$EWD Sweden 🇸🇪. Tight. Note the volume bars colors hard wick on increased volume off 30w (dip buyers).

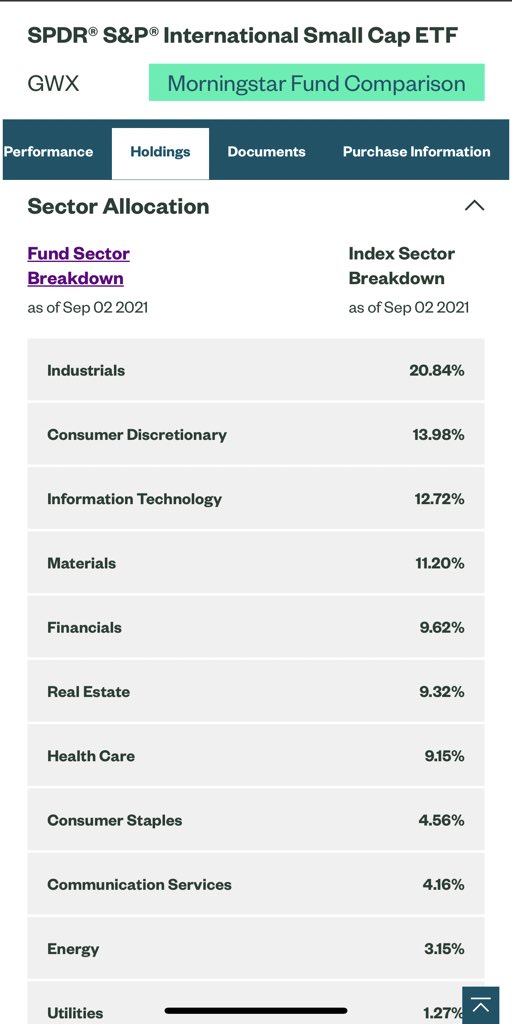

$EWD Sweden country ETF. Check out the industry exposure. 😉. #rotation 🇸🇪👷♂️

$EWD largest holding in the country ETF is Atlas Copco Group. One of their segments is compressor technology. They are the worlds leading company for this.

Atlas Compressor Technology area creates products such as industrial compressors and vacuum solutions, oil and gas treatment equipment, air management systems, and gas and process compressor/expanders.

😍These products are mainly used in the manufacturing, oil, gas and process industries😍😍🙌

Atlas’ Vacuum tech business provides vacuum products, exhaust management systems, valves and related products. The main markets served are semiconductor and scientific as well as a ange of industrial segments incl chemical process industries, food packaging and paper handling.

Atlas products in Industrial tech are mainly developed for automotive and aerospace industries, but are also used in industrial manufacturing and maintenance + vehicle service: assembly systems, industrial power tools, quality assurance products and various types of software.

• • •

Missing some Tweet in this thread? You can try to

force a refresh