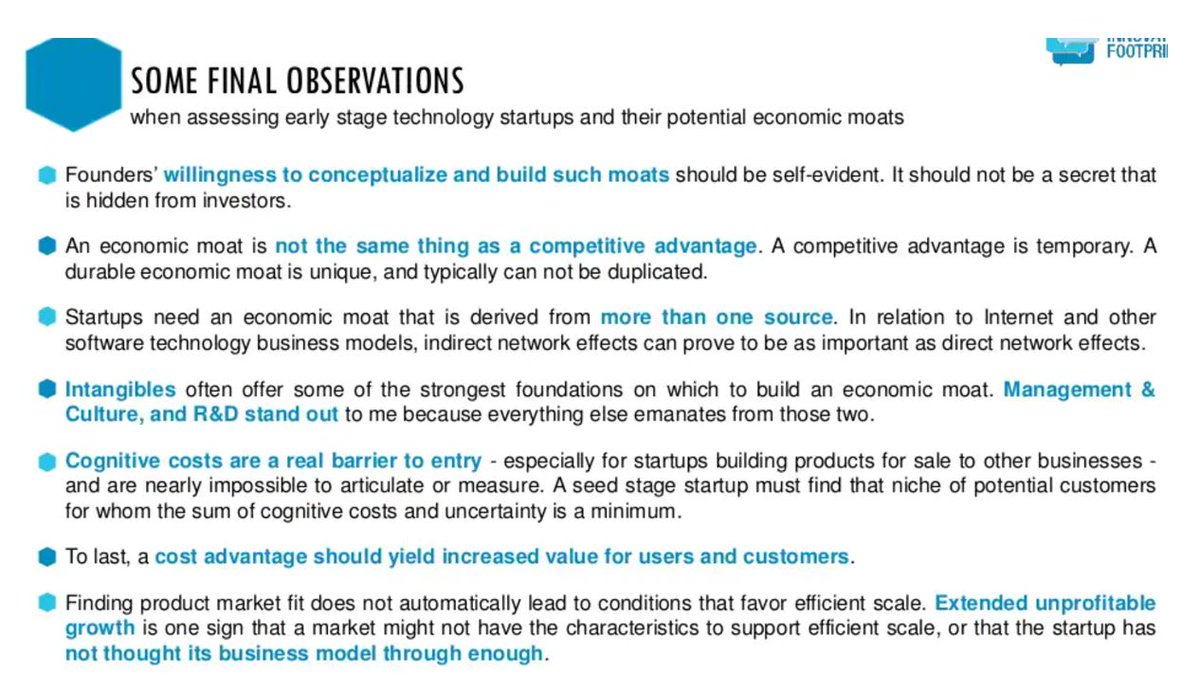

Excellent presentation on Economic Moats🏰.

Goes into much more detail than the cursory & generic explanations. h/t @brianlaungaoaeh 👏

Targeted towards Tech startups, but very useful info for Public Mkt investors too.

cc: @dmuthuk @Gautam__Baid

slideshare.net/BrianLaungAoae…

Goes into much more detail than the cursory & generic explanations. h/t @brianlaungaoaeh 👏

Targeted towards Tech startups, but very useful info for Public Mkt investors too.

cc: @dmuthuk @Gautam__Baid

slideshare.net/BrianLaungAoae…

Contents

✔️Network Effects🕸️

✔️Switching Costs⚖️

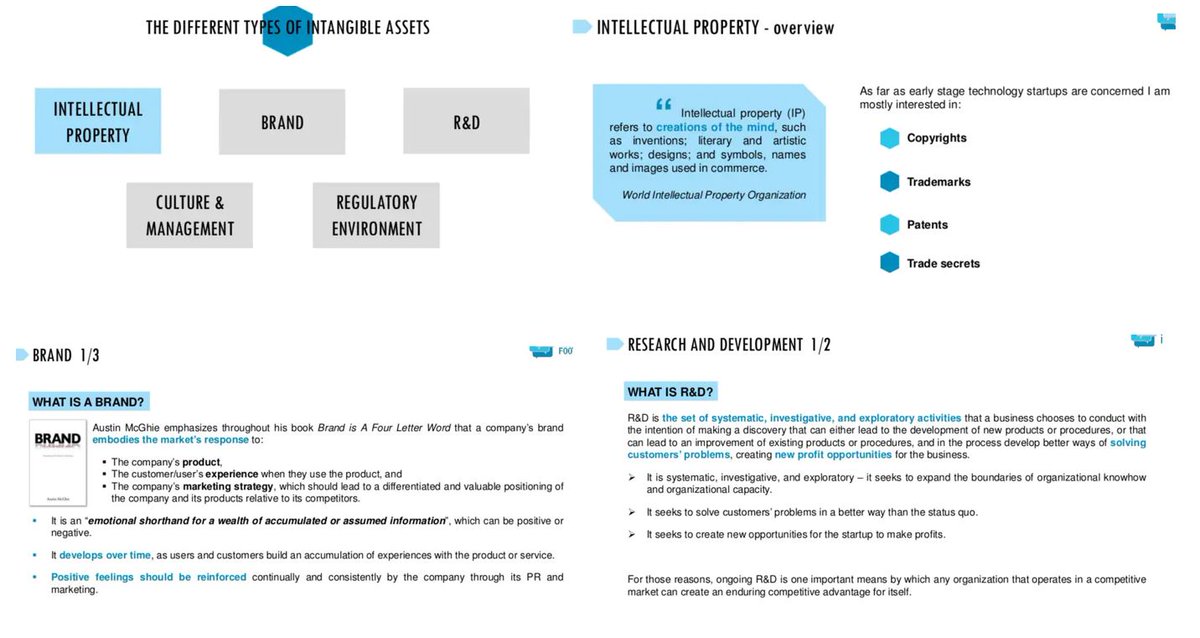

✔️Intangibles ™️

✔️Cost Advantages💰

✔️Efficient Scale💪

✔️Summary📜

✔️Network Effects🕸️

✔️Switching Costs⚖️

✔️Intangibles ™️

✔️Cost Advantages💰

✔️Efficient Scale💪

✔️Summary📜

✔️Switching Costs

Compatibility requirements

Transaction Costs

Cognitive Costs

Uncertainty

Learning Costs

Lost-Benefit Costs

Compatibility requirements

Transaction Costs

Cognitive Costs

Uncertainty

Learning Costs

Lost-Benefit Costs

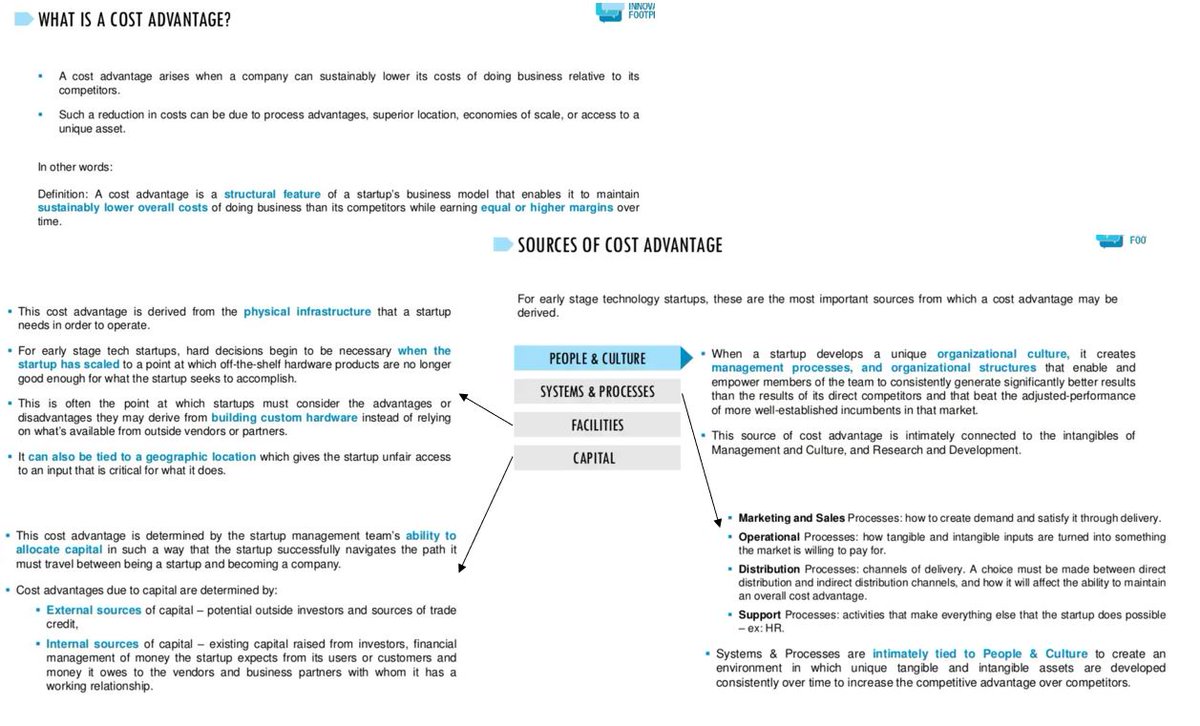

✔️Cost Advantage

People & Culture

Systems & Processes

Facilities

Capital (Ability to Source & Allocate)

People & Culture

Systems & Processes

Facilities

Capital (Ability to Source & Allocate)

• • •

Missing some Tweet in this thread? You can try to

force a refresh