🚨Fidelity Predicts #Bitcoin Price In 5, 10, 15 years!

But more important than "where" the price goes is "how" it gets there, what are the key drivers and indicators, what is the important data to watch as this thesis plays out

A Thread 👇

But more important than "where" the price goes is "how" it gets there, what are the key drivers and indicators, what is the important data to watch as this thesis plays out

A Thread 👇

1/ First about @Fidelity, one of the largest investment firms w/ over 26m customers, $6.5T in customer assets, and $2.4T global AUM. They have been mining Bitcoin since 2017, started Digital Assets in 2018, Investing in BTC companies in 2020, and providing BTC loans in 2021

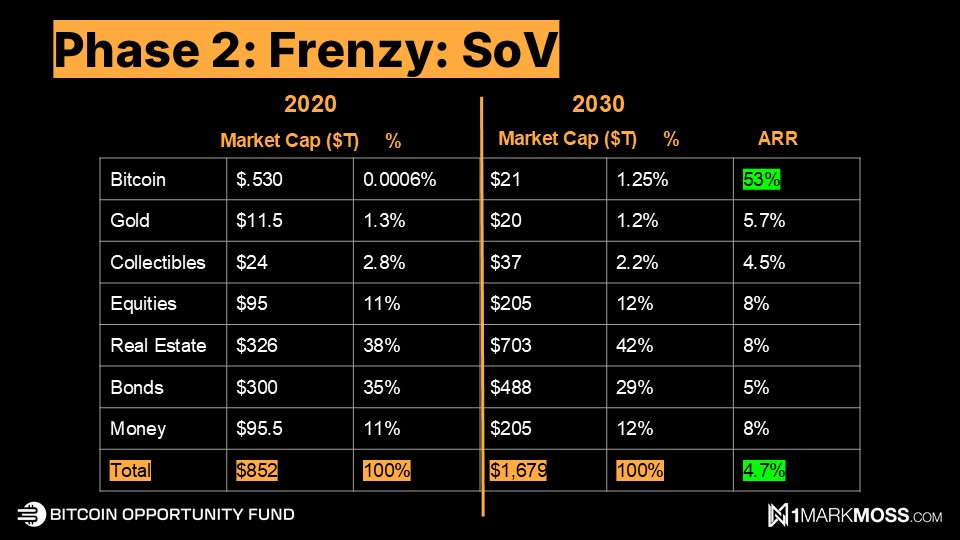

2/ Before looking at price, lets understand it better. Always about SUPPLY v DEMAND

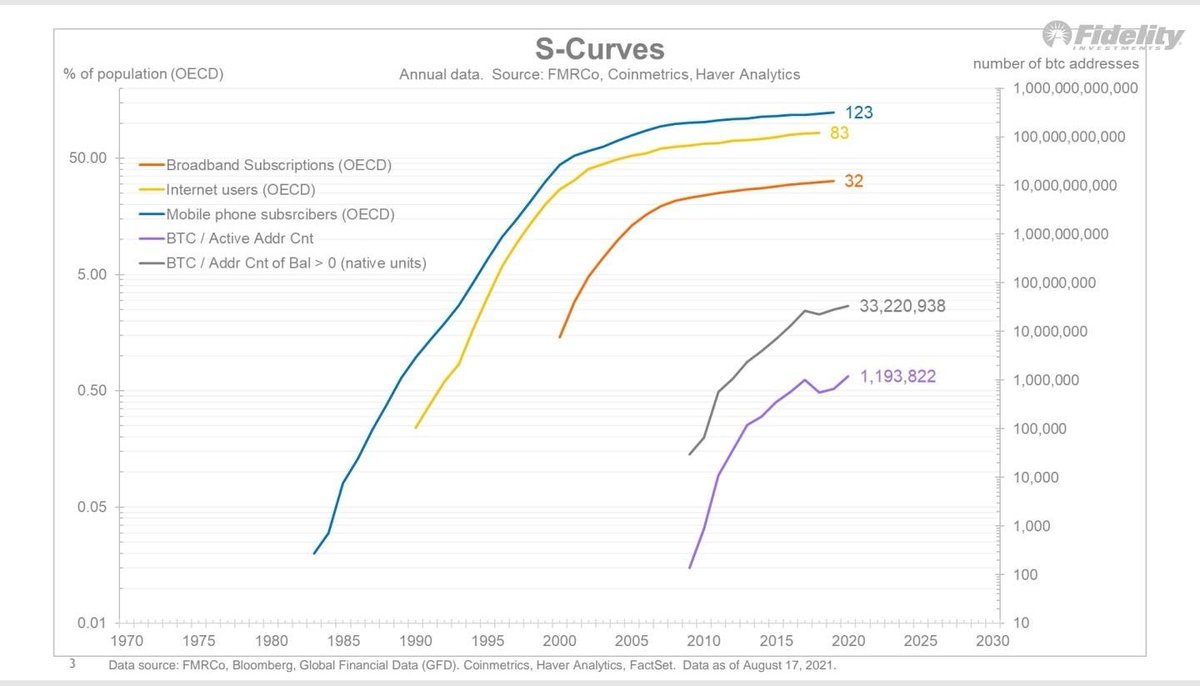

An S Curve helps us understand the adoption cycle or time frame. The rule is the time it takes to get to 10% adoption is the time it takes to go from 10%-90% adoption. Should see 90% by 2029

An S Curve helps us understand the adoption cycle or time frame. The rule is the time it takes to get to 10% adoption is the time it takes to go from 10%-90% adoption. Should see 90% by 2029

3/ The demand for #Bitcoin as shown by growth of wallets with balance of >$1 is tracking with cell phone users, showing a rapidly scaling but steady growth trajectory

4/ Using the mobile phone S Curve growth model (demand), and layering on the halving cycle (supply) it gives us another way to look at the ratio of these and potential price predictions, but there is more to whats driving these...

5/ To understand the demand side, we look at the Money & Fed #s. The monetary base is blowing up but tracking the GDP numbers. But the lower set of lines show the monetary base and balance sheet as a % of GDP and you can see the last 2 years have exploded, this is driving demand

6/ And it's not just the US monetary system pushing demand for alternative assets. Global debt of all countries is exploding to new levels creating global demand for assets outside the dollar that will keep up with or beat inflation

7/ We can see from the top lines that Gold has been a good inflation hedge, keeping up with the monetary expansion and inflation. The bottom lines show Gold as % of M2 supply sitting around averages but now starting to turn up quick, the end purple part includes BTC as a % of M2

8/ Understanding that Gold has been the preferred inflation hedge since 71 when we left the gold standard, we can layer the #BTC chart and $GOLD to see how BTC has been moving similar to Golds path, this is another indicator of where supply v demand and then price could go...

9/ Most people need to adjust thinking to stop thinking is USD valuations and think in terms of "purchasing power (pp)" The bottom lines dropping off are the fiat PP dropping. Gold is barely above that, and the top lines are Stocks and Bonds that have gained the most PP

10/ To understand new tech and the Demand even better, we look at the network growth. We can see a steady growth of demand represented by # of BTC addresses with >$1 in them. More users, more security, more decentralization, and more demand

11/ The Demand v Supply has been steady, but the price has been volatile. Because the speculators or tourists that come in at the top and sell as price drops. You can see the pink "holding time" of coins shrinking as BTC price rises, and tourists selling off as price drops.

12/ The tourists and short-term price action that many focus on, doesn't affect the network or fundamentals, but only the short-term price. We can see the HODLers have been increasing regardless of the short-term price action

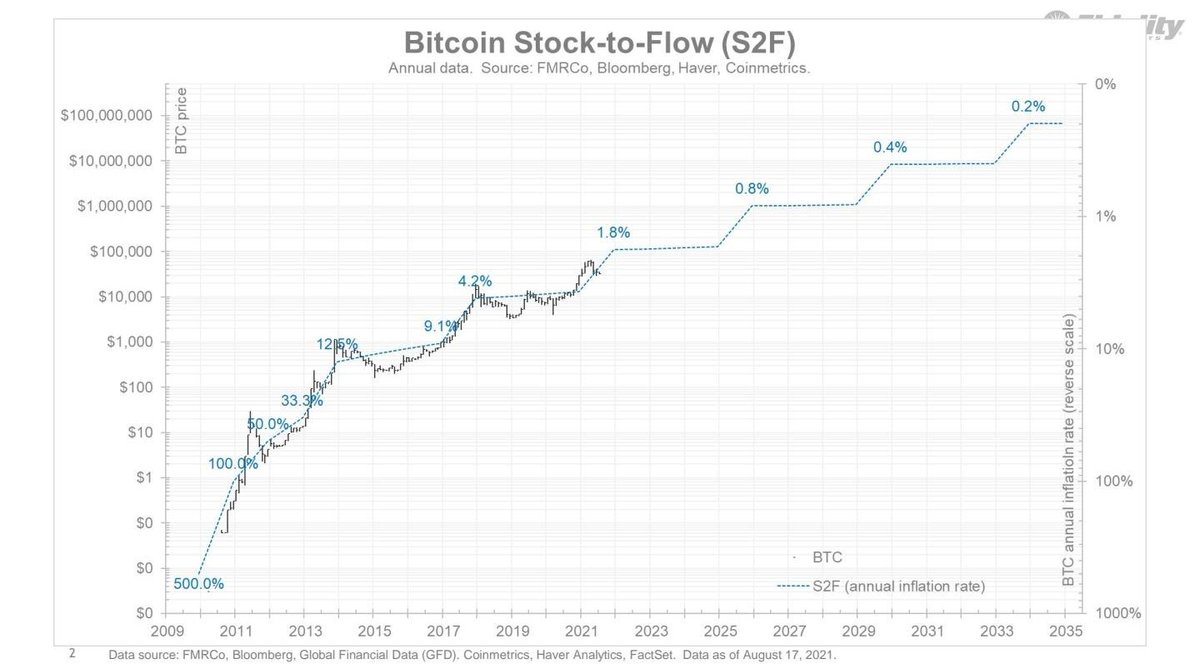

13/ Finally, the #Bitcoin S2F model, which is just one more indicator to look at. This takes the known future supply schedule and overlays the history of price. But misses demand. But now that you understand the demand and adoption side, it gives more confidence to this chart.

14/ Using this data, per Fidelity, we could see #Bitcoin USD price to $1m 2026, $8m by 2030, and about $80m by 2035

NOTE: This would mean USD is as worthless as the Zimbabwe note

If you liked this thread, please Like and Retweet 🙏

watch full video: 👇

NOTE: This would mean USD is as worthless as the Zimbabwe note

If you liked this thread, please Like and Retweet 🙏

watch full video: 👇

I would like to note that this presentation came from @TimmerFidelity who is the Dir. of Global Macro

@Fidelity and it was his own personal take and analysis on the topic and not Fidelity's overall stance

@Fidelity and it was his own personal take and analysis on the topic and not Fidelity's overall stance

• • •

Missing some Tweet in this thread? You can try to

force a refresh