1/15

Dai is almost ready to jump into ... Arbitrum 💥

Maker Protocol Engineering CU are working to connect Dai to @arbitrum rollups solution. They will conduct a final audit of the Custom DAI Gateway before the launching 💪

What is Arbitrum? How does it work? Thread time! 👇

Dai is almost ready to jump into ... Arbitrum 💥

Maker Protocol Engineering CU are working to connect Dai to @arbitrum rollups solution. They will conduct a final audit of the Custom DAI Gateway before the launching 💪

What is Arbitrum? How does it work? Thread time! 👇

2/15

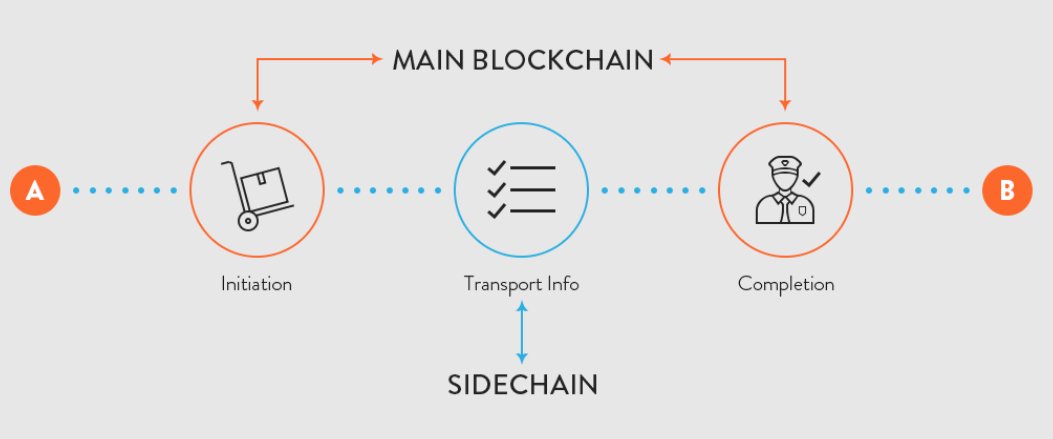

🗞️ What is a rollup?

A rollup is a scalability solution in which transactions are written on Ethereum, but the actual computation and storage of the contract are done off-chain

Transactions are executed on a chain that runs a version of the Ethereum Virtual Machine (EVM)

🗞️ What is a rollup?

A rollup is a scalability solution in which transactions are written on Ethereum, but the actual computation and storage of the contract are done off-chain

Transactions are executed on a chain that runs a version of the Ethereum Virtual Machine (EVM)

3/15

✍️ After executing transactions, the rollup batchs them together and posts them to the main Ethereum chain.

🗞️ We can think of the assertion as "rolling up" all of the calls and their results into a single on-chain transaction.

✍️ After executing transactions, the rollup batchs them together and posts them to the main Ethereum chain.

🗞️ We can think of the assertion as "rolling up" all of the calls and their results into a single on-chain transaction.

4/15

In short:

1⃣ A rollup receives transaction requests.

2⃣ Groups and rolls them in the same “paper”.

3⃣ Execute the paper (with all transactions) with their own computation outside of Ethereum.

4⃣ Publish the outcome on Ethereum, the main chain.

In short:

1⃣ A rollup receives transaction requests.

2⃣ Groups and rolls them in the same “paper”.

3⃣ Execute the paper (with all transactions) with their own computation outside of Ethereum.

4⃣ Publish the outcome on Ethereum, the main chain.

5/15

🖥️ Running a version of the EVM off-chain allows developers to deploy on the rollup the same smart contracts that they would deploy (or they already deployed) in the Ethereum main chain.

🖥️ Running a version of the EVM off-chain allows developers to deploy on the rollup the same smart contracts that they would deploy (or they already deployed) in the Ethereum main chain.

6/15

🌀 Arbitrum is a Optimistic Rollup (OR) scalability solution for the Ethereum blockchain.

👌 It's a type of rollup that when an outcome is posted, it does not contain an accompanying proof guaranteeing its validity.

🌀 Arbitrum is a Optimistic Rollup (OR) scalability solution for the Ethereum blockchain.

👌 It's a type of rollup that when an outcome is posted, it does not contain an accompanying proof guaranteeing its validity.

7/15

👍 That's why the 'optimistic' word. All outcomes transmitted to Eth are assumed as 'valid' in advance

🧐 But, there could be a fraud: ORs have a dispute system in which validators are encouraged to identify fraudulent txs, prove their fraud and rewrite the

👍 That's why the 'optimistic' word. All outcomes transmitted to Eth are assumed as 'valid' in advance

🧐 But, there could be a fraud: ORs have a dispute system in which validators are encouraged to identify fraudulent txs, prove their fraud and rewrite the

8/15

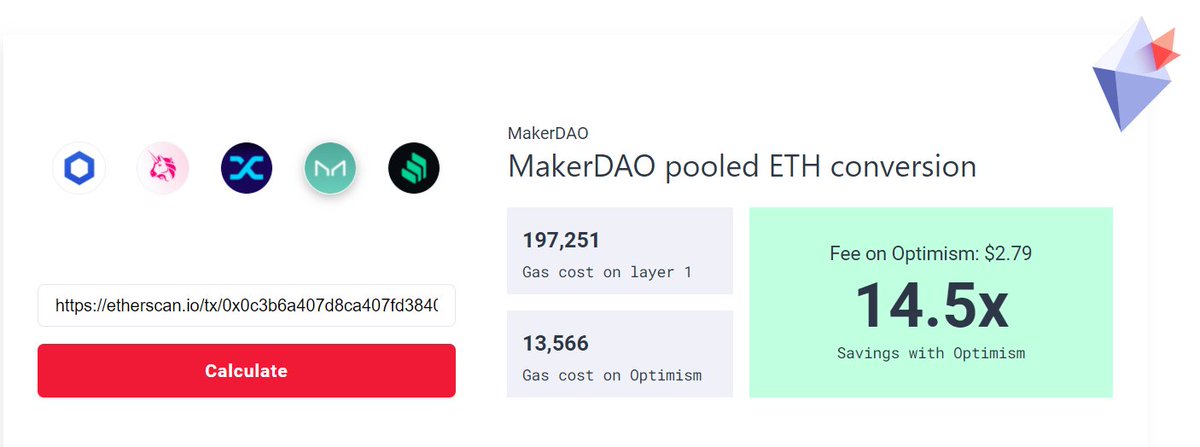

There's one of the main differences between Optimism and Arbitrum:

🛠️ In order to prove a fraudulent transaction, Optimism executes the whole suspicious tx on Ethereum layer 1 to verify it.

🕹️ Arbitrum is quite different

There's one of the main differences between Optimism and Arbitrum:

🛠️ In order to prove a fraudulent transaction, Optimism executes the whole suspicious tx on Ethereum layer 1 to verify it.

🕹️ Arbitrum is quite different

9/15

🔭 On the other hand, @arbitrum has an interactive model which allows narrowing down the scope of the dispute and potentially executes only a few crucial instructions on layer 1 to check if a suspicious tx is valid.

🆗 Not the whole transaction, just a crucial part

🔭 On the other hand, @arbitrum has an interactive model which allows narrowing down the scope of the dispute and potentially executes only a few crucial instructions on layer 1 to check if a suspicious tx is valid.

🆗 Not the whole transaction, just a crucial part

10/15

🧑🏭 Another difference is on the sequencers: Participants that are responsible for executing the transactions on L2.

Arbitrum will be initially running a sequencer that is responsible for ordering transactions, but they have an approach for decentralized sequencers later.

🧑🏭 Another difference is on the sequencers: Participants that are responsible for executing the transactions on L2.

Arbitrum will be initially running a sequencer that is responsible for ordering transactions, but they have an approach for decentralized sequencers later.

11/15

⏲️ Meanwhile, Optimism prefers another approach where the ordering of transactions, and hence the MEV, can be auctioned off to other parties for a certain period of time.

⏲️ Meanwhile, Optimism prefers another approach where the ordering of transactions, and hence the MEV, can be auctioned off to other parties for a certain period of time.

12/15

🎮 As we said, porting contracts from Ethereum to Arbitrum is fast and simple; there's no need to rewrite any code or download any new software.

🖥️ All smart contract languages that work with Ethereum, also work natively with Arbitrum.

🎮 As we said, porting contracts from Ethereum to Arbitrum is fast and simple; there's no need to rewrite any code or download any new software.

🖥️ All smart contract languages that work with Ethereum, also work natively with Arbitrum.

13/15

That's important to understand why rollups are a necessary previous step to a successful implementation of Ethereum 2.0.

Initially, the 64 shards of ETH2 will not handle smart contracts. But they’ll still offer improvements to txs per second when combined with rollups.

That's important to understand why rollups are a necessary previous step to a successful implementation of Ethereum 2.0.

Initially, the 64 shards of ETH2 will not handle smart contracts. But they’ll still offer improvements to txs per second when combined with rollups.

14/15

As Vitalik said: ETH2 + rollups are the formula we need to reach 25,000 - 100,000 tx per second.

That's a lot of Dai in moving around, with low fees, at the speed of light 😄

As Vitalik said: ETH2 + rollups are the formula we need to reach 25,000 - 100,000 tx per second.

That's a lot of Dai in moving around, with low fees, at the speed of light 😄

Dai loves scalability solutions ❤️ and the @MakerDAO team knows it.

Let's keep in touch for following updates! The multi-chain future is near from Dai, and from us too 😎

🤓 MakerDAO’s Timeline for Launching DAI on Arbitrum One here: forum.makerdao.com/t/makerdaos-ti…

Let's keep in touch for following updates! The multi-chain future is near from Dai, and from us too 😎

🤓 MakerDAO’s Timeline for Launching DAI on Arbitrum One here: forum.makerdao.com/t/makerdaos-ti…

• • •

Missing some Tweet in this thread? You can try to

force a refresh