My biggest losers of all time (on % basis or opportunity cost) and what I learned from them.

"Experience is what you get when you didn't get what you wanted."😂

"Experience is what you get when you didn't get what you wanted."😂

Most of these Co.'s, I got in either due to low valuation (which ended up being Value traps) or envy out of missing their previous gains (while not knowing enough about the quality/sustainability/future outlook).

Except for a couple of cases ( $SDRL $UA), I also didn't know enough about the Management teams. Even in those two cases, the founders mismanaged the strategy/business later.

You could be wondering how I could have waited until the losses got so big. Well some losses are sudden, some are slow burning.

It's a mix of

-Inexperience (at that time)

-Lack of interest in losing positions to analyze & determine course of action

It's a mix of

-Inexperience (at that time)

-Lack of interest in losing positions to analyze & determine course of action

-Hoping that the issues are temporary and the company can get back to it's previous position.

-Not effectively monitoring the fundamentals against the thesis

-Not effectively monitoring the fundamentals against the thesis

Even individual investors who are not liable to others for their Portfolio actions, we should be liable to their own Capital, Portfolio objectives, long-term expectations and any actions that deviate from those should be identified and corrected.

If you are picking individual stocks, your time (in research/maintenance) & capital allocated are precious.

Make sure the existing & prospective positions are meeting a high bar set for your portfolio...

Make sure the existing & prospective positions are meeting a high bar set for your portfolio...

..and also fitting in with your interest, competence and Portfolio strategy. This is a critical point that I missed in the early years.

-You could have been wrong in your initial thesis itself and got into a bad investment (we're human)

-You could have been wrong in your initial thesis itself and got into a bad investment (we're human)

-or things got worse sometime later with the Company/Competition/Industry/Management/Financials (welcome to Capitalism)

Either way, it's much better to do an objective analysis of the current facts & take the action now, rather than feeling the need to justify our past actions.

Either way, it's much better to do an objective analysis of the current facts & take the action now, rather than feeling the need to justify our past actions.

Big long-term losers in a Portfolio (after your thesis has already been invalidated) are not doing you any good. They are a major drag on the Portfolio returns, and also on the psyche.

The bad companies are gonna take all the capital and patience you got and give you back nothing in return.

It's much better to rip the band-aid, recover the remaining capital for better opportunities, learn to improve the process and move on.

It's much better to rip the band-aid, recover the remaining capital for better opportunities, learn to improve the process and move on.

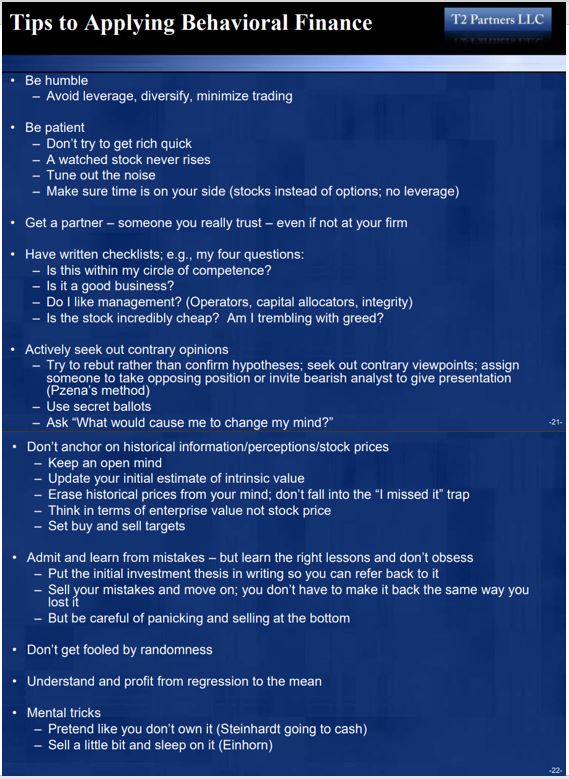

Mistakes are unavoidable in investing, but as you gain more experience, aim for process improvements which will reduce the # instances you get into bad positions, and also get you out of them faster with better monitoring process.

After enough of these hits and some serious reflection, had to do some serious tweaks which roughly translated to the below steps.

✔️Invest in Sectors or Companies within your circle of interest/competence (instead of trying to over-diversify for the sake of it).

✔️Invest in Sectors or Companies within your circle of interest/competence (instead of trying to over-diversify for the sake of it).

✔️Have the Quality hurdle high

✔️Understand the Company, Products, Financials, Management

✔️Good historical operating performance is good, but what matters is the growth and performance in future. Focus more on those factors.

✔️Understand the Company, Products, Financials, Management

✔️Good historical operating performance is good, but what matters is the growth and performance in future. Focus more on those factors.

✔️Understand the external factors and trends helping/hurting the Company.

✔️Have a clear thesis of why you're investing in this company and why now?

✔️Have quarterly checkpoints (or after major news) against thesis and determine hold, sell or buy more?

✔️Have a clear thesis of why you're investing in this company and why now?

✔️Have quarterly checkpoints (or after major news) against thesis and determine hold, sell or buy more?

✔️Do an intermittent check to see if you're still interested in the Company/Sector and if the Opportunity still exists?

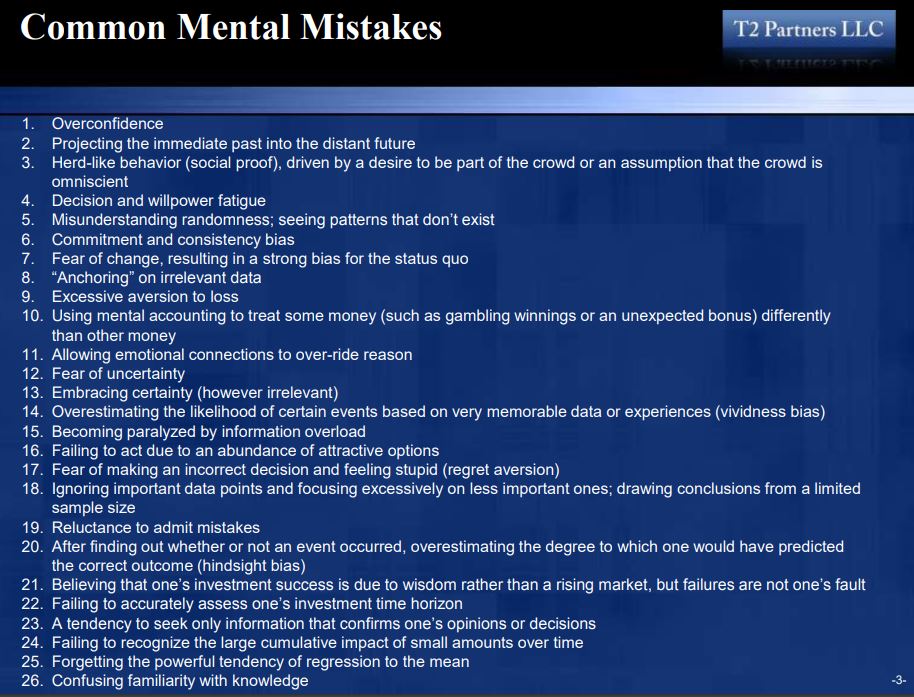

✔️Do a behavioral check against the positions to see which ones you're holding for non-fundamental reasons (anchoring, hoping to get back to even ...)

✔️Do a behavioral check against the positions to see which ones you're holding for non-fundamental reasons (anchoring, hoping to get back to even ...)

✔️Work towards fewer, but higher conviction and lower maintenance positions (either due to high quality or strong tailwinds).

Individual Investing is a very personal journey. What suits me could be totally unsuitable for you.

What matters is that we read & learn widely but always have our own process, strategy and hold ourselves accountable for the actions and results.

/Good Luck 👍

What matters is that we read & learn widely but always have our own process, strategy and hold ourselves accountable for the actions and results.

/Good Luck 👍

• • •

Missing some Tweet in this thread? You can try to

force a refresh