👩❤️👨 Dating + Investing: The Same Game? 👩❤️👨

Men want 2 things.

1. Hot date 🔥 (or several)

2. Hot portco 🦄 (or several)

Turns out:

There's a famous game theory algorithm that maximizes ur chances of finding both.

It's called ...

👇

Men want 2 things.

1. Hot date 🔥 (or several)

2. Hot portco 🦄 (or several)

Turns out:

There's a famous game theory algorithm that maximizes ur chances of finding both.

It's called ...

👇

1/ What is the Secretary Problem?

Imagine ur in HR.

U wanna hire the best secretary from N applicants. So u interview them 1 by 1 until u decide to accept one. Rejected candidates can't be resurrected.

What strategy maximizes ur chances of choosing the BEST?

[code @ end of 🧵]

Imagine ur in HR.

U wanna hire the best secretary from N applicants. So u interview them 1 by 1 until u decide to accept one. Rejected candidates can't be resurrected.

What strategy maximizes ur chances of choosing the BEST?

[code @ end of 🧵]

Now replace "ur in HR" with

"ur a normal guy" (or girl).

Replace "secretary" with

"hot date" &/or "hot portfolio company🦄."

The strategy that maximizes for the BEST secretary also maximizes for the BEST gf/bf also maximizes for the BEST investment. 🤯

So what is it? 🤖

"ur a normal guy" (or girl).

Replace "secretary" with

"hot date" &/or "hot portfolio company🦄."

The strategy that maximizes for the BEST secretary also maximizes for the BEST gf/bf also maximizes for the BEST investment. 🤯

So what is it? 🤖

2/ What is the optimal solution?

TLDR: Look before you leap.

Specifically, spend 36.8% of time looking, then leap.

Why:

The more time u spend looking (w/out choosing) the more INFO u get about the market but the less AGENCY u have (ur remaining suitors pool shrinks). #tradeoffs

TLDR: Look before you leap.

Specifically, spend 36.8% of time looking, then leap.

Why:

The more time u spend looking (w/out choosing) the more INFO u get about the market but the less AGENCY u have (ur remaining suitors pool shrinks). #tradeoffs

Here's the full story:

Split the candidate pool (N) into 2 groups:

i) a "look window" (the first m) which u browse passively to get a sense of the market

ii) a "leap window" (of size N-m) where u leap at the 1st candidate that's better than the best from the "look window"

Split the candidate pool (N) into 2 groups:

i) a "look window" (the first m) which u browse passively to get a sense of the market

ii) a "leap window" (of size N-m) where u leap at the 1st candidate that's better than the best from the "look window"

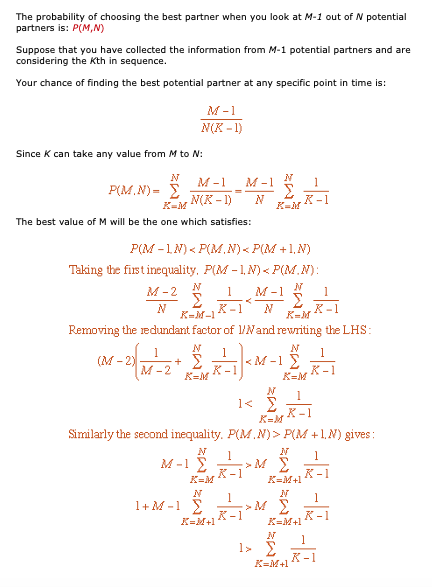

Turns out if you follow this algorithm, about 36.8% of the time you actually end up with the BEST secretary/soulmate/portco.

2-page mathematical derivation below👇

(feel free to skip if that's not up your alley)

2-page mathematical derivation below👇

(feel free to skip if that's not up your alley)

So far in this "classic" secretary problem, we've made a few (unreasonable) assumptions:

a. that 100% of dates/portcos u propose to say "YES"

b. that u want nothing but da BEST (what if ur happy w/ top 10%?)

c. no 2nd chances

Let's relax these constraints & see what happens ...

a. that 100% of dates/portcos u propose to say "YES"

b. that u want nothing but da BEST (what if ur happy w/ top 10%?)

c. no 2nd chances

Let's relax these constraints & see what happens ...

3/ Now what if SHE/HE doesn't like you back???

Reality check: not all of us are @ParikPatelCFA ... we get rejected sometimes!!

What if each hot date you propose to only has a 50% chance of accepting u back? Should u then look more or look less before you leap?

[simulation 👇]

Reality check: not all of us are @ParikPatelCFA ... we get rejected sometimes!!

What if each hot date you propose to only has a 50% chance of accepting u back? Should u then look more or look less before you leap?

[simulation 👇]

Solution:

- u should spend LESS time looking & leap sooner (since ur not Brad Pitt, u need all the agency u can get)

- given a 50% chance of rejection it's mathematically optimal to spend 30% of time looking (vs 37%)

- ur final chances of scoring the best r only 25% (vs 37%)

- u should spend LESS time looking & leap sooner (since ur not Brad Pitt, u need all the agency u can get)

- given a 50% chance of rejection it's mathematically optimal to spend 30% of time looking (vs 37%)

- ur final chances of scoring the best r only 25% (vs 37%)

4/ What if good enough is OK?

"The best is like... so overrated."

^ If that's what ur thinking, life just got WAY EASIER!

Solution:

- Spend 14% of time looking & expect 80% chance of landing a top 5% partner

- Spend 10% of time looking & expect 90% chance at a top 10% partner

"The best is like... so overrated."

^ If that's what ur thinking, life just got WAY EASIER!

Solution:

- Spend 14% of time looking & expect 80% chance of landing a top 5% partner

- Spend 10% of time looking & expect 90% chance at a top 10% partner

If ur new to VC/👼investing, u probably don't have a great sense of founder quality in the market.

So it makes sense to noncommittally look for some time (But is 37% ideal?)

Ur also gonna make >1 investment in ur lifetime

(So maybe a top 5% goal, ie 14% search time is optimal?)

So it makes sense to noncommittally look for some time (But is 37% ideal?)

Ur also gonna make >1 investment in ur lifetime

(So maybe a top 5% goal, ie 14% search time is optimal?)

Also, u don't have to be a new investor for this to be relevant.

Each new vertical requires discovery & strategy.

Input vars:

- total time u want to spend in said space (N)

- minimum threshold to bid (top 5%?)

- likelihood of hearing "yes"

Output:

- an optimal bidding strategy

Each new vertical requires discovery & strategy.

Input vars:

- total time u want to spend in said space (N)

- minimum threshold to bid (top 5%?)

- likelihood of hearing "yes"

Output:

- an optimal bidding strategy

5/ What if 2nd chances are possible?

(Maybe timing just wasn't right the 1st time...?)

Let's say dates/candidates/startups who u'd previously "passed" on can come back (albeit w/ lower "yes" probability):

Say p(acceptance, 1st time) = 100%

And p(acceptance, 2nd time) = only 33%

(Maybe timing just wasn't right the 1st time...?)

Let's say dates/candidates/startups who u'd previously "passed" on can come back (albeit w/ lower "yes" probability):

Say p(acceptance, 1st time) = 100%

And p(acceptance, 2nd time) = only 33%

Such newfound optionality means:

- u now have the luxury to spend MORE time looking while simultaneously enjoying greater probability of success! (47% of time for 53% success!)

- if u lower ur standards from finding the best to finding top 5%, u have >99% chance of success!

- u now have the luxury to spend MORE time looking while simultaneously enjoying greater probability of success! (47% of time for 53% success!)

- if u lower ur standards from finding the best to finding top 5%, u have >99% chance of success!

6/ Try it yourself!

If you enjoyed this thread and want to tweak the input parameters yourself (e.g. what happens if u have only 50% chance of getting a yes the 1st time & a 10% chance the 2nd time around?)

Here is my (uncleaned) code: github.com/mingzhao95/sec…

If you enjoyed this thread and want to tweak the input parameters yourself (e.g. what happens if u have only 50% chance of getting a yes the 1st time & a 10% chance the 2nd time around?)

Here is my (uncleaned) code: github.com/mingzhao95/sec…

• • •

Missing some Tweet in this thread? You can try to

force a refresh