1/18

MATIC-A vault is now live in Maker! You can issue Dai through $MATIC as collateral thanks to the decision of the Maker community & governance.

We all know that $MATIC is the native token of @0xPolygon PoS Chain. But, let's talk more deeply about this project in a thread:

MATIC-A vault is now live in Maker! You can issue Dai through $MATIC as collateral thanks to the decision of the Maker community & governance.

We all know that $MATIC is the native token of @0xPolygon PoS Chain. But, let's talk more deeply about this project in a thread:

2/18

MATIC-A was onboarded on the Aug 25 executive proposal that passed with these parameters:

- Stability Fee: 3%

- Liquidation Ratio: 175%

- Debt Ceiling: 10M DAI

- Target Available Debt: 3M DAI

Info about how to onboard a collateral in Maker here:

MATIC-A was onboarded on the Aug 25 executive proposal that passed with these parameters:

- Stability Fee: 3%

- Liquidation Ratio: 175%

- Debt Ceiling: 10M DAI

- Target Available Debt: 3M DAI

Info about how to onboard a collateral in Maker here:

https://twitter.com/MakerGrowth/status/1430238350770905089?s=20

3/18

So, what is the @0xPolygon chain?

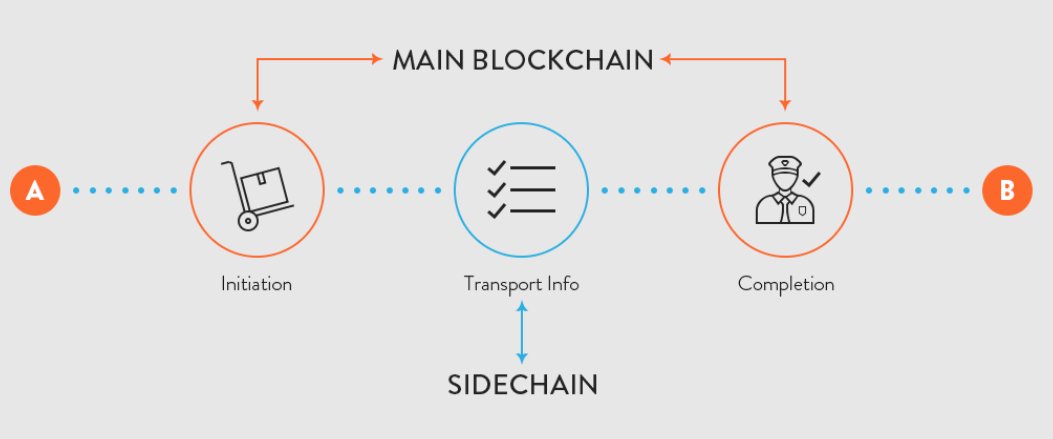

We could define the Polygon PoS Chain as a sidechain. But, in essence, it's not a common sidechain.

So, what is the @0xPolygon chain?

We could define the Polygon PoS Chain as a sidechain. But, in essence, it's not a common sidechain.

4/18

Sidechains usually have a consensus mechanism that limits the number of validators able to verify the chain such as Delegated-Proof-of-Stake (DPos) or Proof-of-Authority (PoA).

Sidechains usually have a consensus mechanism that limits the number of validators able to verify the chain such as Delegated-Proof-of-Stake (DPos) or Proof-of-Authority (PoA).

5/18

In a DPoS scheme, the token holders delegate the ability to verify the chain to a capped number of validators.

In a PoA scheme, the chain initiator chooses authorities to verify the chain.

Polygon is quite different.

In a DPoS scheme, the token holders delegate the ability to verify the chain to a capped number of validators.

In a PoA scheme, the chain initiator chooses authorities to verify the chain.

Polygon is quite different.

6/18

The Polygon PoS Chain system allows any participant to become a validator and check by itself all the transactions. Anyone who wants to become a validator just needs to stake their MATIC tokens and run a full node. That's it.

The Polygon PoS Chain system allows any participant to become a validator and check by itself all the transactions. Anyone who wants to become a validator just needs to stake their MATIC tokens and run a full node. That's it.

7/18

Another big difference from other PoS chains: MATIC tokens are staked on the Ethereum main chain. If a validator acts in a malicious way, for example, by double signing, their stake is slashed.

If you're bad, bye bye to your $MATIC!

Another big difference from other PoS chains: MATIC tokens are staked on the Ethereum main chain. If a validator acts in a malicious way, for example, by double signing, their stake is slashed.

If you're bad, bye bye to your $MATIC!

8/18

Polygon is a blockchain that boosts scalability to another level without largely losing the security of the Ethereum main chain.

If many validators start acting maliciously, the community can come together and redeploy the contracts on Eth to fork out.

Polygon is a blockchain that boosts scalability to another level without largely losing the security of the Ethereum main chain.

If many validators start acting maliciously, the community can come together and redeploy the contracts on Eth to fork out.

9/18

Heimdall is a Polygon PoS Verifier layer, who can do the job described above.

The main chain Stake Manager contract works in conjunction with Heimdall to act as the trust-less stake management mechanism for the PoS engine, including selecting and updating the validators.

Heimdall is a Polygon PoS Verifier layer, who can do the job described above.

The main chain Stake Manager contract works in conjunction with Heimdall to act as the trust-less stake management mechanism for the PoS engine, including selecting and updating the validators.

10/18

On the other hand, Bor is the block producer layer that aggregates transactions into blocks.

In sync with Heimdall, Bor selects the block producers and verifiers for each span (set number of blocks).

On the other hand, Bor is the block producer layer that aggregates transactions into blocks.

In sync with Heimdall, Bor selects the block producers and verifiers for each span (set number of blocks).

11/18

On top of that, another of Heimdall's responsibilities is checkpointing.

Checkpoints represent snapshots of the Bor chain state and are supposed to be attested by ⅔+ of the validator set before it is validated and submitted on the contracts deployed on Ethereum.

On top of that, another of Heimdall's responsibilities is checkpointing.

Checkpoints represent snapshots of the Bor chain state and are supposed to be attested by ⅔+ of the validator set before it is validated and submitted on the contracts deployed on Ethereum.

12/18

A little bit complicated? Don't worry, there is easy-to-read recap:

Polygon PoS Chain is a specific type of sidechain with huge scalability that offers a lot of extra security measures based on the Ethereum main chain.

A little bit complicated? Don't worry, there is easy-to-read recap:

Polygon PoS Chain is a specific type of sidechain with huge scalability that offers a lot of extra security measures based on the Ethereum main chain.

13/18

Did you know that @0xPolygon PoS Chain is the 3rd place of protocols in which Dai loves to stay?

At the moment, 5.82% of all Dai are running on the Polygon PoS Chain's highways.

This is 358M Dai, with a max set on 659M Dai. Look at that curve!

Did you know that @0xPolygon PoS Chain is the 3rd place of protocols in which Dai loves to stay?

At the moment, 5.82% of all Dai are running on the Polygon PoS Chain's highways.

This is 358M Dai, with a max set on 659M Dai. Look at that curve!

14/18

But that's not all! Actually, the Polygon PoS Chain is just a part of all Polygon projects.

Polygon is defined by itself as a protocol and a framework for building and connecting Ethereum-compatible blockchain networks.

But that's not all! Actually, the Polygon PoS Chain is just a part of all Polygon projects.

Polygon is defined by itself as a protocol and a framework for building and connecting Ethereum-compatible blockchain networks.

15/18

This framework includes a set of smallest projects that complement each other:

Polygon SDK: A modular framework for building Ethereum-compatible blockchain networks.

zkRollups: Ethereum layer 2 solution based on zero-knowledge proofs.

This framework includes a set of smallest projects that complement each other:

Polygon SDK: A modular framework for building Ethereum-compatible blockchain networks.

zkRollups: Ethereum layer 2 solution based on zero-knowledge proofs.

16/18

Polygon Avail: A general-purpose, scalable data availability-focused blockchain targeted for standalone chains, sidechains and off-chain scaling solutions.

Optimistic Rollups: Ethereum L2 solution based on fraud proofs.

Polygon Avail: A general-purpose, scalable data availability-focused blockchain targeted for standalone chains, sidechains and off-chain scaling solutions.

Optimistic Rollups: Ethereum L2 solution based on fraud proofs.

17/18

Application Specific Chains: Sovereign Ethereum sidechains secured by their own set of validators.

Enterprise Chains: Blockchains that use "security as a service".

Polygon PoS Chain: the sidechain that most of us know and that we talked about in this thread.

Application Specific Chains: Sovereign Ethereum sidechains secured by their own set of validators.

Enterprise Chains: Blockchains that use "security as a service".

Polygon PoS Chain: the sidechain that most of us know and that we talked about in this thread.

🙌 Thanks to @finematics, @hackernoon and @0xPolygon for the resources to make this thread.

🤓 Let's keep learning about DeFi!

🤓 Let's keep learning about DeFi!

• • •

Missing some Tweet in this thread? You can try to

force a refresh