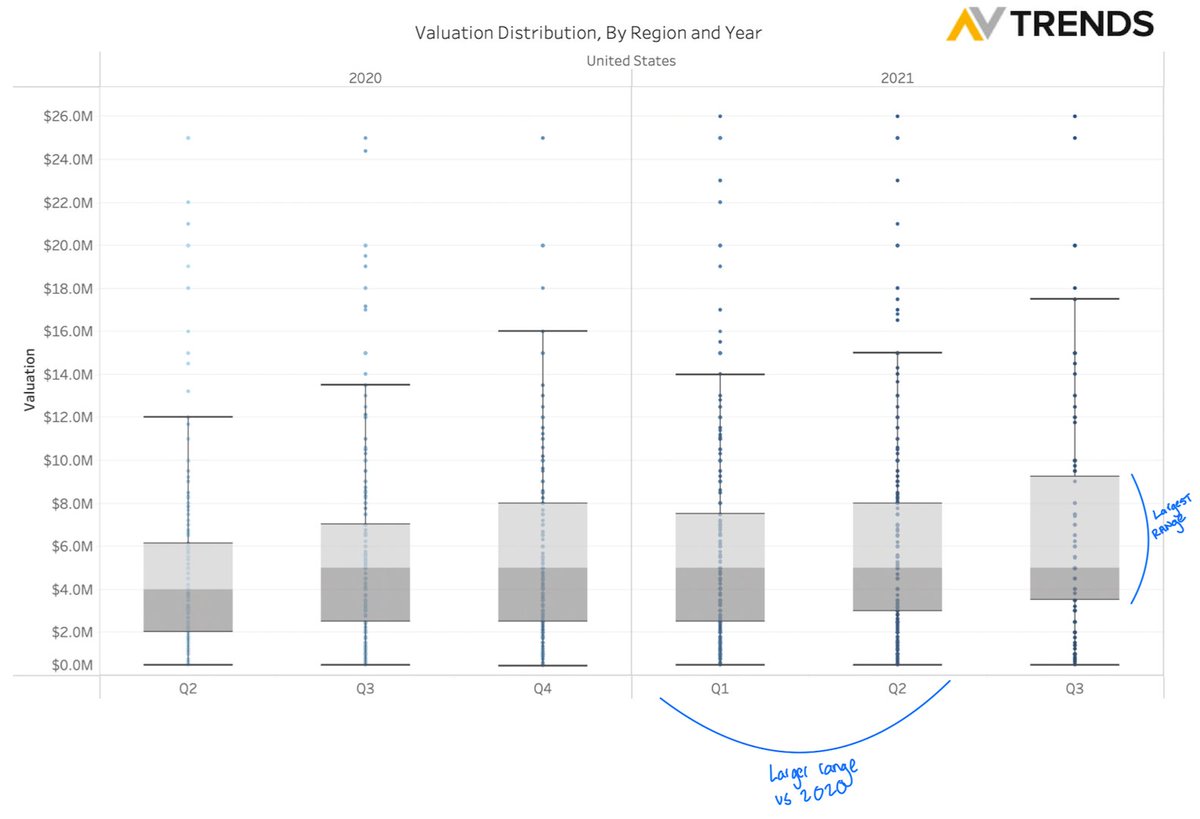

It’s also key to note that in addition to valuations going up, so is the variation! you can see that in the band around the previous graph and in the distribution in this one

On what drives the variation - I would argue that what’s driving this is multifaceted, but that a lot of it boils down to how they have optimized their probability of success (stay tuned for the upcoming tweets)

On how to think about the variation - I think it's key to understand that while where the market is at plays a role, there is no one valuation you should raise at! These numbers are all just benchmarks - there is no one perfect valuation for you and your startup!

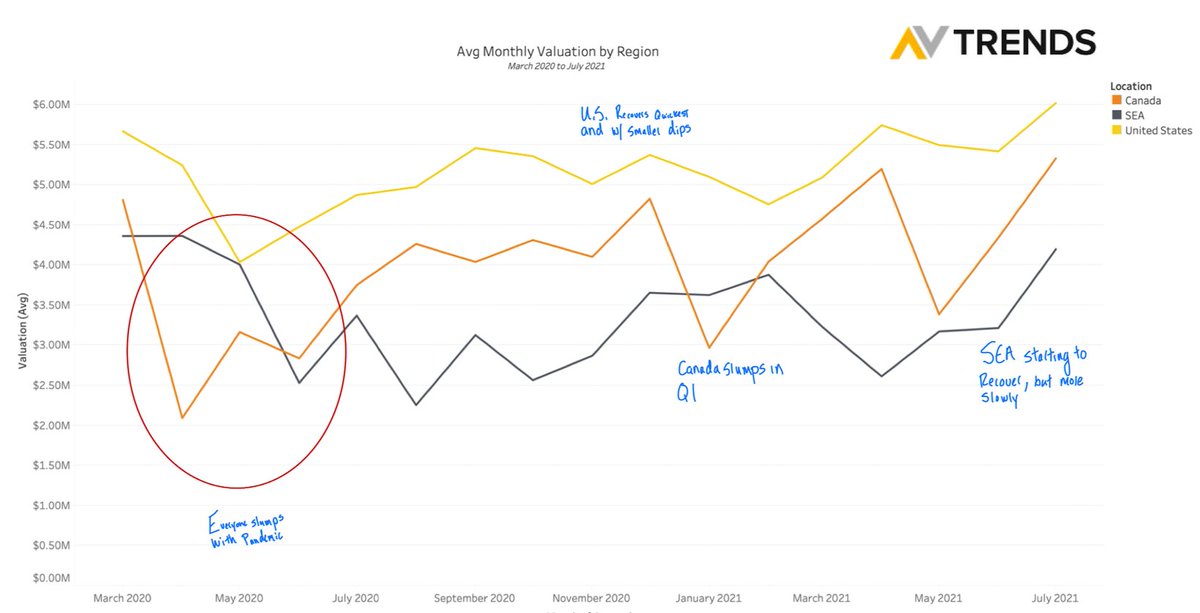

In terms of what valuations look like across geographies, you can see that the trend of increasing valuations persists, but the path has been different. While the US bounced back strong, Canada and SEA have taken a much slower path to recovery.

My thoughts - I think that this boils down to an increase in VC capital in the US, and a more accelerated vaccine rollout.

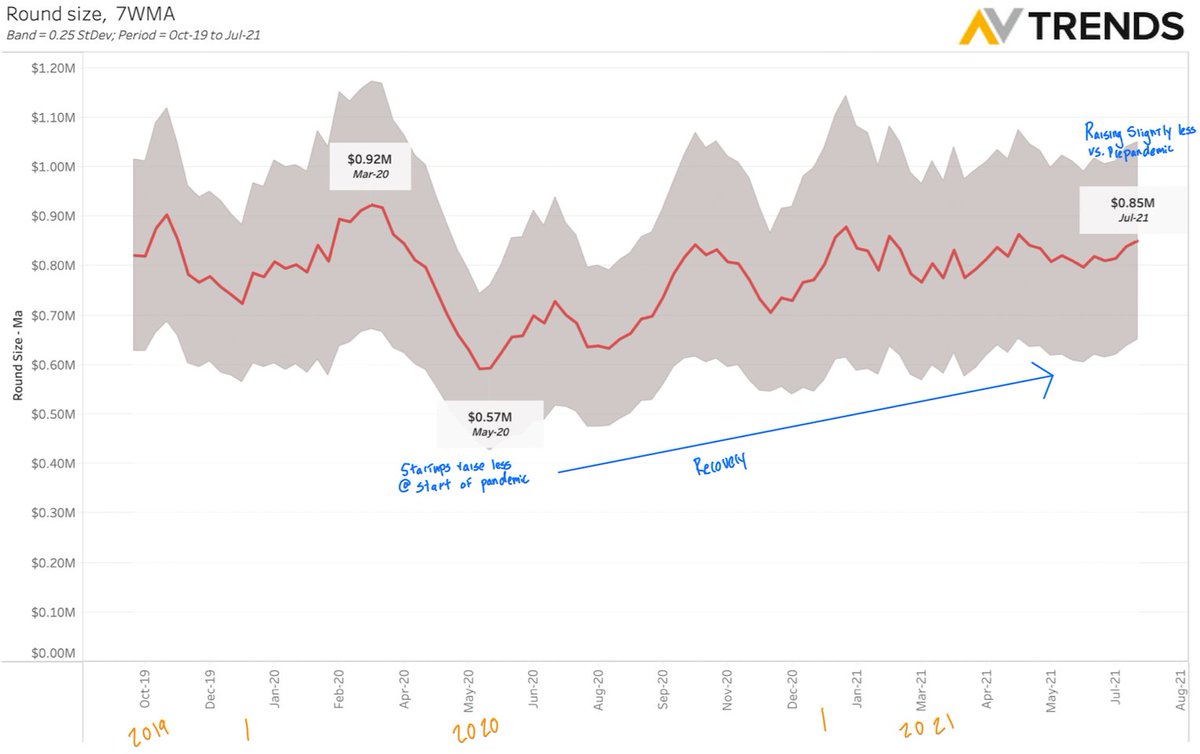

Another question I got is how much are companies raising. Here you see a similar pattern to valuations - an initial dip at the onset of the pandemic, with a similar recovery. However, it's important to note that overall, companies are raising slightly less than pre-pandemic

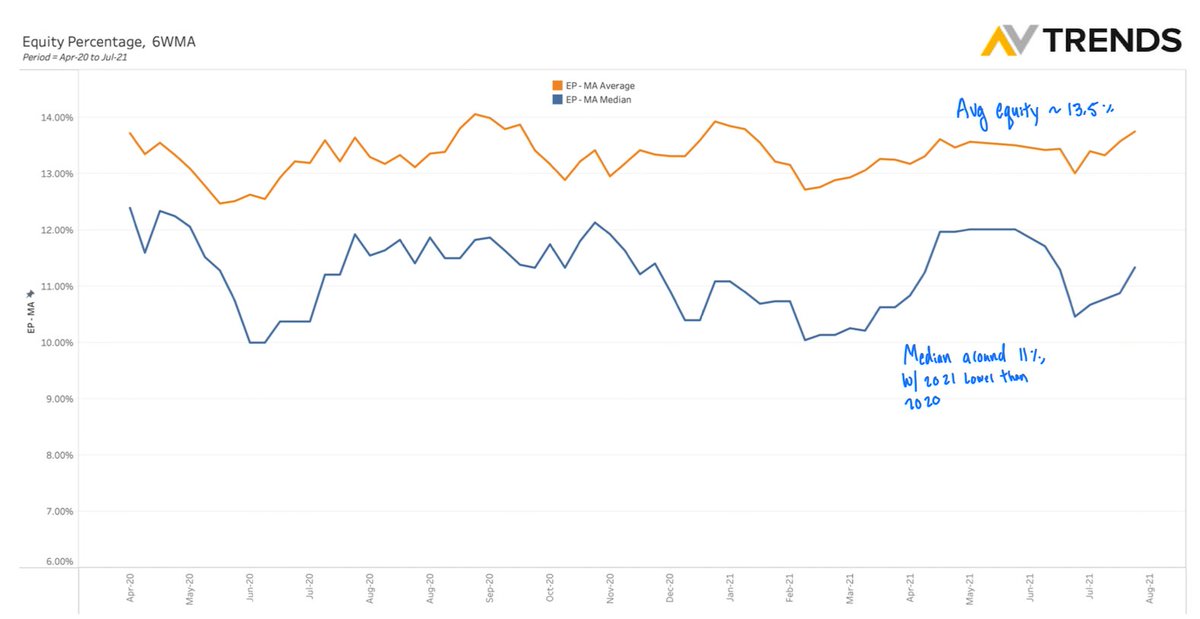

You can see this trend of raising slightly less at the same or higher valuations as before the pandemic in the equity percentage - with the median value being lower in 2021 than 2020.

That's all I got for Q&A for now. I will be back later this week with some more thoughts. All feedback, questions, and trolling are appreciated!

• • •

Missing some Tweet in this thread? You can try to

force a refresh