$SIE if you want to own this German conglomerate (largest industrial company in Europe) you need to buy it on the Frankfurt exchange. No ADRs/pinks, for American investors. 🇩🇪👷♂️💪

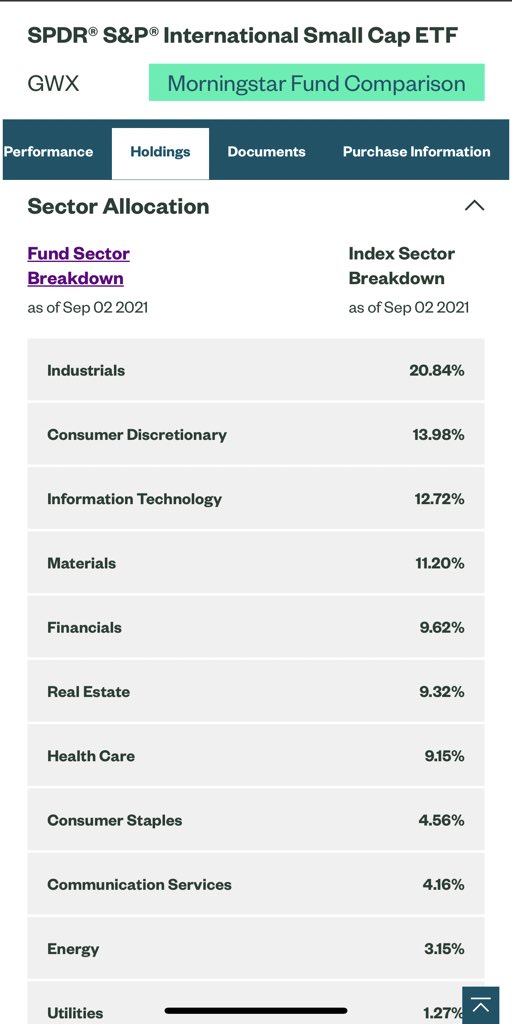

principal divisions of $SIE: Industry, Energy, Healthcare, and Infrastructure & Cities. SIE is a prominent maker of medical diagnostics equipment and its medical health-care division (12% of Corp rev), is its second-most profitable unit, after the industrial automation division

$SIE: electrical (buildings, industrial automation, lighting, medical), motors /conveyor belts, compressors for oil+gas, motors for rolling steel mills , gear for wind turbines , cement mills,water processing #, raw materials processing , gas and steam turbines,

$SIE In the renewable energy industry, the company provides a portfolio of products and services to help build and operate microgrids of any size. It provides generation and distribution of electrical energy as well as monitoring and controlling of microgrids

$SIE med products: clinical information tech systems; hearing instruments; in-vitro diagnostics eq; imaging eq incl angiography, computed tomography, fluoroscopy, MRI, mammography, molecular imaging ultrasound,x-ray equipment; radiation oncology and particle therapy equipment

$SIE transportation and logistics: equipment and systems for rail transportation incl rail vehicles for mass transit, regional and long-distance transp, locomotives, eq and systems for rail electrification, central control systems, interlockings, and automated train controls

$SIE traffic detection, information and guidance; equipment and systems for airport logistics including cargo tracking and baggage handling; and equipment and systems for postal automation including letter parcel sorting

$SIE my mistake above. There is a sponsored ADR for Siemens. $SIEGY

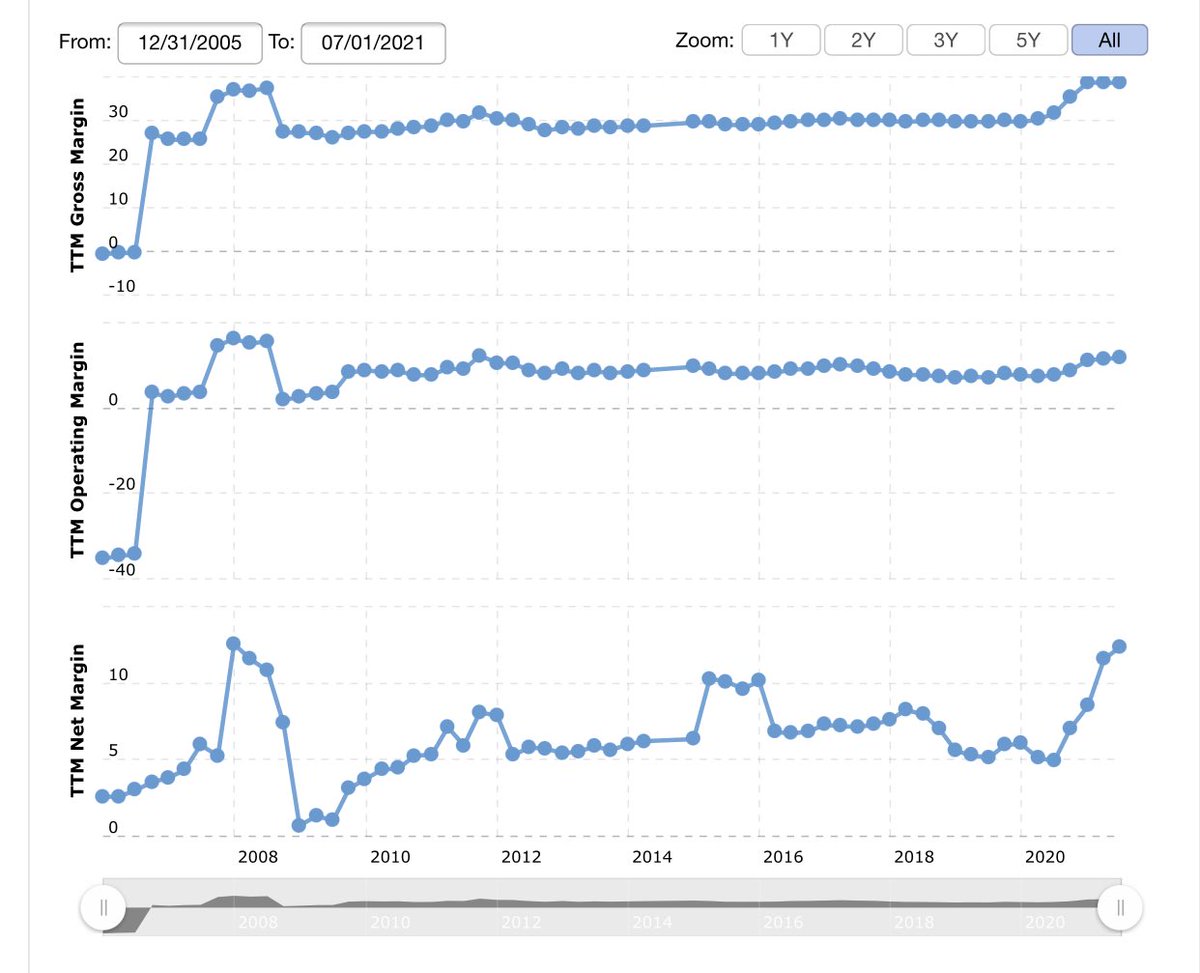

last $SIE ER call. This is a BIG DEAL for industrials btw. Pay attn: “one major topic in the industry overall, are the increasing raw material prices, “Looking at GP, we are to the extent possible covered by price escalation formula on our contracts and hedging activities.

The flip side of the above is to watch for see bear reversals or slope flattening of various commodity charts and think of the *BULLISH* implication of this.

The classic one is if oil dumps and gasoline remains bid, who benefits ? Refiners.

Last year i focused less on shorting bonds and more on buying banks. Why? That’s how I like to approach things. What’s the bullish way to play a specific bear (bond bear in last year case )

Recently we had iron ore pullback. Who benefits ? First derivative is steel makers.

You also wanna remember pain factors from certain earning calls for down the road when these flip

Example. Pre Covid Zion got destroyed when bonds went parabolic. Not as hedged etc. well who do you think I bot when we top ticked bonds in 2020?

Caterpillar has felt the squeeze from rising steel prices. Stuff like this.

Home builders and lumber is the obvious one

I don’t like to short these margin squeezes for good companies if they’re in secular industry bull. For example

I wouldn’t short a co that does clean tech/industrial even if they’re getting squeezed on materials.

$SIE ER “if these material cost increases remain end-market prices for our goods must also increase accordingly and this is what we are working on also with our customers.” #inflation

#inflation has l multiplicative effect as it moves up the value chain. Eg iron ore miner ➡️ steel maker hikes prices ➡️ industrial machinery maker hikes prices ➡️ engineering /contractor hikes ➡️ etc

$SIE back in Feb 2021: Siemens Energy, which supplies turbines to the power sector, said that it will cut 7,800 jobs, or 8.5% of its workforce, by 2025 👉to raise margins and competitiveness.👈 // this ! This is why inflation is bad.

$SIE ER call. This is worth noting. Natty isn’t going anywhere. “The renewables play important role but gas power plants will be key for the stability and reliability of electricity supply and will remain an important contributor to electricity generation over the coming years.”

$SIE strong euro is no bueno for these EU industrials. Revenue rose by 9% on a reported basis. 👉excluding the headwinds from currency and portfolio effects, total revenue rose by 11%👈

$SIE Gas and Power segment: “across all KPIs in our Gas and Power segment, truly a solid result. Order showed an improvement rising 11% on a comparable basis year-over-year.”

$SIE gas turbine market share regained. To over 20%

• • •

Missing some Tweet in this thread? You can try to

force a refresh